Preview of Trump’s First Economic Report Card: U.S. Q1 2025 GDP May Signal Official Recession

- Is Silver’s ‘Meme Moment’ Arriving? Surging Prices Mask Momentum Bubble Concerns

- Gold Price Forecast: XAU/USD gains momentum to near $5,050 amid geopolitical risks, Fed uncertainty

- Dollar Slumps to Four-Year Low, Trump Still Says ‘Dollar Is Doing Great’?

- Bitcoin No Longer Digital Gold? Gold and Silver Token Market Cap Hits Record $6 Billion

- Fed Rate Decision Looms as Apple, Microsoft, Meta and Tesla Q4 Earnings Draw Attention: Week Ahead

- Yen Exchange Rate’s Shock Jump. Dropping 200 Pips Near 160 Level, BOJ’s Inaction Hides a Mystery, Buy the Dip or Seek Safety?

April 30, 2025, marks the 100th day of Donald Trump’s return to the White House, and the market will also receive the first economic report card of the Trump 2.0 administration—U.S. Q1 2025 GDP. Wall Street analysts widely predict that GDP growth will slow sharply to near-zero, largely due to the impact of tariffs, potentially signaling an official start of a recession.

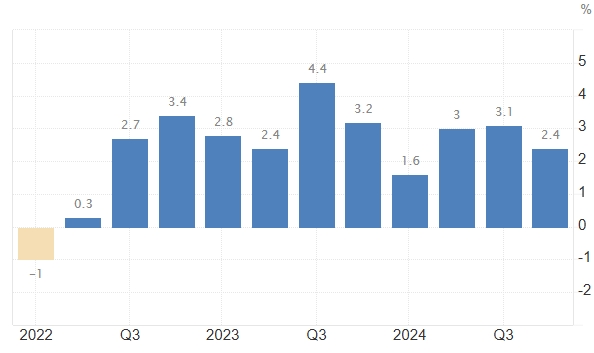

Currently, economists’ consensus forecast for annualized Q1 GDP growth stands at 0.4%—the lowest level in nearly three years—down significantly from the 2.4% growth recorded in Q4 2024.

[U.S. GDP Growth, Source: Trading Economics]

Bloomberg economists noted that the trade deficit was the largest drag on Q1 GDP, as businesses rushed to stockpile goods ahead of Trump’s new tariff policies, while consumers scrambled to purchase goods before anticipated price increases.

Goldman Sachs expects Q1 GDP to contract by -0.2%, marking the first negative growth since Q1 2022. Bank of America forecasts a steeper decline of -0.4%.

According to the Atlanta Fed’s GDPNow model, released on April 24, the actual Q1 GDP growth rate is expected to worsen from -2.2% a week earlier to -2.5%.

The reciprocal tariffs imposed by the U.S. only began taking effect in April, with some later temporarily suspended. Trump’s unprecedented high tariffs —among the highest seen in a century—are expected to have a more pronounced impact on the economy in Q2. Since the U.S. raised tariffs on Chinese goods to 145% in early April, freight transportation volumes have plummeted, with declines potentially reaching as much as 60%.

Apollo predicts that the U.S. economy will enter a recession during the summer.

Goldman Sachs also warned that early consumer purchasing may have temporarily boosted economic data in March and early April. However, large-scale layoffs and weakening hiring trends could become key vulnerabilities in the labor market, with the negative effects of tariffs likely to become fully apparent by May or June.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.