Has DPZ Stock Been Good for Investors?

Key Points

Domino's stock is only providing modest returns because business growth is also modest.

The stock is more attractively valued now compared to in the past, which could improve the outlook for investors from here.

- 10 stocks we like better than Domino's Pizza ›

Pizza stock Domino's Pizza (NASDAQ: DPZ) has underperformed for investors over the last one-, three-, and five-year periods. The S&P 500 has done better over each time span. One would have to zoom out to the 10-year performance to find a period wherein it was better to own Domino's stock instead of just owning an S&P 500 index fund.

On one hand, Domino's is one of the strongest restaurant chains on the stock market. And investors should gravitate toward high-quality businesses such as these. On the other hand, Domino's has struggled with top-line growth in recent years, with revenue only increasing by 18% total over the last five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

With nearly 22,000 locations worldwide, growth is hard to come by at this point for Domino's. That said, growth isn't the only path toward creating shareholder value.

Can Domino's stock have rewarding upside ahead?

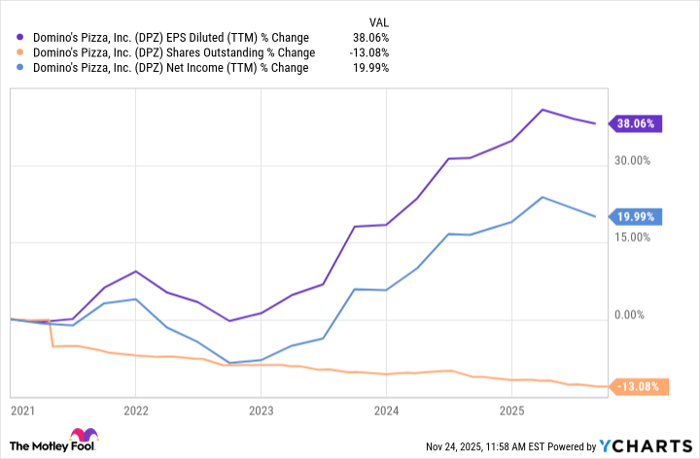

Domino's has grown its earnings per share (EPS) roughly twice as fast as its revenue over the last five years. And the reason is simple: This is a high-margin business, and management buys back stock on a regular basis. So while profits overall are somewhat stagnant, they're going up on a per-share basis because the overall share count is going down.

Data by YCharts

Another thing in shareholders' favor is that Domino's does pay a dividend. While modest, it does go up regularly, with management increasing the payment for 13 consecutive years.

To be sure, Domino's Pizza shareholders still got a smaller return than the S&P 500 over the last five years, even after accounting for the dividend. But returns are a little improved for investors who reinvested the dividends along the way.

Where do Domino's shareholders go from here?

Domino's Pizza continues to grow its sales and will likely do so in coming years. But growth is expected to remain at a modest single-digit rate. Going forward, shareholders can expect profits to stay strong, allowing management to continue buying back stock and paying dividends.

Profit margins are likely to stay strong for Domino's because of its competitive advantages. The company's restaurants are primarily operated by its franchisees, who pay into an advertising fund and use the company's supply chain.

By pooling resources, Domino's operates one of the most efficient supply chains in the world, keeping food expenses lower than competitors.

And having collected nearly $400 million in advertising funds through the first three quarters of 2025, Domino's has a bigger budget to get its message out to consumers.

Again, growth could be modest for Domino's. But the other thing in shareholders' favor today is the price tag. As of this writing, the stock trades at 22 times its free cash flow, which is its lowest valuation in over a decade. It may have underperformed in recent years, but it's now more attractively priced, which could set it up for better returns over the next five years.

Should you invest $1,000 in Domino's Pizza right now?

Before you buy stock in Domino's Pizza, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Domino's Pizza wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $576,882!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,119,006!*

Now, it’s worth noting Stock Advisor’s total average return is 1,002% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Domino's Pizza. The Motley Fool has a disclosure policy.