Over the past two weeks, leading coin Bitcoin (BTC) has struggled to maintain upward momentum, losing its grip on key support levels amid rising fear and volatility.

As market uncertainty climbs, Bitcoin miners appear to be pulling back, signaling a gradual reduction in their exposure and hinting at their intentions to sell.

BTC Miners Retreat as BTC Struggles

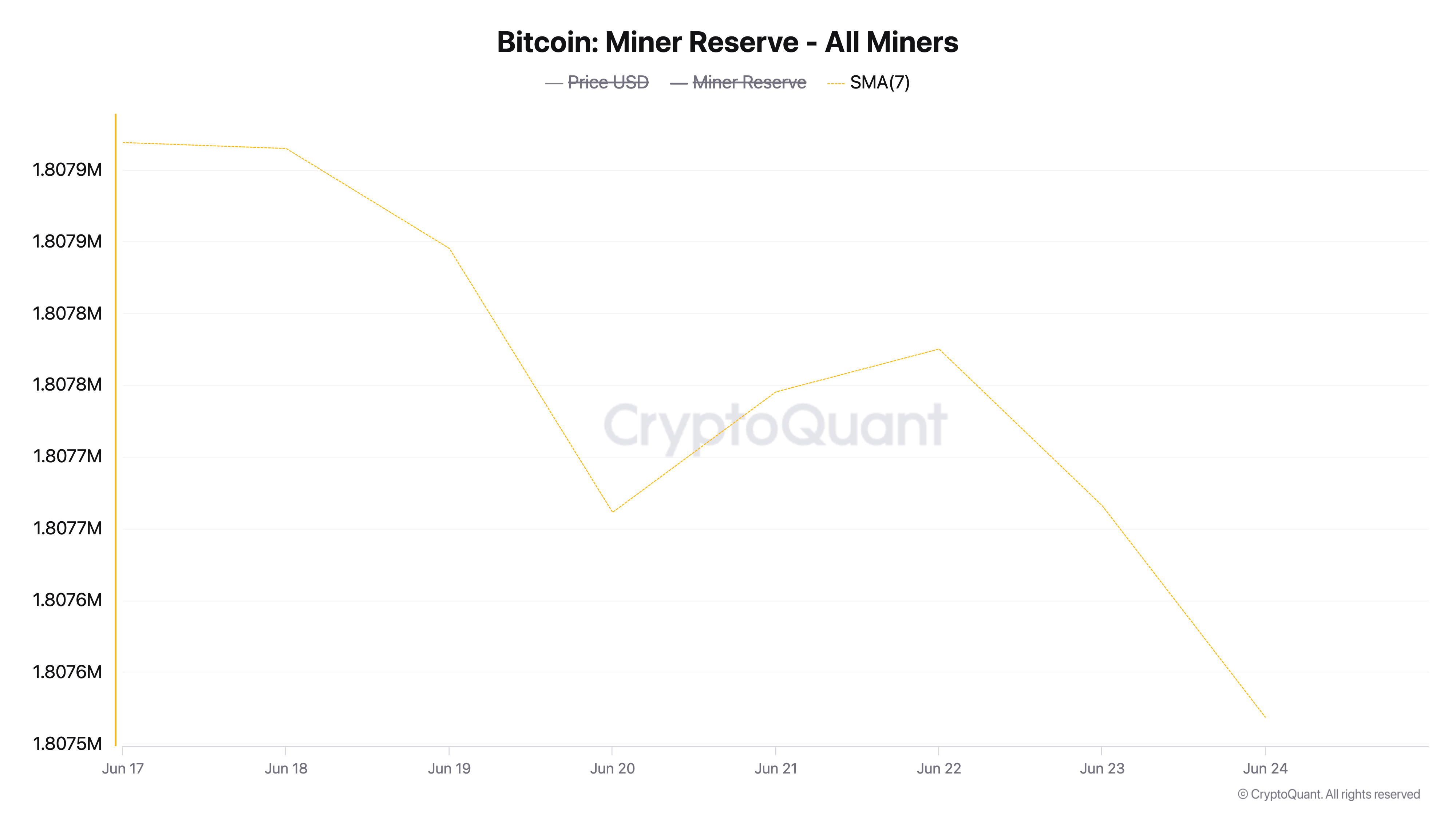

According to CryptoQuant’s data, the BTC miner reserve has gradually dipped over the past week. Observed on a seven-day moving average, it has declined by a modest 0.022%.

This signals that miners on the BTC network are slowly offloading their holdings, likely to cover losses or respond to a potential surge in operational costs amid the coin’s ongoing price decline.

BTC Miner Reserve. Source: CryptoQuant

BTC Miner Reserve. Source: CryptoQuant

The BTC miner reserve tracks the number of coins held in miners’ wallets. It represents the coin reserves miners have yet to sell. When the metric climbs, miners are holding onto more of their mined coins, often signaling confidence in future price increases.

Conversely, as is the case with BTC, when the reserve falls, miners are moving coins out of their wallets to sell, confirming growing bearish sentiment against BTC.

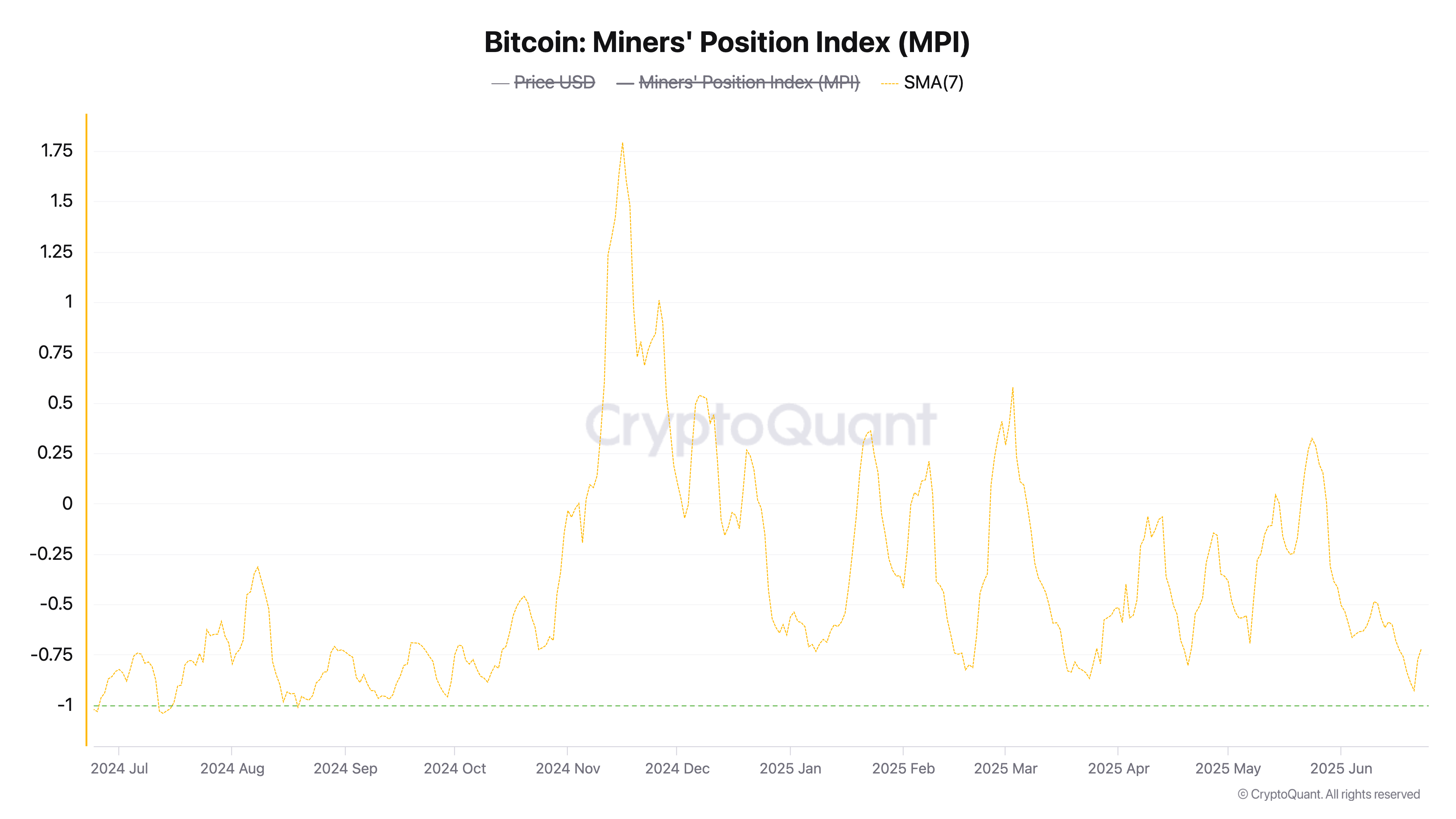

Furthermore, the coin’s climbing Miners’ Position Index (MPI) adds to the bearish outlook. Also observed using a 7-day SMA, it has risen by 55% over the past three days, indicating the movement of coins from miner wallets to exchange addresses.

Bitcoin: Miners’ Position Index. Source: CryptoQuant

Bitcoin: Miners’ Position Index. Source: CryptoQuant

The MPI measures the ratio of miner outflows to their one-year moving average. When it climbs, it suggests increased selling pressure from miners, indicating they may be offloading coins in anticipation of a market downturn.

Miner Sell-Off Hints at Deeper BTC Correction

Miners’ retreat from the market suggests their lack of confidence in BTC’s ability to hold above the psychologically important $100,000 mark in the short term. Their fears were validated over the past two daily trading sessions when BTC briefly plunged below this key support level.

At press time, the coin trades at $104,990, hovering just above the support formed at $103,952. With increased selling pressure from the miners and heightened macro uncertainties, BTC’s price could test this support level if demand weakens.

A break below this level could see BTC drop to $101,520. If the bulls fail to defend this zone, a further dip below $100,000, down to $97,658, could follow.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, if market sentiment improves and demand surges, BTC could rally toward $106,295.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.