EUR/JPY falls to near 168.00 due to growing odds of BoJ’s rate hikes

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

EUR/JPY continues its decline after retreating from an 11-month high of 169.72.

The Japanese Yen receives support from the hawkish tone surrounding the BoJ’s interest rate hikes

The Euro draws support from the improved risk appetite following the Israel-Iran ceasefire.

EUR/JPY halts its three-day winning streak, trading around 168.10 during the European hours on Tuesday. The currency cross extends its losses after pulling back from an 11-month high of 169.72, reached on Monday.

The decline of the EUR/JPY cross could be attributed to the strengthening of the Japanese Yen (JPY) against its peers, driven by the hawkish sentiment surrounding the Bank of Japan’s (BoJ) interest rate hikes. This cites persistent core inflation driven by firms passing wage increases onto prices as a reason for further policy tightening.

Latest data showed that Japan's core inflation climbed to a more than two-year high in May and remained above the central bank's 2% target. Moreover, the better-than-expected Japan's PMI keeps the door open for further rate hikes by the BoJ in the coming month.

Japan's Economy Minister, Ryosei Akazawa, is expected to make his seventh visit to the United States on June 26, raising hopes for a US-Japan trade agreement ahead of the July 9 deadline for steep reciprocal US tariffs.

The downside of the EUR/JPY cross could be restrained as the Euro (EUR) receives support as safe-haven demand weakens following the ceasefire agreement that came into effect between Israel and Iran. The Israeli government agreed to a ceasefire with Iran, while Iranian state media announced later that Tehran had also accepted the deal, raising hopes for an end to the 12-day conflict. However, the Israeli military said that Iran had launched missiles toward Israel after the ceasefire took effect.

The headline German IFO Business Climate Index climbed to 88.4 in June from 87.5 in May, surpassing the market forecast of 88.3. Meanwhile, the Current Economic Assessment Index improved to 86.2 from 86.1 previously. The IFO Expectations Index, which indicates firms’ projections for the next six months, advanced to 90.7 against the previous 88.9 and expected 90.0 readings.

Euro PRICE Today

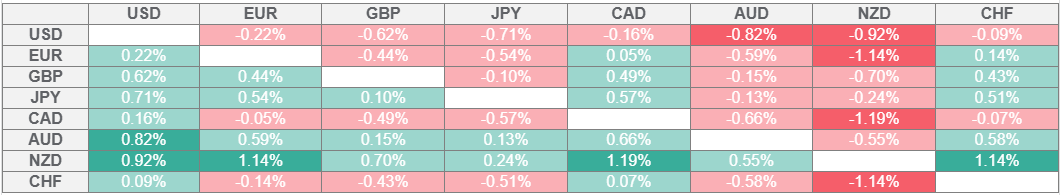

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.