Federal Reserve is expected to hike rates due to rising oil prices and inflation risks

The Federal Reserve is now heading toward rate hikes as inflation threatens to rise again. The pressure is coming from rising oil prices, triggered by military conflict in the Middle East.

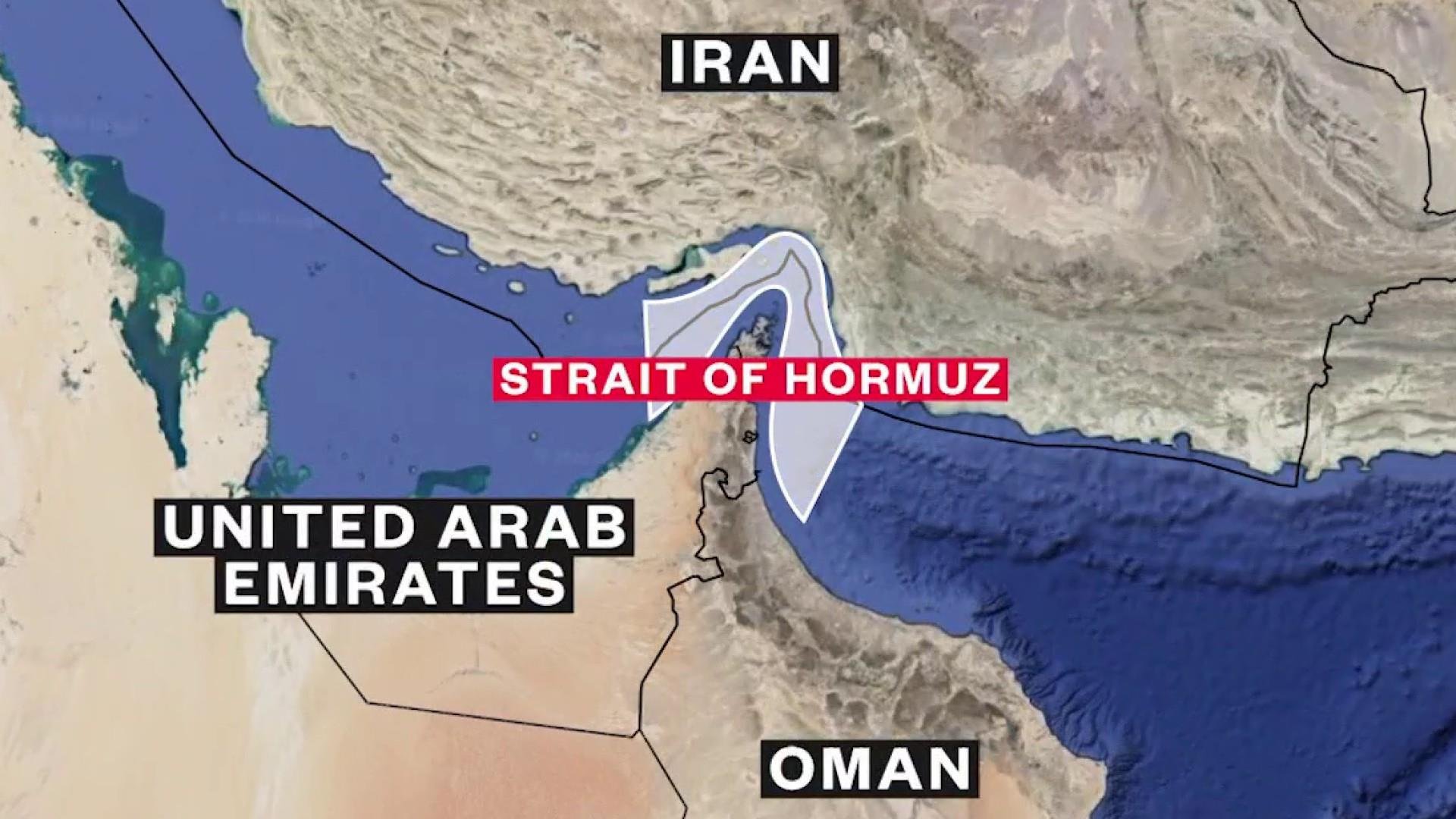

The US bombed three nuclear sites in Iran last Saturday night after Iran responded to earlier Israeli airstrikes. Now Iran is has shut down the Strait of Hormuz, the most critical oil route in the world.

According to JP Morgan, if that happens, oil could surge to $130 per barrel, pushing US inflation to 5%. That’s the same level inflation hit in March 2023, when the Fed was hiking rates back-to-back.

According to research reviewed by the Fed in 2010, a persistent oil shock leads to weaker consumption and investment, along with a hit to the dollar. In that study, they showed that countries importing oil, like the United States, get poorer as oil prices go up.

The loss in national wealth leads to less spending, a weaker exchange rate, and a change in trade balances. People and businesses will try to cut down oil use, but it won’t be enough to avoid damage. The result is a worse oil trade balance and less import of other goods. The non-oil part of the trade balance improves, but only because the economy slows down.

Iran warns of retaliation as US and Israel bomb nuclear sites

Ten days ago, Israel carried out unprovoked airstrikes on Iranian territory. Tehran hit back. Then, over the weekend, the US joined the fight and dropped bombs on three nuclear facilities in Iran. In response, Iran’s foreign minister said the country “reserves all options to defend its sovereignty.”

But since 2000, Iran has threatened over ten times to close off the Strait of Hormuz. If they actually go through with it this time, energy prices will definitely explode.

The Strait is only 21 miles wide but carries one-fifth of the world’s oil every day. It also sees more traffic than both the Panama and Suez Canals. About 35% of all seaborne LNG also passes through it. The US Navy has kept forces in the area for decades because of how strategic it is.

Hormuz is the only way out of the Persian Gulf by sea. If Iran closes it, the world loses access to a massive portion of oil supply overnight. That would almost guarantee a military response from Washington, Tel Aviv, or most likely both.

US Secretary of State Marco Rubio told Fox News on Sunday that China should intervene and talk Iran down. “I encourage the Chinese government in Beijing to call them about that, because they heavily depend on the Straits of Hormuz for their oil.” China is Iran’s biggest oil customer and maintains friendly diplomatic ties with Tehran, publicly condemning Israel’s actions.

Trump demands rate cuts while Powell stays silent

While global tension rises, President Donald Trump continues to push for interest rate cuts. Even before his reelection in 2024, Trump had been attacking Jerome Powell and demanding cheaper borrowing costs.

Since returning to the White House, he’s kept up the heat. Trump has criticized the Fed Chair publicly nearly every week, insulting Powell both at press conferences and online. Powell, for his part, hasn’t said anything. He avoids reacting, never comments on the insults, and refuses to take the bait.

But rate cuts right now are not realistic. With oil possibly hitting $130 and inflation climbing back toward 5%, cutting rates could add fuel to the fire. Instead, the Federal Reserve will likely raise them again, just like they did in 2023. The link between oil and inflation is well known. The Fed’s own modeling from the research we mentioned earlier shows how damaging oil shocks are, especially when financial markets can’t absorb the risk. The worse the shock, the harder it is to fight the resulting high inflation.

With Trump pushing for cuts and Powell boxed in by rising costs, the Federal Reserve is once again facing political and economic pressure at the same time.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.