BOJ June Meeting Preview: 2025 Rate Hikes Off the Table; Slowdown in Bond Purchase Cuts?

TradingKey - On Tuesday, June 17, 2025, the Bank of Japan (BOJ) will hold its monetary policy meeting. The market widely expects that the policy interest rate will remain unchanged at 0.5%. The key focus ahead of the meeting is likely to be how quickly the BOJ will reduce its pace of scaling back bond purchases, as it transitions from a net buyer to a net seller of Japanese government bonds (JGBs).

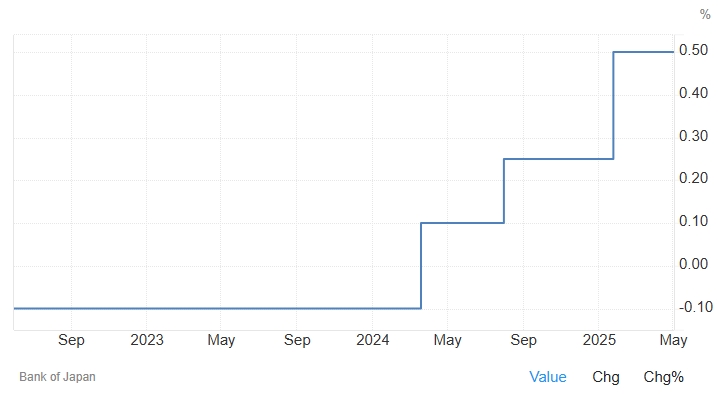

At its January 2025 policy meeting, the BOJ raised the benchmark interest rate from 0.25% to 0.5%, marking the end of nearly a decade of negative interest rates.

However, amid uncertainty over U.S. tariffs and weak real GDP growth in Q1 2025, the market expects limited appetite for further rate hikes. This meeting is expected to mark the third consecutive meeting with no change in policy.

BOJ Policy Rate, Source: Trading Economics

Next Rate Hike May Not Come Until 2026

On Thursday, June 12, former BOJ official Takako Masai said that U.S. tariff policies may have effectively ended the BOJ’s tightening cycle. Masai said that Japanese exports are under pressure, and the likelihood of further rate hikes is rapidly diminishing.

Masai warned that the uncertainty surrounding U.S. tariffs could negatively impact exports, production, wage growth, and consumer spending, particularly in Japan’s key auto industry. As a result, the BOJ may be unable to raise rates for the foreseeable future.

According to a Reuters survey of economists, the most likely timing for the BOJ’s next rate hike is January 2026. More than three-quarters of respondents expect the policy rate to rise by about 25 basis points by the end of March 2026.

Key Focus: Adjustment to Bond Purchase Pace

The BOJ began its monetary tightening cycle in March 2024 when it exited negative interest rate policy. Since August 2024, it has been reducing bond purchases by ¥400 billion per quarter.

Since early 2024, the BOJ has shifted from being a net buyer to a net seller of JGBs, and in Q1 2025, it reduced its holdings at the fastest pace on record.

To date, the BOJ still holds over half of all outstanding Japanese government bonds. However, as the central bank continues to withdraw from the market, there has been a lack of buyers for JGBs. By late May 2025, JGB prices had plummeted and yields surged — raising concerns within the BOJ.

Rising JGB yields pose a challenge to the BOJ’s tightening path, as higher borrowing costs could further weaken an already fragile economy. This undermines the preconditions for further rate hikes.

As a result, markets are betting that authorities may take action on both the supply and demand sides: slowing down the pace of bond sales and reducing new bond issuance.

According to a Bloomberg survey, two-thirds of economists expect the BOJ to announce a revised bond reduction plan, potentially slowing the pace starting from April 2026. About 40% of economists anticipate that the quarterly reduction could be cut from ¥400 billion to ¥200 billion.

In addition, a Reuters poll found that three-quarters of economists expect the Japanese government to reduce ultra-long bond issuance to stabilize the bond market.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.