AUD/JPY jumps to near 94.00 as safe-haven assets lose steam, BoJ policy in focus

AUD/JPY gains sharply to near 94.00 as the safe-haven demand of the Japanese Yen diminishes.

The BoJ is expected to hold interest rates steady at 0.5%.

This week, investors will focus on the Aussie employment data for May.

The AUD/JPY pair climbs to near 94.00 during European trading hours on Monday. The cross moves sharply higher as demand for safe-haven assets, such as the Japanese Yen (JPY) has diminished, while tensions between Israel and Iran have escalated.

Japanese Yen PRICE Today

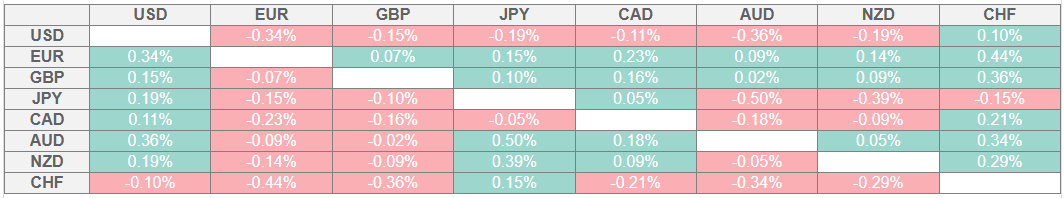

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

S&P 500 futures have gained significantly during the European trading session, exhibiting an increase in the risk-appetite of investors. Tensions between Israel and Iran have escalated as the former threatens to accelerate attacks if Tehran doesn’t stop launching missile attacks.

Going forward, the major trigger for the Japanese Yen will be the Bank of Japan’s (BoJ) monetary policy announcement on Tuesday. The BoJ is almost certain to keep interest rates steady at 0.5%. Investors will closely monitor comments from BoJ Governor Kazuo Ueda at the press conference, following the monetary policy decision, to get about cues about when the central bank could hike interest rates again.

Earlier this month, Kazuo Ueda stated that interest rate hikes would become appropriate once officials get convinced that the “economy and inflation will re-accelerate after a period of economic sluggishness”.

Meanwhile, the Australian Dollar (AUD) outperforms its peers, except European currencies. This week, investors will focus on the Australian employment data for May, which will be released on Thursday. The Unemployment Rate is expected to remain steady at 4.1%.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.