3 US Economic Indicators With Crypto Implications This Week

- Gold drifts higher amid growing concerns over US government shutdown

- Australian Dollar receives support following cautious remarks from RBA Hauser

- Gold draws support from safe-haven flows and Fed rate cut bets

- Forex Today: BoE policy announcements to set direction for Pound Sterling

- WTI holds near $59.50, further downside appears due to oversupply concerns

- U.S. Stock Market Opinions Diverge: Will the Market Rise or Fall Going Forward?

Following the Bureau of Labor Statistics’ (BLS) report on the US CPI (Consumer Price Index) last week, crypto traders and investors are still monitoring the country’s economic calendar.

This week, three US economic indicators will influence Bitcoin (BTC) and crypto market sentiment. Notably, Trump’s trade policies and geopolitical tension in the Middle East continue to influence the US economy.

US Economic Indicators To Watch This Week

The following US economic indicators could move the portfolios of crypto traders and investors this week.

US Economic Indicators this week. Source: Trading Economics

US Retail Sales

This week, the retail sales data released by the country’s Census Bureau will start the list of US economic indicators. This data point reflects consumer spending, which drives about 70% of the US economy and thereby influences market sentiment.

Data on MarketWatch shows a 0.1% month-over-month (MoM) retail sales growth for April 2025, as reported in May. This reflects a modest consumer spending growth. Economist polls reported by MarketWatch predict a 0.6% MoM decline in retail sales from April to May 2025.

This suggests economists expect consumer spending to contract, likely due to uncertainties following Trump’s tariff chaos. A confirmed -0.6% or worse decline could boost expectations for Federal Reserve (Fed) rate cuts, as it suggests economic weakness.

Such an outcome would support Bitcoin as a hedge against monetary easing or inflation, potentially driving prices higher.

Conversely, if the data surprises positively, for instance, coming in flat or above 0.1%, it could strengthen the US dollar and reduce rate-cut bets. In the same way, such an eventuality would pressure crypto prices downward.

Initial Jobless Claims

Since Thursday is Juneteenth holiday, last week’s initial jobless claims report will be released on Wednesday, June 18. This US economic indicator measures the number of US citizens who filed for unemployment insurance for the first time.

BeInCrypto reported that the US labor market is progressively becoming Bitcoin’s key macroeconomic data point. For this reason, this data point will be a critical watch this week.

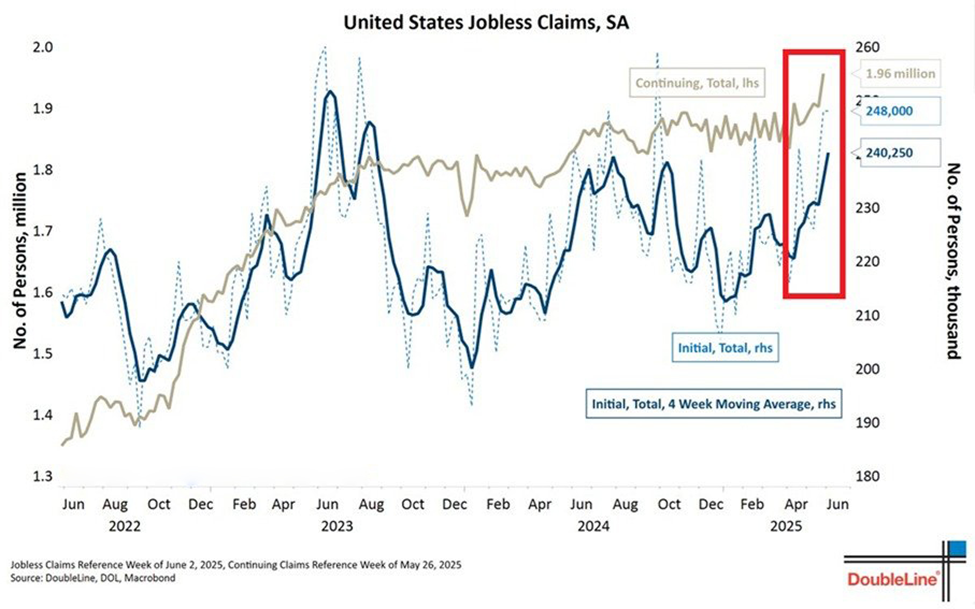

After a previous reading of 248,000 for the week ending June 7, which came in higher than the 242,000 economists had projected, economists project even higher unemployment insurance claims to 250,000 for last week.

US initial jobless claims projections. Source: eye zen hour on X

The expectation of increased initial jobless claims suggests economists’ cognizance of the softening labor market in the US. This is bullish for Bitcoin as it tilts the odds further in favor of a Fed pivot.

“The labor market is CRACKING → Initial jobless claims hit 248K (highest since October) → 4-week average: 240K (highest since August 2023) → People on benefits: 1.96M (highest since November 2021) Weakness = Fed pivot = crypto moon,” analyst eye zen hour wrote in a post.

FOMC Interest Rate Decision

Meanwhile, this week’s highlight of US economic indicators will be the Federal Open Market Committee (FOMC) interest rate decision, also on Wednesday. This macroeconomic data point will be a full circle after last week’s US CPI.

BeInCrypto reported that inflation increased in May, and for the first time since February. The US CPI is a lagging indicator, making it a primary focus for inflation targeting and, therefore, tied to the Federal Reserve’s 2% target.

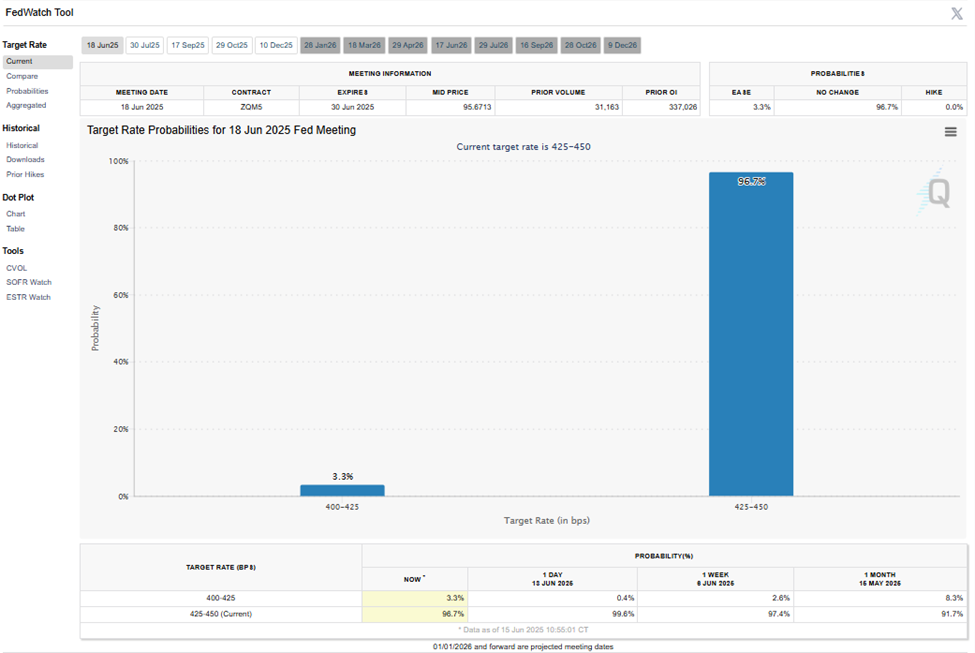

Last week’s US CPI inflation data will affect the FOMC’s interest rate decision. According to the CME FedWatchTool, markets are projecting a 96.7% probability that the Fed will leave interest rates unchanged at 4.25-4.5%.

Meanwhile, some see a 3.3% probability of rate cuts, potentially to the 4.0 to 4.25% range, which would signify a quarter basis point (bp) reduction.

Fed interest rate cut probabilities. Source: CME FedWatch Tool

This week, the FOMC interest rate decision would hinge on economic data signaling a need for monetary stimulus to support its dual mandate of price stability (2% inflation target) and maximum employment.

Beyond the aforementioned US economic indicators, key drivers for rate cuts may include political pressure from President Donald Trump. Despite the Fed’s commitment to caution, Trump continues to pressure Powell to cut rates.

“Fed should lower one full point. Would pay much less interest on debt coming due. So important,” Trump wrote on Truth Social after the CPI data.

With markets pricing in cuts starting in September, a surprise cut on Wednesday would shock the market, with Bitcoin likely to rally. The surge would come as lower rates reduce the opportunity cost of holding non-yielding assets.

Conversely, a hold may not impact the market as much, given that it is already expected and, therefore, priced in.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

BeInCrypto data shows Bitcoin was trading for $106,576 as of this writing, up by nearly 1% in the last 2 hours.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.