US Dollar Index falls to near 99.50 as 2-year Treasury yield drops over half a percent

The US Dollar Index remains under pressure as the 2-year US Treasury yield edges down to 3.81%.

Trump announced his plans to introduce pharmaceutical tariffs within the next two weeks.

The Fed is widely expected to hold interest rates steady on Wednesday, with investors watching Fed Powell for policy remarks.

The US Dollar Index (DXY), which measures the US Dollar (USD) against a basket of six major currencies, is depreciating after registering gains in the previous session, trading near 99.60 during the European hours on Tuesday.

The Greenback is under pressure as the yield on the 2-year US Treasury bond breaks its three-day winning streak, slipping to 3.81%, depreciating by 0.70%. In contrast, the 10-year yield extends its gains, holding steady at 4.36% at the time of writing.

Additionally, US President Donald Trump stated on Monday that he intends to introduce pharmaceutical tariffs within the next two weeks. Trump also announced plans last week to direct the US Trade Representative and the Commerce Department to begin imposing a 100% tariff on films produced abroad.

The Federal Reserve (Fed) is scheduled to announce its monetary policy on Wednesday. While the Fed is widely expected to keep interest rates unchanged, markets are closely watching Chair Jerome Powell’s comments, particularly amid tariff-related uncertainty and mounting pressure from President Donald Trump for rate cuts.

Treasury Secretary Scott Bessent said Monday that the US is “very close to some deals,” reinforcing comments made by Trump over the weekend about progress in trade negotiations. However, Trump confirmed he will not meet with Chinese President Xi Jinping this week. Meanwhile, China’s Commerce Ministry stated Friday it is reviewing a US proposal to restart talks.

On the economic front, US data signaled resilience in the services sector. The ISM Services PMI climbed to 51.6 in April, surpassing expectations of 50.6 and improving from March’s 50.8. The New Orders Index rose to 52.3 from 50.4, and the Services Employment Index increased to 49 from 46.2.

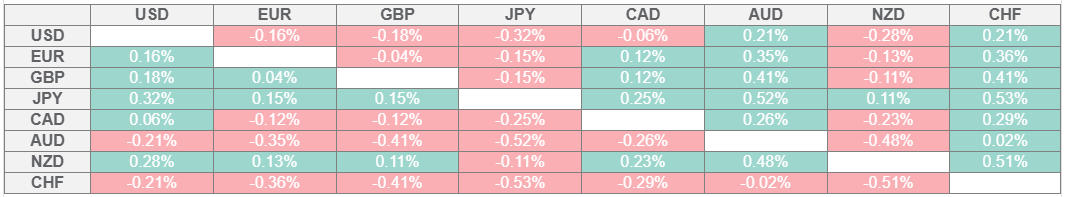

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.