Forex Today: Major pairs stabilize as focus shifts to central banks

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Tuesday, May 6:

Major currency pairs fluctuate in familiar ranges early Tuesday as investors refrain from taking large positions ahead of this week's key central bank meetings. Eurostat will release Producer Price Index data for March. Later in the day, trade balance figures from Canada and the US will be featured in the economic calendar.

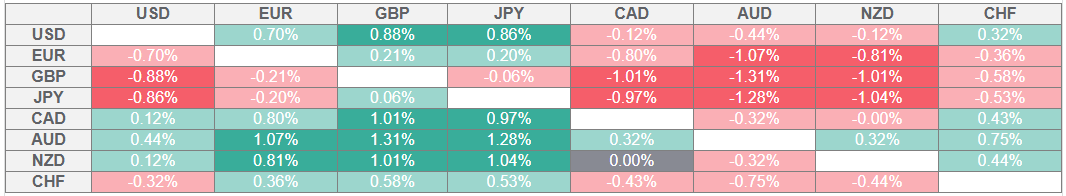

US Dollar PRICE Last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) started the week under bearish pressure but managed to find a foothold in the second half of the day.

The data from the US showed that the ISM Services Purchasing Managers Index (PMI) improved to 51.6 in April from 50.8 in March. This reading came in better than the market expectation of 50.6 and helped the USD hold its ground. Meanwhile, US Treasury Scott Bessent noted on Monday that they are very close to reaching some agreements on trade.

Similarly, US Commerce Secretary Howard Lutnick told Fox Business that they are hoping to announce trade deals soon, adding that the first deal is likely to be a with a top-10 economy. US stock index futures lose between 0.2% and 0.5% in the European morning on Tuesday, after Wall Street's main indexes closed in negative territory on Monday, and the USD Index moves sideways in a narrow band above 99.50. The Federal Reserve's two-day policy meeting will go underway later in the day.

In the Asian session on Tuesday, the data from China showed that the Caixin Services PMI edged lower to 50.7 in April from 51.9 in March. After setting a fresh 2025-high near 0.6500 on Monday, AUD/USD seems to have entered a consolidation phase slightly above 0.6450 on Tuesday.

EUR/USD trades marginally higher on the day but remains below 1.1350 in the European session.

GBP/USD closed in positive territory on Monday and snapped a four-day losing streak. The pair continues to stretch higher and trades above 1.3320 early Tuesday. The Bank of England will announce monetary policy decision on Thursday.

USD/JPY fell nearly 0.9% on Monday and erased a portion of the previous week's gains. The pair stays under bearish pressure and trades below 143.50 in the European morning.

Escalating tensions in the Middle East allowed Gold to gather bullish momentum to start the week. After rising nearly 3% on Monday, XAU/USD extends its rally toward $3,400 on Tuesday, already gaining more than 1% on the day.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.