Pectra Upgrade and FOMC Decision: All About Ethereum’s Big Day Ahead

Ethereum (ETH) faces a critical inflection point with two powerful catalysts converging on Wednesday, May 7.

Traders are split on whether the “perfect storm” could spark a breakout or deepen recent price volatility amid mixed macro signals and waning confidence in Ethereum’s narrative.

Ethereum Faces Volatile Crossroads: Pectra Upgrade and FOMC Converge

The long-awaited Ethereum Pectra upgrade is only hours out. It is expected to introduce key enhancements such as EIP-7702 and a 2,048 ETH staking cap, improving Ethereum’s usability and efficiency.

Combined with Fed Chair Jerome Powell’s potentially dovish tone, some believe this week could ignite a powerful rally in ETH and altcoins.

“May 7th Ethereum Pectra upgrade. May 7th FOMC. Micro caps already surging. If the Crypto Lords are on our side, mother of all breakouts could happen—especially on altcoins,” said CryptoSkull on X (Twitter).

Others echoed the sentiment, albeit with caution, cognizant of the volatility of the crypto market.

“FOMC week and ETH Pectra update? Time to keep our eyes peeled. Bullish vibes are great, but let us not forget the market’s mood swings. Feds might just throw us a curveball,” another user warned.

Meanwhile, another cohort sees the collision between Pectra Upgrade and the FOMC meeting as a high-stakes convergence. Specifically, the convergence of the two events will likely trigger a reaction in the Ethereum price.

Ethereum (ETH) price performance. Source: BeInCrypto

Ethereum (ETH) price performance. Source: BeInCrypto

Ethereum Community Borders Along Hope, Hype, and Hard Lessons

Still, not all see the Pectra upgrade as an immediate price catalyst. Maria Magenes, VP of Strategy at Hype Partners and former Balancer and MakerDAO marketing lead, tempered expectations.

“Even if I’ve joked about my hope for a price bump, that’s not the real point of why this is exciting… Network upgrades don’t imply price bumps… These aren’t cosmetic changes…They ensure Ethereum remains the most composable, decentralized, and reliable network in the ecosystem,” she explained.

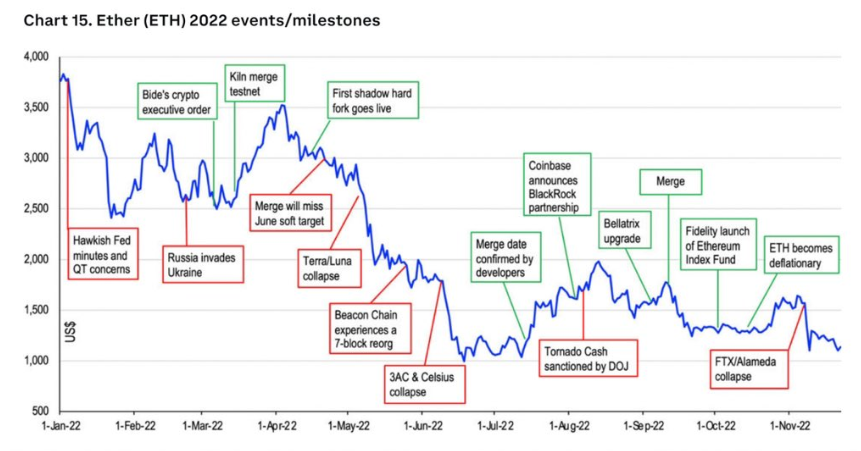

Ethereum price action against event-specific volatility. Source: Maria on X

Ethereum price action against event-specific volatility. Source: Maria on X

Meanwhile, others shared a nuanced take, calling Pectra a legit volatility trigger. Beyond the technical upgrade, however, Ethereum is also contending with a broader narrative crisis.

Once the undisputed leader in smart contract platforms, the network faces renewed scrutiny over fees, decentralization trade-offs, and developers’ exits to ecosystems like Solana.

Still, some traders remain bullish. As BeInCrypto noted, Ethereum traders are eyeing a breakout, with price patterns suggesting pressure is building.

Nevertheless, the May 7 FOMC decision adds significant uncertainty. While most analysts expect the Fed to hold rates steady, traders remain wary of Powell’s tone. A hawkish stance could derail risk-on momentum.

“We’re still seeing the risk-off mentality going into the Fed meeting…Bitcoin build-up is good…expecting ETH to turn upwards after Wednesday,” analyst Michaël van de Poppe wrote.

May 7 could shape Ethereum’s near-term fate, with the second-largest crypto by market capitalization metrics caught between protocol progress and macro peril.

On Wednesday, whether Pectra powers a rally or is drowned out by macroeconomic headwinds will be determined.