US Dollar Index advances to near 99.50 as US yields rebound ahead of Core PCE data

The US Dollar Index appreciates as 2-year and 10-year yields on US Treasury bonds halt their losing streak.

US GDP is forecasted to rise just 0.4% YoY in Q1, down from 2.4% in the previous quarter.

JOLTS Job Openings fell to 7.19 million in March—the lowest level since September 2024.

The US Dollar Index (DXY), which tracks the US Dollar (USD) against a basket of six major currencies, extends its gains for a second consecutive day, trading near 99.40 during Wednesday’s European session.

The Greenback appreciates as 2-year and 10-year yields on US Treasury bonds halt, their losing streak, with trading around 3.66% and 4.16%, respectively, at the time of writing. Investor focus now shifts to the upcoming US Core PCE Price Index for March and Q1 Annualized GDP figures, set to be released later in the North American session.

The Bureau of Economic Analysis (BEA) is expected to report a sharp slowdown in US economic growth, with Q1 GDP forecasted to rise just 0.4% annually, down from 2.4% in the previous quarter. The deceleration is largely attributed to the economic drag from significant tariffs introduced by President Donald Trump earlier this month.

On Tuesday, the JOLTS report showed US job openings fell to 7.19 million in March—the lowest level since September 2024—underscoring signs of weakening labor demand and growing economic uncertainty.

Economic sentiment in the United States (US) took another hit on Tuesday as the Conference Board’s Consumer Confidence Index dropped sharply to 86.0 in April from a revised 93.9 in March—its lowest level since April 2020. The decline reflects rising public concern over the impact of tariffs.

However, trade tensions appear to be easing as President Trump indicated a willingness to reduce tariffs on Chinese goods, while Beijing announced exemptions for select US imports from its 125% tariff list, raising hopes of a resolution to the prolonged trade dispute.

US Dollar PRICE Today

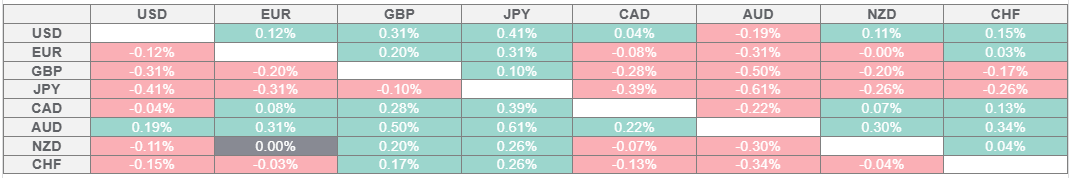

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.