Super Micro Computer Inc Stock Plummets 15%! Revenue and Profit Both Disappoint, Market Pessimistic About Server Outlook!

Super Micro Computer's performance fell short. Its stock dropped 15%, impacting several server competitors.

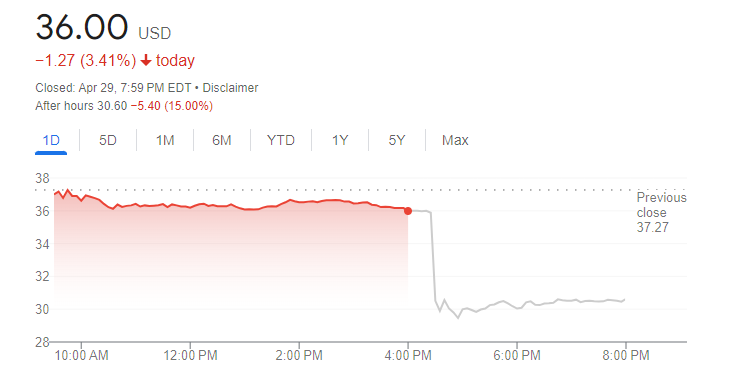

On Tuesday, after-hours trading showed Super Micro Computer Inc (SMCI) released preliminary third-quarter results. The report did not meet expectations. The stock fell as much as 16% before closing down 15%.

Super Micro Computer Inc stock price trend chart, source: Google.

According to the report, Super Micro Computer Inc's revenue was $4.5-4.6 billion. This is well below the analyst forecast of $5.35 billion. Adjusted earnings per share (EPS) were 29-31 cents, also lower than the expected 53 cents.

Super Micro Computer Inc explained, "Some customers delayed product decisions in Q3. This pushed some sales to Q4." They also noted that older products led to increased inventory write-downs, affecting performance.

After the financial report, not only did Super Micro Computer's stock crash, but the entire server sector suffered. Dell (DELL) dropped 3.28%, Nvidia (NVDA) fell 2.06%, and HP (HPQ) decreased 1.65%.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.