NZD/USD Price Forecast: Falls toward 0.5900 support after breaking below nine-day EMA

NZD/USD may challenge the psychological resistance at 0.5950, with potential to extend gains toward the six-month high of 0.6038.

The 14-day RSI holding above the 50 mark signals a continued bullish bias.

A decisive break below the nine-day EMA could undermine the short-term bullish momentum.

The NZD/USD pair extends losses for the second successive session, trading around 0.5920 during early European hours on Wednesday.

Technical indicators on the daily chart suggest a short-term neutral bias, with the pair treading water around the nine-day Exponential Moving Average (EMA). Further movement will offer a clear directional trend.

However, the 14-day Relative Strength Index (RSI) is still positioned above the 50 mark, suggesting the bullish bias is persistent. If 14-day RSI rises toward the 70 mark, it could reinforce the bullish market sentiment.

On the upside, the immediate barrier appears at the psychological level of 0.5950. Further resistance appears at the six-month high of 0.6038, last seen in November 2024. A sustained break above this level could open the doors to explore the area around its seven-month high near 0.6350, recorded in October 2024.

The successful break below the nine-day EMA could weaken the short-term bullish momentum and open the door for further downside toward the 50-day EMA at 0.5799.

Further depreciation would deepen the bearish bias and put the downward pressure on the NZD/USD pair to test support at 0.5485—a level not visited since March 2020.

NZD/USD: Daily Chart

New Zealand Dollar PRICE Today

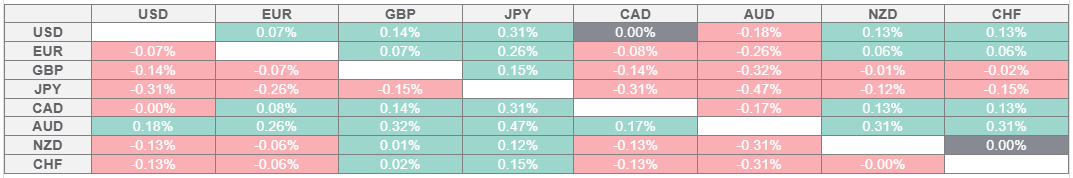

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies today. New Zealand Dollar was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.