US Dollar Index falls below 99.50 due to eroding investor confidence, Retails Sales eyed

The US Dollar Index struggles as escalating US-China trade tensions erode investor confidence in American assets.

President Trump has launched an investigation into tariffs on critical minerals, further intensifying the trade conflict.

Market expectations, reflected in the CME FedWatch tool, indicate approximately 85 basis points of Federal Reserve rate cuts by year-end.

The US Dollar Index (DXY), which measures the US Dollar (USD) against a basket of six major currencies, declined after gaining in the previous session, trading near 99.50 during Wednesday's European hours. The Greenback faces headwinds due to eroding investor confidence in US assets amid escalating US-China trade tensions.

Late Tuesday, Bloomberg reported that US President Donald Trump initiated an investigation into potential tariffs on critical minerals, marking another move in the intensifying trade war that continues to affect key global economic sectors.

Simultaneously, the Wall Street Journal, citing informed sources, suggested that the Trump administration aims to leverage tariff negotiations to encourage US trading partners to reduce their engagements with China.

A consumer sentiment survey by the Federal Reserve Bank of New York highlighted a sharp rise in household expectations of higher inflation, weaker job prospects, and deteriorating credit conditions in the coming months.

According to the CME FedWatch tool, markets are pricing in approximately 85 basis points of Federal Reserve (Fed) rate cuts by the end of the year while expecting the Fed to maintain rates during its next meeting.

US Retail Sales data for March is set to be released later in the day, offering potential insights into how tariff-related uncertainties are impacting consumer spending. Additionally, Fed Chairman Jerome Powell is scheduled to deliver a speech during the late American session.

US Dollar PRICE Today

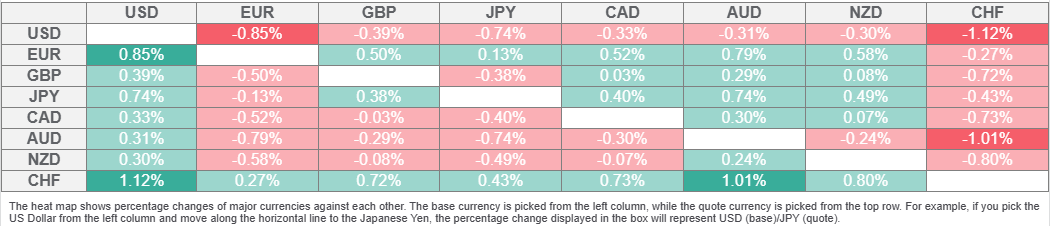

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Swiss Franc.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.