ETF Inflows Surge as Bitcoin Reclaims $100,000—But Caution Creeps Into Options

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

Spot Bitcoin ETFs registered another consecutive day of inflows on Thursday, coinciding with the coin’s rally back above the $100,000 mark for the first time since February.

None of the major ETFs saw outflows during yesterday’s session, confirming the renewed institutional confidence in the asset’s long-term trajectory.

Bitcoin ETFs See Another Day of Inflows

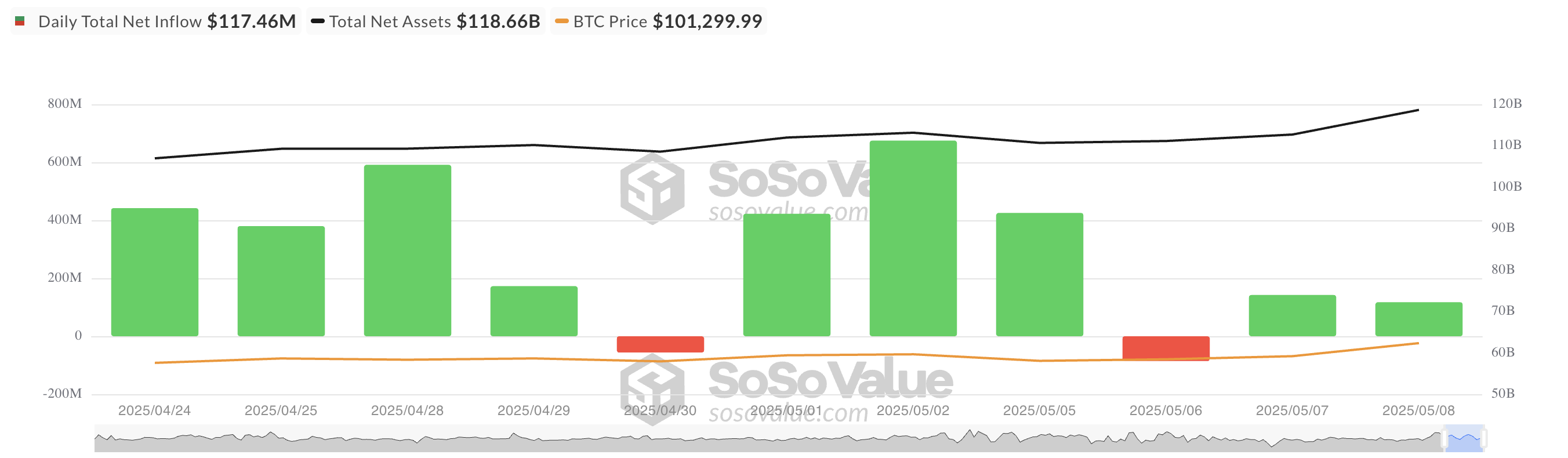

Yesterday, Bitcoin-backed ETFs recorded a net inflow of $117.46 million, down 17% from the previous day’s $142.31 million. While the slight dip may reflect profit-taking after BTC surged past the $100,000 mark, the continued inflows still signal growing investor confidence in the leading cryptocurrency.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

On Thursday, BlackRock’s iShares Bitcoin Trust (IBIT) led the trend, posting the highest daily inflow among all ETF issuers. The fund recorded a net inflow of $69 million for the day, pushing its total historical net inflow to $44.35 billion.

Fidelity’s ETF, FBTC, came in second with a daily net inflow of $35.34 million. Its total historical net inflow now stands at $11.67 billion.

Notably, none of the 12 ETFs logged net outflows yesterday.

BTC Rally Fuels Futures Frenzy

BTC’s break above the psychological six-figure threshold during Thursday’s trading session has reignited bullish momentum across markets.

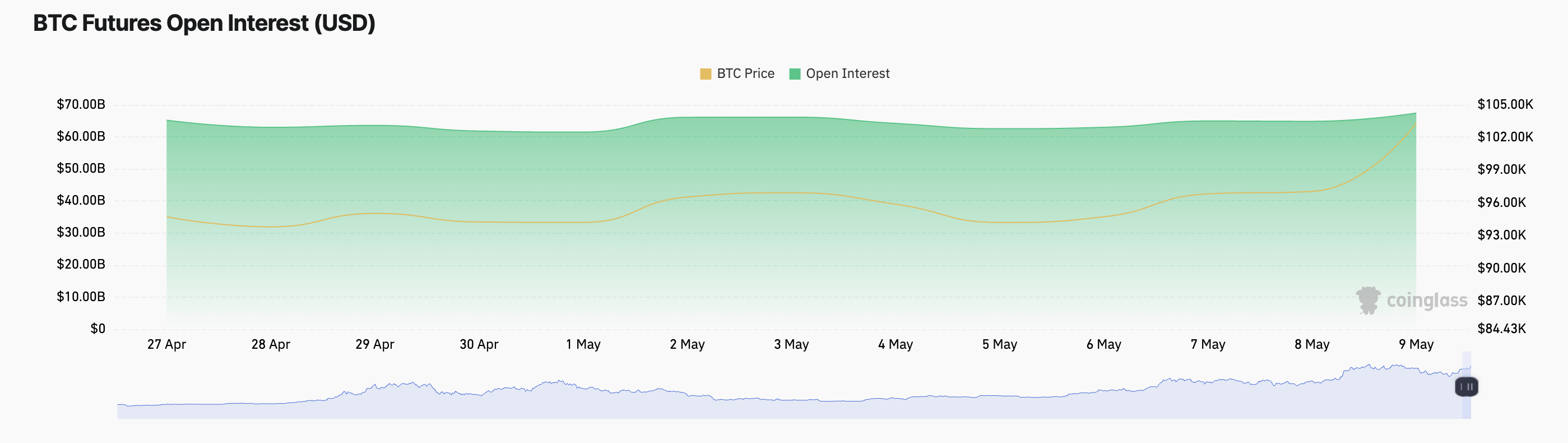

This is reflected by the coin’s futures open interest, which currently stands at $67.45 billion and has climbed 5% over the past day. When an asset’s open interest climbs alongside its price, new money is entering the market to support the trend, indicating strong bullish momentum.

BTC Futures Open Interest. Source: Coinglass

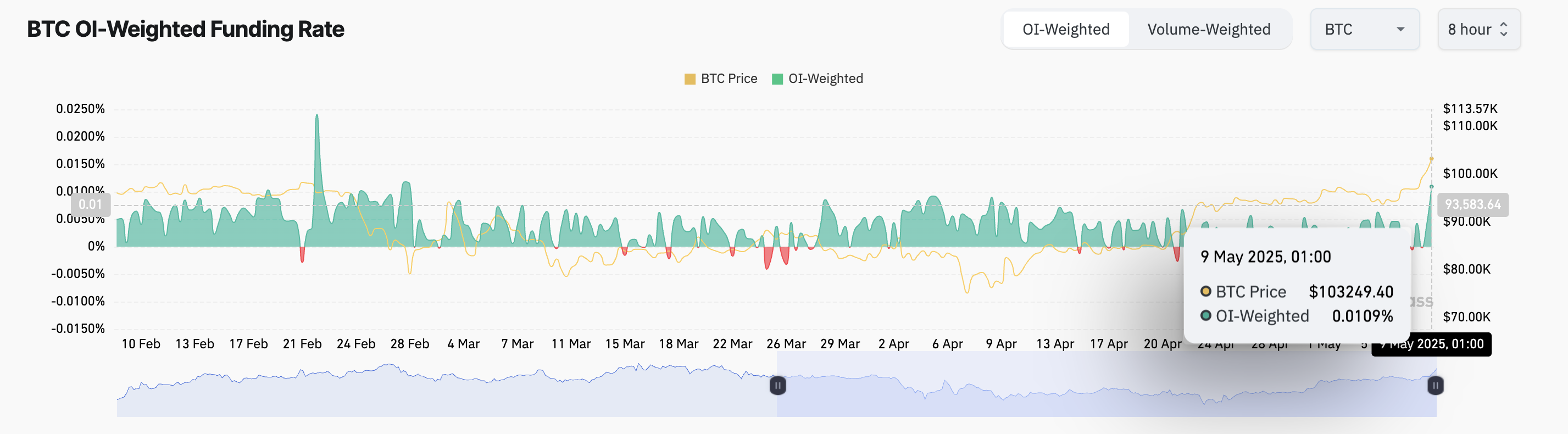

Moreover, BTC’s funding rate has soared to its highest level since February 28, reflecting a multi-month high demand for long positions among futures traders. As of this writing, the metric is at 0.0109%.

BTC Funding Rate. Source: Coinglass

A high funding rate like this means traders holding long positions are paying a premium to remain in the trade, which can reinforce bullish sentiment in the BTC market in the short term.

However, while ETF investors and futures traders appear to be leaning bullish, the options market shows signs of caution. Data indicates a growing demand for downside protection, with increased activity around put options.

BTC Options Open Interest. Source: Deribit

The mixed sentiment could shape short-term price action as markets digest BTC’s rally above $100,000 and assess whether it can continue.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.