Forex Today: Markets await comments from central bankers

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Here is what you need to know on Friday, May 9:

The US Dollar (USD) Index stays in a consolidation phase slightly below 100.50 after reaching its highest level in nearly a month earlier in the day. In the absence of high-tier data releases, market participants will pay close attention to comments from central bankers on Friday. In the early American session, Statistics Canada will publish April employment data.

US Dollar PRICE This week

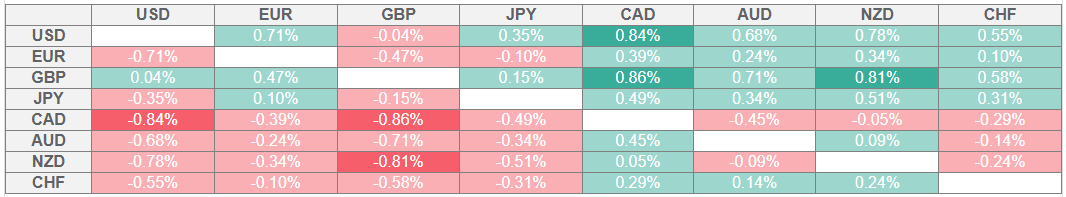

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Federal Reserve's (Fed) hawkish tone and the announcement of the UK-US trade deal boosted the USD on Thursday. After rising nearly 0.8% on the day, the USD Index continued to stretch higher and touched its strongest level since April 11 near 100.90 during the Asian trading hours on Friday. Several Fed policymakers, including NY Fed President John Williams and Fed Governor Christopher Waller, will be delivering speeches in the second half of the day. Meanwhile, US stock index futures trade mixed in the European session on Friday after Wall Street's main indexes closed in positive territory on Thursday.

The data from China showed early Friday that the trade surplus shrank to $96.18 billion in April from $102.64 billion in March. On a yearly basis, Exports rose by 9.3%, while Imports contracted by 0.2%. AUD/USD trades marginallyl higher on the day above 0.6400 to begin the European session.

The Bank of England (BoE) announced on Thursday that it lowered the policy rate by 25 basis points (bps) to 4.25%, as widely anticipated. In the policy statement, the BoE reiterated that a gradual and careful approach to further withdrawal of monetary policy restraint remains appropriate. While speaking at the post-meeting press conference, BoE Governor Andrew Bailey noted that the overall impact of tariffs on inflation remains uncertain. GBP/USD lost more than 0.3% on Thursday and continued to edge lower early Friday. At the time of press, the pair was trading slightly above 1.3250.

USD/JPY preserved its bullish momentum and rose more than 1% on Thursday. The pair corrects lower early Friday but holds above 145.00.

EUR/USD dropped to its weakest level in nearly a month below 1.1200 in the Asian session on Friday after closing in negative territory for two consecutive days. The pair stages a rebound and trades near 1.1250 in the European morning.

Gold came under renewed bearish pressure on Thursday and dropped below $3,300. XAU/USD gains traction early Friday and trades near $3,330.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.