Bitcoin, crypto market unfazed as Fed holds interest rates steady

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- Trump says Venezuela's Maduro deposed, captured after US strikes

- Bitcoin Price Surges To $90,000. U.S. Arrests Venezuela's President, Triggers Bull Frenzy

- After Upheaval in the World’s Largest Oil Reserve Holder, Who Will Emerge as the Biggest Winner in Venezuela’s Oil Market?

- U.S. to freeze and take control of Venezuela's Bitcoin holdings after Maduro capture

- Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

The Federal Reserve left interest rates unchanged at 4.25% - 4.50%, in line with market expectations.

Fed Chair Jerome Powell stated that the agency will continue to monitor economic developments, maintaining a wait-and-see approach.

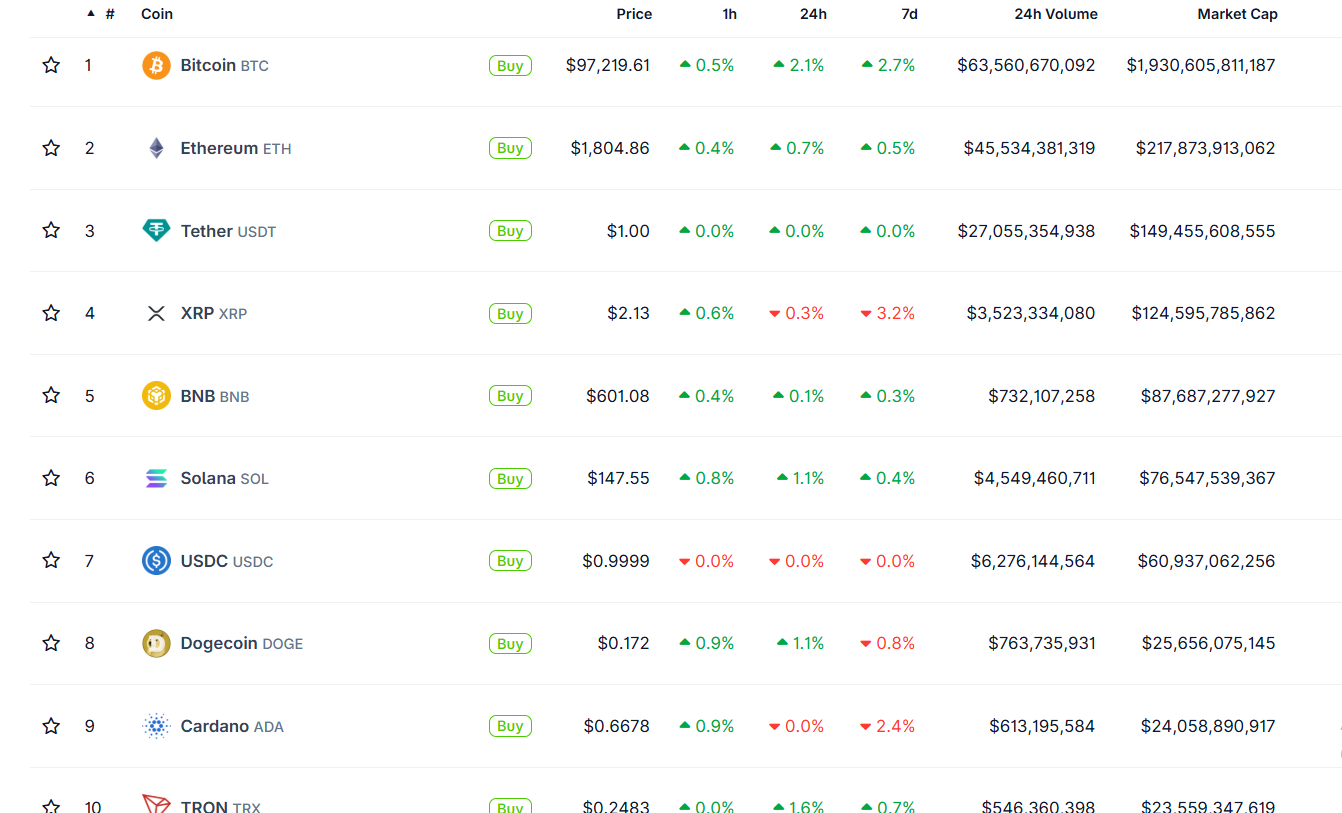

The crypto market held steady following the Fed decision, with top assets Bitcoin, Ethereum, XRP and Solana seeing little price changes.

Bitcoin (BTC) saw a 2% gain on Wednesday following the Federal Reserve's (Fed) decision to keep rates at 4.25% - 4.50%, which aligned with expectations. Fed Chair Jerome Powell shared that the Federal Open Market Committee (FOMC) will continue to observe economic developments, highlighting that it is still unsafe to reach a conclusion on policy changes.

Bitcoin sees slight gain after Fed decision to leave rates steady

The Federal Reserve kept interest rates unchanged at 4.25% to 4.50% in May, in line with market expectations. Market participants have highly anticipated the decision, following weeks of tension surrounding the US economy.

Fed Chair Jerome Powell stated in a press conference that the economy is still in good condition despite recent uncertainties. He also shared that the FOMC's decision allows the agency to observe economic developments properly.

"We believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments," Powell stated.

Powell emphasized that trade policy remains a major source of uncertainty, reinforcing the Fed's cautious approach. He added that it's still unclear how things will unfold, particularly with tariff policies, while stressing the importance of remaining patient and observant in the current environment.

"I think there's a great deal of uncertainty about, for example, where tariff policies are going to settle out," Powell said.

The decision follows recent criticism from President Donald Trump over the Fed's reluctance to lower interest rates. Trump called Powell "too slow" and highlighted that cutting rates is best for the economy.

Bitcoin traded above $97,000 on Wednesday, maintaining a 2% gain as the crypto market remained unfazed following the Fed's decision. Other top assets, Ethereum (ETH), XRP, Solana (SOL) and Dogecoin (DOGE), also held steady with little price changes.

Top Cryptocurrencies. Source: CoinGecko

Several sectors witnessed mixed reactions following the FOMC meeting, as many failed to retain gains from earlier in the day. The Artificial Intelligence (AI) and DePIN sectors dipped 3% while the real-world asset (RWA) and meme coin categories remained fairly muted.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.