Bitcoin, crypto market unfazed as Fed holds interest rates steady

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

- WTI climbs to $76.00, eyes one-year high amid rising tensions in the Middle East

- How to Survive Bitcoin Winter? Will It Still Fall Below $60,000 in 2026?

The Federal Reserve left interest rates unchanged at 4.25% - 4.50%, in line with market expectations.

Fed Chair Jerome Powell stated that the agency will continue to monitor economic developments, maintaining a wait-and-see approach.

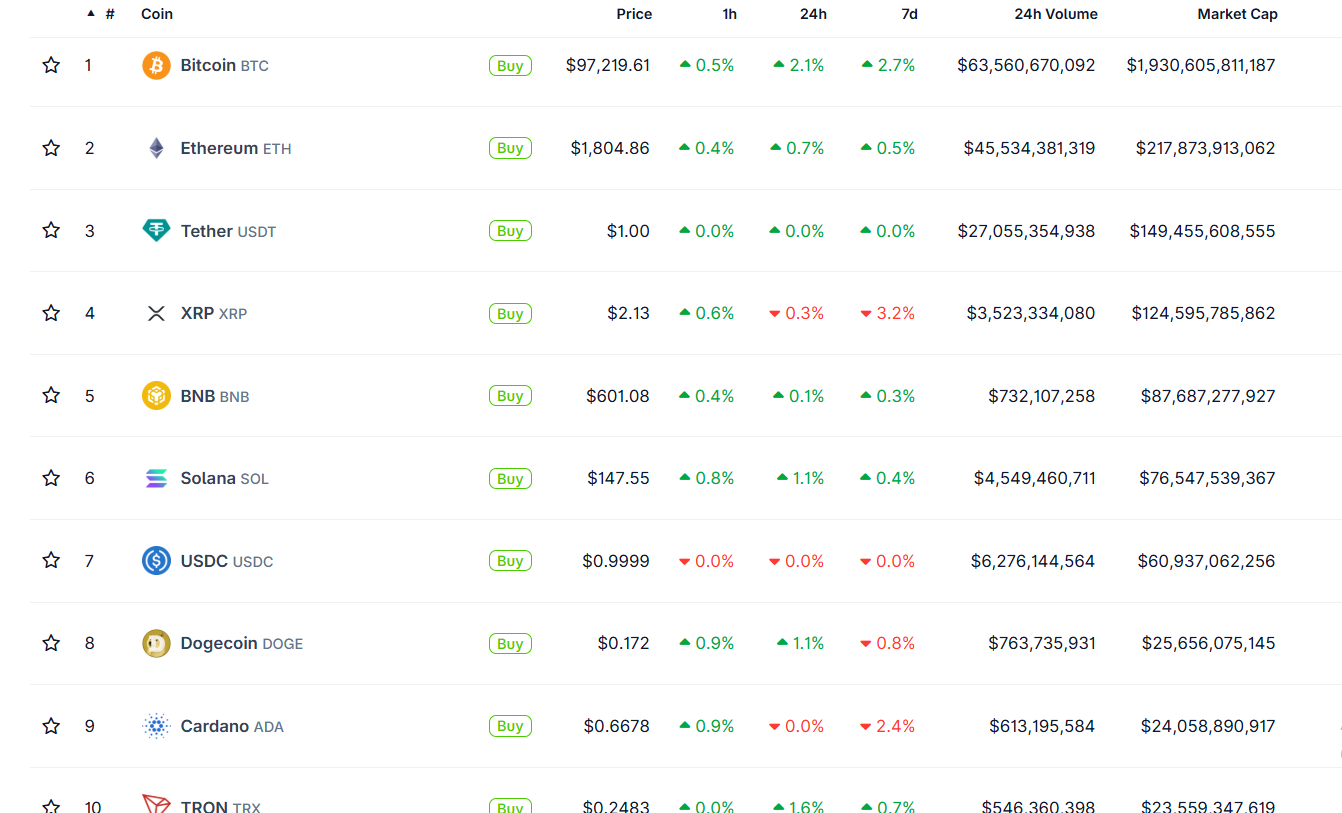

The crypto market held steady following the Fed decision, with top assets Bitcoin, Ethereum, XRP and Solana seeing little price changes.

Bitcoin (BTC) saw a 2% gain on Wednesday following the Federal Reserve's (Fed) decision to keep rates at 4.25% - 4.50%, which aligned with expectations. Fed Chair Jerome Powell shared that the Federal Open Market Committee (FOMC) will continue to observe economic developments, highlighting that it is still unsafe to reach a conclusion on policy changes.

Bitcoin sees slight gain after Fed decision to leave rates steady

The Federal Reserve kept interest rates unchanged at 4.25% to 4.50% in May, in line with market expectations. Market participants have highly anticipated the decision, following weeks of tension surrounding the US economy.

Fed Chair Jerome Powell stated in a press conference that the economy is still in good condition despite recent uncertainties. He also shared that the FOMC's decision allows the agency to observe economic developments properly.

"We believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments," Powell stated.

Powell emphasized that trade policy remains a major source of uncertainty, reinforcing the Fed's cautious approach. He added that it's still unclear how things will unfold, particularly with tariff policies, while stressing the importance of remaining patient and observant in the current environment.

"I think there's a great deal of uncertainty about, for example, where tariff policies are going to settle out," Powell said.

The decision follows recent criticism from President Donald Trump over the Fed's reluctance to lower interest rates. Trump called Powell "too slow" and highlighted that cutting rates is best for the economy.

Bitcoin traded above $97,000 on Wednesday, maintaining a 2% gain as the crypto market remained unfazed following the Fed's decision. Other top assets, Ethereum (ETH), XRP, Solana (SOL) and Dogecoin (DOGE), also held steady with little price changes.

Top Cryptocurrencies. Source: CoinGecko

Several sectors witnessed mixed reactions following the FOMC meeting, as many failed to retain gains from earlier in the day. The Artificial Intelligence (AI) and DePIN sectors dipped 3% while the real-world asset (RWA) and meme coin categories remained fairly muted.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.