EUR/JPY retreats from highs as Trump tariff threat tempers trade optimism

- EUR/JPY trades near 163.45, slipping after rejection from 163.94 resistance.

- Caution ahead of ECB’s Schnabel speech limits Euro support, despite ECB-BoJ policy gap.

- Soft Japanese data underscores Yen weakness, but safe-haven demand keeps gains in check.

- US–China trade talks revive risk appetite, though Trump’s tariff threat tempers optimism

The EUR/JPY pair is trading lower on Friday, weighed down by renewed US–China trade tensions, mixed economic data out of Japan, and cautious investor positioning ahead of a scheduled speech by European Central Bank (ECB) Executive Board member Isabel Schnabel.

At the time of writing, EUR/JPY is down 0.20% at 163.45, as markets recalibrate expectations around safe-haven demand for the Japanese Yen (JPY) and continued Euro (EUR) resilience stemming from the ECB–Bank of Japan (BoJ) policy divergence.

Revived US–China trade talks lift mood, but Trump’s tariff warning reins in optimism

A key market driver this week has been the prospect of revived high-level trade talks between the United States and China. Initial optimism was supported by confirmation that high-level trade talks between the United States and China will proceed on Saturday in Switzerland, with US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are expected meeting senior Chinese officials.

However, risk sentiment eased after US President Donald Trump suggested an 80% tariff on China, signaling a potential softening from the current 145% rate but still creating uncertainty. This ambiguity has capped gains in risk-sensitive currencies while supporting safe havens like the JPY.

ECB’s Schnabel in focus as policy divergence with BoJ remains key driver

ECB Executive Board member Isabel Schnabel is speaking at the Hoover Institution’s monetary conference in the US. Known for her hawkish stance, Schnabel’s remarks will be closely watched for insights on inflation and future rate cuts, as the ECB signals a cautious shift toward easing.

Markets expect a 25 basis point cut in June, but policymakers remain data-dependent. Meanwhile, the Bank of Japan maintains an ultra-loose monetary stance, contrasting with the ECB’s trajectory and supporting EUR/JPY strength. Any hint of prolonged ECB restrictiveness could further boost the Euro.

Weak Japanese data highlights BoJ’s dovish path, limits Yen support

Earlier on Friday, Japan released key economic indicators for March that offered a mixed snapshot of domestic conditions. The preliminary Coincident Index fell to 116.0 from a revised 117.3, suggesting a slowdown in current economic momentum. Meanwhile, the Leading Economic Index printed at 107.7, slightly above forecasts (107.5) but down from the previous 108.2, hinting at softer expectations for future growth.

These figures reinforce the view that the BoJ will maintain its accommodative monetary policy stance, particularly in the absence of inflationary or growth pressures.

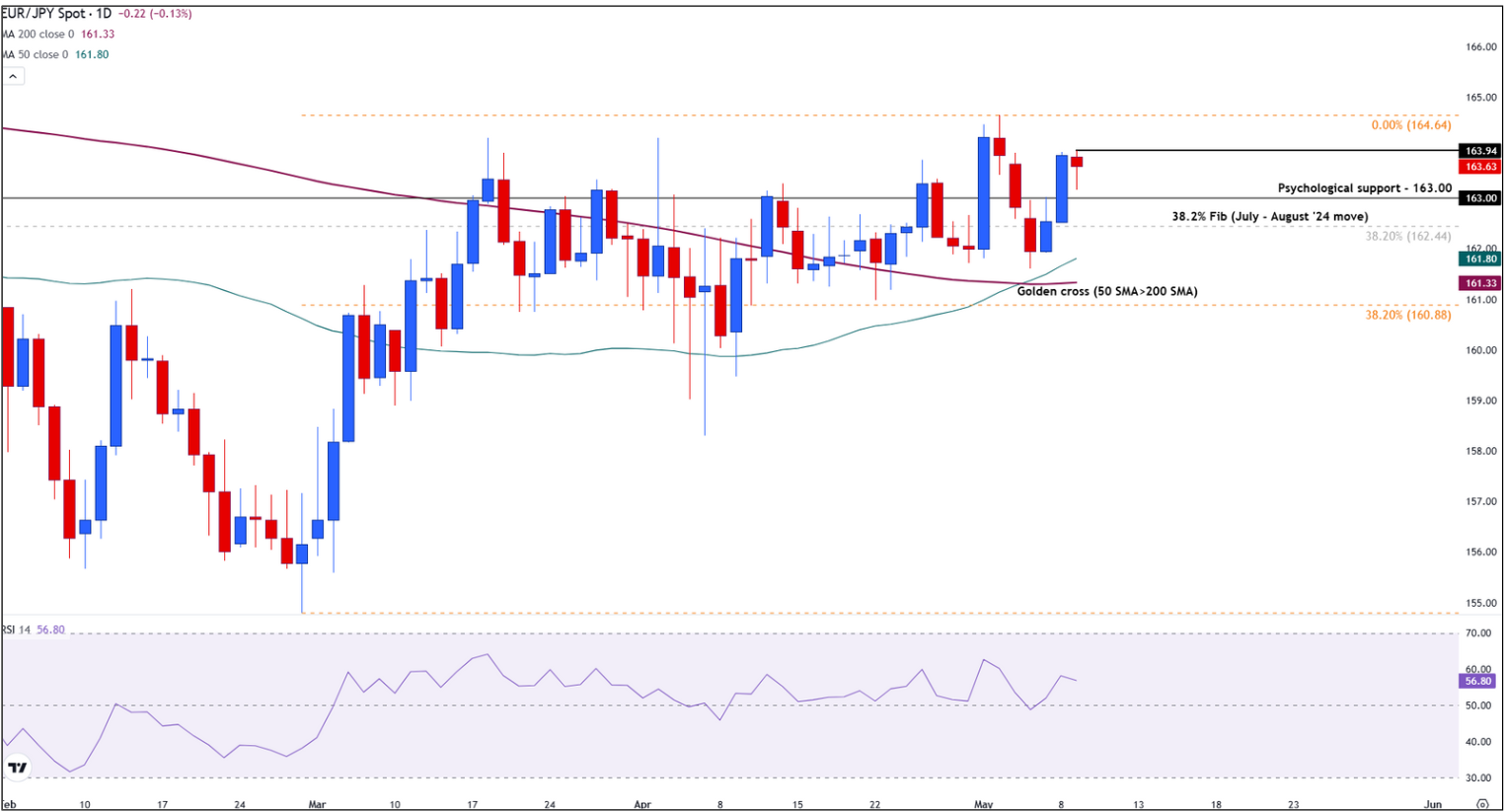

EUR/JPY stabilizes after rejection from 163.94 resistance

EUR/JPY is consolidating around 163.45, having tested intraday resistance at 163.94 during early Friday trading. The pair continues to trade above its 50-day (161.80) and 200-day (161.32) Simple Moving Averages, which recently formed a golden cross, reinforcing a bullish medium-term outlook.

Upside momentum remains contained below 163.94, with a confirmed daily close above this level needed to expose the March high at 164.64.

Support is seen at the 163.00 psychological level, followed by the 38.2% Fibonacci retracement of the July–August 2024 rally at 162.44. A break below that zone would bring the moving average cluster near 161.80–161.32 into focus.

The Relative Strength Index (RSI) is currently holding around 55.78, suggesting modest bullish momentum without overbought conditions.

EUR/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.