Forex Today: Gold corrects from record-high, focus shifts to Powell speech

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

Here is what you need to know on Tuesday, October 14:

Markets quiet down early Tuesday following Monday's volatile action. Business sentiment data from Germany and the United States (US) will be featured in the economic calendar later in the day. More importantly, Federal Reserve (Fed) Chairman Jerome Powell will speak on the Economic Outlook and Monetary Policy at the National Associations for Business Economics (NABE) Annual Meeting in Philadelphia.

US Dollar Price This week

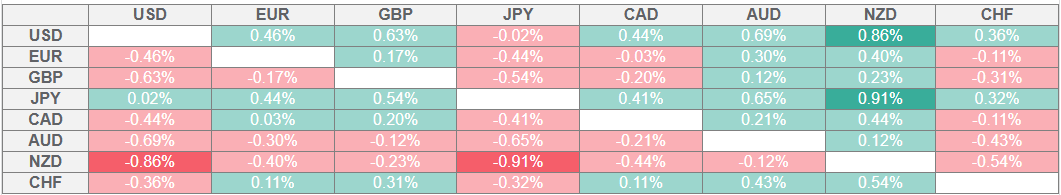

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) staged a rebound on Monday as investors reassessed the US-China trade conflict after US President Donald Trump announced at the end of the previous week that they were planning to impose additional 100% tariffs on Chinese imports. US Treasury Secretary Scott Bessent told Fox Business on Monday that he believes China is open to discussions and added that 100% tariff doesn't have to happen. Wall Street's main indexes ended the day with significant gains and the USD Index rose 0.4% on the day, erasing a large portion of Friday's losses.

Early Tuesday, China's Commerce Ministry said that the US needs to correct its ‘wrong practices’ as soon as possible and noted that the US cannot have talks while threatening to intimidate and introduce new restrictions, which is not the right way to get along with China. The USD Index holds steady above 99.00 early Tuesday, while US stock index futures lose between 0.5% and 1%, reflecting a souring risk mood.

The minutes of the Reserve Bank of Australia's (RBA) September monetary policy meeting showed that board members agreed that the policy is still a little restrictive but it's also difficult to determine because of the considerable uncertainty about the global outlook, US tariffs and the Chinese economy. AUD/USD stays under heavy bearish pressure early Tuesday and trades at its lowest level since late August near 0.6470.

The UK's Office for National Statistics (ONS) reported on Tuesday that the ILO Unemployment Rate edged higher to 4.8% in the three months to August from 4.7%. Other details of the publication showed that the Employment Change was +91K in this period, compared to the 232K increase recorded previously. GBP/USD stays on the back foot after posting small losses on Monday and trades below 1.3300.

Japanese Finance Minister Katsunobu Kato said on Tuesday that he has recently seen one-sided and rapid moves in the foreign exchange and reiterated that it’s important for currencies to move in a stable manner, reflecting fundamentals. After rising in the Asian session on Tuesday, USD/JPY lost its traction and was last seen trading in negative territory below 152.00.

EUR/USD fluctuates in a narrow channel below 1.1600 after closing in the red on Monday. French Prime Minister Sebastien Lecornu is expected to present the budget proposal later in the day, which will reportedly target a total cut costs of around €31 billion.

Gold's relentless rally continued on Monday and the yellow metal gains more than 2% to register its highest daily close ever above $4,110. After hitting a new record peak near $4,180 early Tuesday, XAU/USD corrected lower and was last seen trading at around $4,130.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.