EUR/USD remains vulnerable on risk aversion, accelerating German inflation

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

The Euro hovers near recent lows with upside attempts capped below 1.1600.

Risk appetite remains subdued as trade tensions between the US and China flare up.

German CPI data confirmed that inflation accelerated in September.

EUR/USD steadies in the early European session on Tuesday, but remains close to multi-month lows, trading at 1.1590 at the time of writing. A frail market sentiment, amid ongoing concerns about global trade, is keeping investors' appetite for risk subdued.

News that China and the United States have raised their fees on each other's vessels has reactivated concerns about a trade war between the world's two major economies on Tuesday. This has dampened previous hopes of a de-escalation, following US Treasury Secretary Scot Bessent's announcement on Monday of an upcoming meeting between US President Donald Trump and his Chinese counterpart, Xi Jinping.

Data from Germany revealed that consumer inflation accelerated to 2.4% in September from 2.2% in August, in line with the preliminary reading. The Euro (EUR) edges lower following the data release.

The US economic docket remains thin, amid a data blackout from the US federal government. Still, Federal Reserve (Fed) Chairman Jerome Powell will speak later today. However, in the absence of hard data to contextualize his comments, he is unlikely to alter market expectations of two interest rate cuts by the central bank in the next two meetings.

Euro Price Today

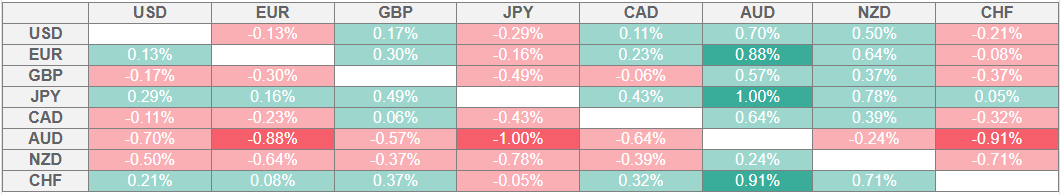

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The US Dollar appreciates amid trade war fears

Market hopes that US President Trump's softer tone towards China would lead to a new de-escalation of the trade rift have been crushed by news that China has started charging higher fees to US cargo vessels, in a move that will be responded to in the US, opening a new front in trade hostilities.

Apart from that, Chinese authorities have dampened tensions between the two countries, as Beijing accused the US of having "double standards" and the commerce ministry affirmed that the US cannot seek dialogue, while threatening new measures.

All this stems from China's decision to impose restrictions on rare earth exports to Western countries announced last week, which was responded to by Trump with a threat of 100% levies on Chinese imports effective on November 1, which rattled financial markets and sent the US Dollar tumbling last Friday.

On the macroeconomic front, German Consumer Prices Index (CPI) data showed a 0.2% increase in September and a 2.4% year-on-year growth, accelerating from 0.1% and 2.2%, respectively, in August. The Harmonized Index of Consumer Prices (HICP) has revealed the same figures.

Later on the day, the German ZEW Economic Sentiment Index is expected to show a moderate improvement, yet with the gauge measuring the current economic situation steady at historically low levels.

Technical Analysis: EUR/USD is under bearish pressure below 1.1600

EUR/USD remains on its back foot after failing to regain the 1.1600 level on Monday. Technical indicators in the 4-hour chart highlight the bearish momentum, with the Relative Strength Index (RSI) capped below the 50 level and the Moving Average Convergence Divergence (MACD) about to cross below the signal line.

Support at the 1.1560 area (intraday low) is holding bears for now, but it remains under pressure as upside attempts keep finding sellers. Further down, the August 5 low, at 1.1530, and the base of the descending channel, in the area of 1.1525, will come into focus.

To the upside, the intraday high is at 1.1590, ahead of Monday's peak of 1.1630. Further up, the top of the descending channel comes at the 1.1680 area.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.