Australian Dollar maintains position following RBA Meeting Minutes release

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

The Australian Dollar moves little as the RBA Minutes of its October meeting indicated that policy is still a little restrictive.

Traders adopt caution as RBA Governor Michele Bullock said that services inflation remains persistent.

The US Dollar may face challenges amid rising odds of further Fed rate cuts.

The Australian Dollar (AUD) holds ground against the US Dollar (USD) on Tuesday. The AUD/USD pair moves little following the release of the Reserve Bank of Australia’s (RBA) Minutes of its October monetary policy meeting, which showed that board members agreed that policy was still a little restrictive but difficult to determine.

The RBA Meeting Minutes also noted that economic risks persist, with consumption remaining weak amid softer job and wage growth. Monthly CPI data for housing and services indicate that Q3 inflation could come in above forecasts.

Market sentiment remains cautious after RBA Governor Michele Bullock remarked last week that services inflation remains somewhat persistent. She acknowledged that second-quarter inflation was slightly above expectations but continues to move in the right direction.

Australia’s Consumer Inflation Expectations rose to 4.8% in October, up from 4.7% previously, the highest level since June. Growing concerns that inflation may surpass forecasts in Q3 reinforce the cautious outlook surrounding the Reserve Bank of Australia. Traders largely expect the RBA to hold interest rates steady after keeping the Official Cash Rate unchanged at 3.6% in September.

US Dollar steadies ahead of Fed Chair Powell’s speech

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is remaining steady and trading around 99.30 at the time of writing. Traders will likely observe the speech from US Federal Reserve (Fed) Chair Jerome Powell later in the day.

The CME FedWatch Tool suggests that markets are now pricing in nearly a 97% chance of a Fed rate cut in October and a 92% possibility of another reduction in December.

Philadelphia Fed President Anna Paulson said on Monday that rising risks to the job market argue for more interest rate cuts by the US central bank, as trade tariffs now appear unlikely to push up inflation as much as expected.

The Federal Open Market Committee (FOMC) Minutes from the September meeting suggested policymakers are leaning toward further rate cuts this year. The majority of policymakers supported the September rate cut and signaled further reduction later this year. However, some members favored a more cautious approach, citing concerns about inflation.

US President Trump stated on Friday that there was no reason to meet with China’s President Xi Jinping during the upcoming summit in South Korea in two weeks. Trump also announced plans to impose 100% tariffs on Chinese imports. However, Trump shared some conciliatory remarks in his post on Truth Social on Sunday, noting that China’s economy “will be fine” and that the US wants to “help China, not hurt it.”

China's Commerce Ministry announced on Thursday that the country will tighten rules on rare earth exports, effective December 1. Foreign businesses and individuals must obtain a dual-use items export license for rare earth exports.

China's Trade Balance arrived at CNY645.47 billion in September, narrowing from the previous figure of CNY732.7 billion. Exports rose 8.4% YoY in September vs. 4.8% in July. The country’s imports advanced 7.5% YoY in the same period vs. 1.7% recorded previously. In US Dollar (USD) terms, China’s Trade Surplus came at $90.45 billion, expanded less than expected $98.96 billion in September, and was down from the previous $102.33.

Reuters, citing a report from The Age on Sunday, said a leaked brief from Australia’s Prime Minister Anthony Albanese’s department revealed that government officials have begun discussions with miners about contributing to a A$1.2 billion ($776.28 million) “critical minerals strategic reserve.” Australia is considering setting minimum prices for critical minerals and providing funding for new rare earth projects under a proposed resources agreement with the United States.

Australian Dollar holds above 0.6500 to target nine-day EMA barrier

The AUD/USD pair is trading around 0.6510 on Tuesday. Technical analysis on the daily chart suggests a prevailing bearish bias as the pair is moving downwards within a descending channel pattern. Additionally, the 14-day Relative Strength Index (RSI) remains below the 50 level, strengthening a bearish bias.

On the downside, the AUD/USD pair may target the lower boundary of the descending channel around 0.6460. A break below the channel would strengthen the bearish bias and prompt the pair to test the four-month low of 0.6414, recorded on August 21, followed by the five-month low of 0.6372.

The initial barrier lies at the nine-day Exponential Moving Average (EMA) of 0.6546, followed by the 50-day EMA at 0.6556. A break above these levels would improve the short- and medium-term price momentum and lead the AUD/USD pair to test the descending channel’s upper boundary around 0.6600. Further advances above the channel would cause the emergence of the bullish bias and support the pair to explore the region around the 12-month high of 0.6707, recorded on September 17.

AUD/USD: Daily Chart

Australian Dollar Price Today

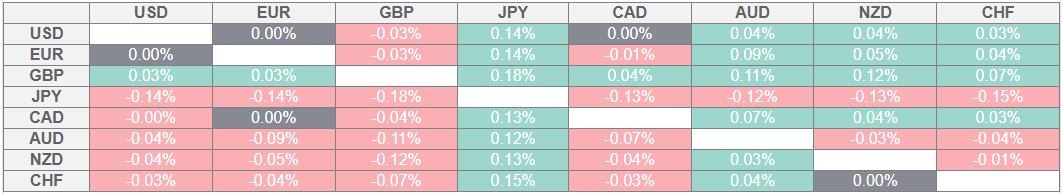

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.