Crypto market faces renewed volatility as Bitcoin tumbles below $113,000

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

Bitcoin drops below $113,000, extending a fresh sell-off wave among top altcoins.

The traders’ interest in the derivatives market remains minimal, suggesting a risk-off sentiment.

Total liquidations crossed $450 million in the crypto market over the last 24 hours, a sign of resurfacing volatility.

Bitcoin (BTC) price drops below $113,000 at press time on Tuesday, undermining the 4% gains from Sunday. The sell-off pressure extends to top altcoins, resulting in an over 3% drop in Ethereum (ETH), Ripple (XRP), and Solana (SOL). The derivatives market remains on edge as the Open Interest remains low, while rising liquidations push more capital out of the market.

Bitcoin risks further losses

Bitcoin takes a bearish reversal from the 50-day Exponential Moving Average (EMA) at $115,508, risking an extension to last week’s three-day correction, including Friday’s 7% decline. At the time of writing, BTC approaches $112,500, undermining the support from the 100-day EMA at $113,501.

The technical indicators on the daily chart suggest that selling pressure is increasing as the Relative Strength Index (RSI) drops to 44, having reversed near the halfway line, with room for further correction before reaching the oversold zone. Furthermore, the Moving Average Convergence Divergence (MACD) approaches the zero line after a crossover with its signal line on Friday, which marked the bearish shift in momentum. If MACD drops below the zero line, it could indicate an increase in the overhead pressure.

The immediate support levels for Bitcoin are $109,561, low from Saturday, followed by the zone between the 200-day EMA at $108,027 and the $107,429 level marked by the July 8 low.

BTC/USDT daily price chart.

If BTC rises above the 50-day EMA at $115,508, it would negate the dead cat bounce thesis, suggesting a potential rally to the $120,000 round figure.

Altcoins under pressure add to increased liquidation

With the Bitcoin price under pressure, altcoins are facing a panic sell-off with Ethereum, Solana, and XRP down over 3% by press time on Tuesday. Typically, a correction in Bitcoin, especially in volatile market conditions, leads to a broader market pullback.

Corroborating the sell-off thesis, CoinGlass data shows that the broader market long position liquidations amount to $276.90 million, outpacing the short liquidations of $190.23 million in the last 24 hours. The total liquidation in the same period amounts to $467.13 million, approaching the $500 million mark and erasing the short-term recovery in traders’ sentiment.

Crypto Market Liquidations. Source: CoinGlass

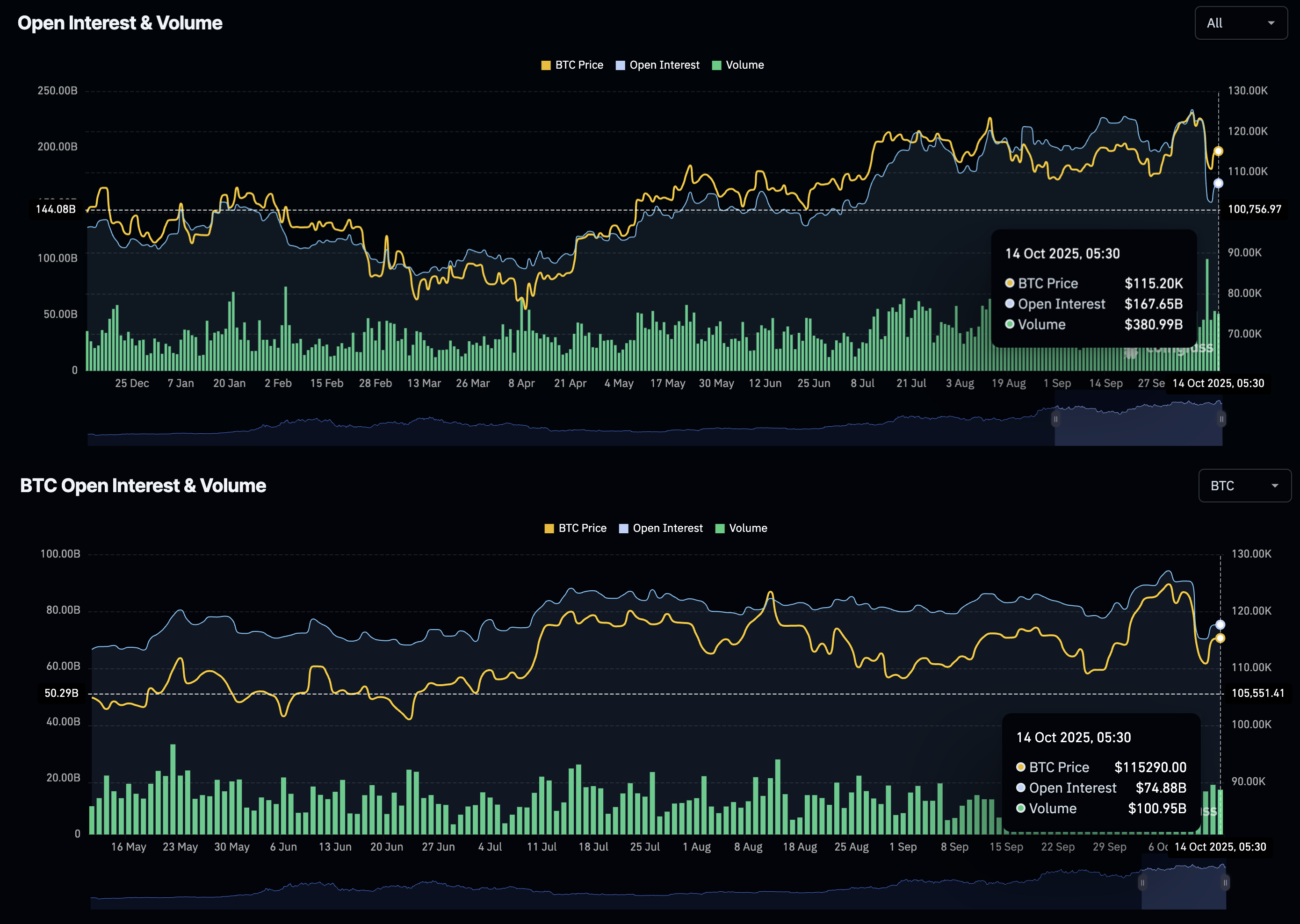

The broader cryptocurrency market Open Interest (OI) stands at $163.59 billion, down by 0.72% in the last 24 hours. Similarly, Bitcoin futures OI is down by over 1.50% in the same period, holding at $73.68 billion. Typically, a decline in OI refers to capital outflow as traders exit the market, adopting a wait-and-see approach amid heightened risk-off sentiment.

Bitcoin Open Interest. Source: CoinGlass

This decline in traders’ sentiment with open Interest amid rising liquidations could fuel a downward spiral for altcoins, resulting in further losses.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.