The Australian Dollar moves little following the release of preliminary S&P Global Purchasing Managers Index data.

Australia's S&P Global Manufacturing PMI rose to 52.9, while Services PMI climbed to 55.1 in August.

FOMC Meeting Minutes suggested that most members considered the decision appropriate to maintain the interest rates.

The Australian Dollar (AUD) depreciates against the US Dollar (USD) on Thursday, extending its losses for the fourth successive day. The AUD/USD pair remains subdued despite the release of the improved preliminary data of S&P Global Australia’s Purchasing Managers Index (PMI). Furthermore, the preliminary S&P Global US Purchasing Managers Index (PMI) reports will be eyed later in the day.

Australia's S&P Global Manufacturing PMI came in at 52.9 in August, against 51.3 prior. Meanwhile, Services PMI rose to 55.1 from the previous reading of 54.1. The Composite PMI improved to 54.9 from 53.8 previously. However, Australia’s Consumer Inflation Expectations rose 3.9% in August, against the previous rise of 4.7%.

The Federal Open Market Committee’s (FOMC) Minutes for the July 29-30 meeting indicated that most Federal Reserve (Fed) officials emphasized that inflation risks outweighed labor market concerns during last month’s meeting, as tariffs deepened divisions among policymakers. Most policymakers considered it appropriate to maintain the benchmark interest rate in the 4.25%–4.50% range.

Australian Dollar remains subdued as US Dollar steadies ahead of Powell’s upcoming speech

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground and trading around 98.20 at the time of writing. Traders are awaiting Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium in Wyoming on Friday, which may provide clues about the September policy decision.

Fed funds futures traders are currently pricing in an 83% chance of a cut next month and 54 basis points (bps) of cuts by year-end, according to the CME FedWatch tool.

White House press secretary Karoline Leavitt announced on Tuesday that plans for a bilateral meeting between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy are now underway, according to CNN.

US President Donald Trump said on Tuesday that there won’t be American troops on the ground to help enforce a potential peace deal in Ukraine. The terms of security guarantees are still being negotiated between the US, European partners, and Ukraine.

The Trump administration has broadened its 50% tariffs on steel and aluminum imports, taking effect on August 18. Friday’s notification included 407 new product codes in the US Harmonized Tariff Schedule. US President Donald Trump also told reporters he intends to issue further announcements on steel tariffs, along with new levies aimed at semiconductor imports.

The People’s Bank of China (PBOC) announced on Wednesday that it would leave its one- and five-year Loan Prime Rates (LPRs) unchanged at 3.00% and 3.50%, respectively.

US Treasury Secretary Scott Bessent said late Monday that the talks between the United States (US) and China are going well, adding that he expects US growth to pick up in the fourth quarter (Q4). Bessent further noted that the current arrangement with China is highly effective, as the country remains the largest contributor to tariff revenue.

Australia’s Westpac Consumer Confidence surged 5.7% in August to 98.5, following a 0.6% increase in July. The sentiment has reached a high since February 2022, as the Reserve Bank of Australia (RBA) has delivered rate cuts totaling 75 basis points since January. Matthew Hassan, Head of Australian Macro-Forecasting, said the prolonged period of consumer pessimism may be coming to an end, although maintaining momentum could require additional easing. However, he emphasized that policymakers are under no immediate pressure to deliver further cuts.

The Reserve Bank of Australia (RBA) delivered a 25 basis points (bps) interest rate cut on Tuesday, as widely expected, bringing the Official Cash Rate (OCR) to 3.6% from 3.85% at the August policy meeting.

Australian Dollar tests two-month lows near 0.6400

AUD/USD is trading around 0.6430 on Thursday. The technical analysis on the daily chart indicates that short-term price momentum is weakening as the pair remains below the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) is positioned below the 50 level, indicating a bearish market bias.

On the downside, the AUD/USD pair could target the two-month low of 0.6419, recorded on August 1, followed by the three-month low of 0.6372, reached on June 23.

The primary barrier appears at the nine-day EMA of 0.6473, followed by the 50-day EMA at 0.6492. A break above this crucial resistance zone could improve the short- and medium-term price momentum and prompt the AUD/USD pair to target the monthly high at 0.6568, reached on August 14, followed by the nine-month high of 0.6625, which was recorded on July 24.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

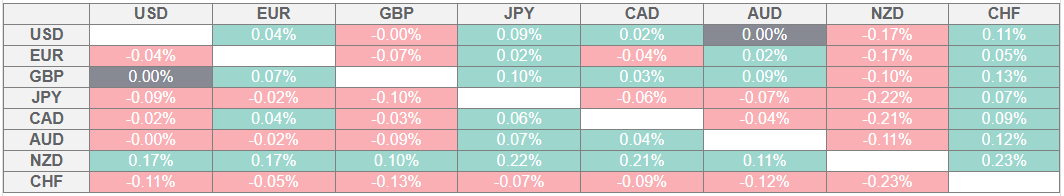

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.