AUD/USD advances further beyond 0.6500 amid notable USD weakness

- Crypto Meltdown. 240,000 Liquidated, $100 Billion Wiped Off Crypto Market Cap.

- Trump’s Greenland Tariff Suspension: Crypto Prices Rebound as Investors Weigh Rally Longevity

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Gold Price Forecast: XAU/USD surges to all-time high above $4,650 amid Greenland tariff threats

- US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

AUD/USD attracts strong follow-through buying on Friday amid a broadly weaker USD.

Dovish remarks from Fed’s Waller and a positive risk tone weigh on the safe-haven buck.

Trade uncertainties and reviving RBA rate cut bets could act as a headwind for the Aussie.

The AUD/USD pair is building on the previous day's bounce from the vicinity of mid-0.6400s, or a three-and-a-half-week trough, and gaining strong follow-through positive traction on Friday. The intraday move up remains uninterrupted through the first half of the European session and lifts spot prices further beyond the 0.6500 psychological mark.

The US Dollar (USD) drifts lower in reaction to dovish remarks from Federal Reserve (Fed) Governor Christopher Waller, saying that the central bank should cut interest rates in July amid mounting risks to the economy. This, along with a generally positive tone around the equity markets, drags the safe-haven buck away from its highest level since June 23 touched on Thursday, and turns out to be a key factor that benefits the risk-sensitive Aussie.

Investors, however, seem convinced that the Fed would delay cutting interest rates at least until September amid signs that the Trump administration's increasing import taxes are passing through to consumer prices. The bets were reaffirmed by comments from influential FOMC members on Thursday and the upbeat US macro data. This, in turn, could limit any meaningful USD corrective decline and act as a headwind for the AUD/USD pair.

Meanwhile, Thursday’s disappointing Australian employment details underscored a softening labor market. Adding to this, signs of weakness in the economy firmed market expectations that the Reserve Bank of Australia (RBA) will cut interest rates further. This should further contribute to capping the AUD/USD pair and warrants some caution for bulls. Traders now look forward to the US macro data for short-term impetus heading into the weekend.

US Dollar PRICE Today

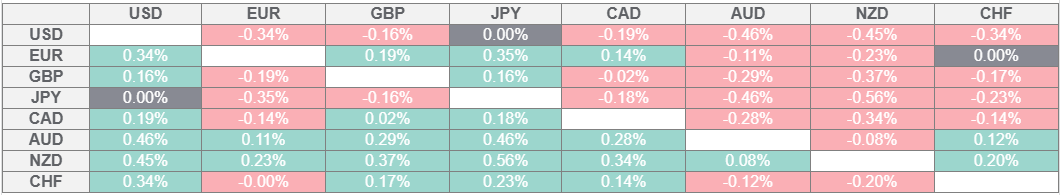

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.