AUD/USD advances to near 0.6570 on upbeat Australian Dollar, US CPI eyed

- Crypto Meltdown. 240,000 Liquidated, $100 Billion Wiped Off Crypto Market Cap.

- Trump’s Greenland Tariff Suspension: Crypto Prices Rebound as Investors Weigh Rally Longevity

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Gold Price Forecast: XAU/USD surges to all-time high above $4,650 amid Greenland tariff threats

- US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

AUD/USD climbs to near 0.6570 as the antipodean trades firmly.

China’s Q2 GDP data beats estimates, lifting demand for the Australian Dollar.

Investors await the US CPI data for June, which will influence market expectations for the Fed’s monetary policy outlook.

The AUD/USD pair jumps to near 0.6570 during the European trading session on Tuesday. The Aussie pair gains sharply as the Australian Dollar (AUD) outperforms its peers, following the release of upbeat China’s Q2 Gross Domestic Product (GDP) data earlier in the day.

Australian Dollar PRICE Today

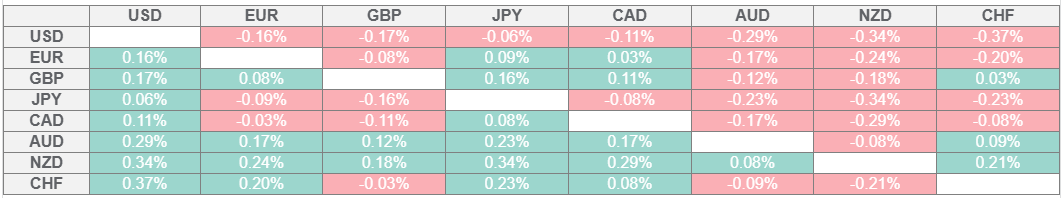

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

China’s National Bureau of Statistics (NBS) reported that the economy expanded 5.2% in the April-June period compared to the same quarter of the previous year, faster than estimates of 5.1%, but slower than the 5.4% growth seen in the previous quarter. On a quarterly basis, the Chinese economy grew by 1.1%.

Meanwhile, Industrial Production surprisingly rose at a faster pace of 6.8% in June. Economists anticipated the factory data to have grown moderately by 5.6% against 5.8% in May.

Strong Chinese data strengthens the Australian Dollar (AUD), given that the Australian economy relies heavily on its exports to Beijing.

On the domestic front, investors await the employment data for June, which is scheduled to be released on Thursday. The employment report is expected to show that Australian employers added 20K fresh workers. The Unemployment Rate is seen steady at 4.1%.

In the United States (US), investors await the Consumer Price Index (CPI) data for June, which will be published at 12:30 GMT. The US CPI report is expected to show that the headline inflation rose at a faster pace of 2.7% on year, compared to a 2.4% growth seen in May. In the same period, the core CPI – which excludes volatile food and energy prices – is estimated to have accelerated to 3% from the prior release of 2.8%.

Signs of price pressures accelerating would discourage Federal Reserve (Fed) officials from endorsing interest rate cuts.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.