The Pound appreciates on risk appetite and nears two-week highs at 194.20.

The Yen loses ground with all eyes on BoJ's Ueda conference on Tuesday.

A confirmation above 194.20 would bring the four-month high, at 196.25 into focus.

Trump’s decision to pause tariffs on the EU intel on July 9 has boosted risk appetite on a light trading session on Monday, with UK markets closed for the Spring Bank holiday.

The de-escalation of the EU-US trade rift has soothed investors, wary of a severe blow to international trade, which would significantly slash the global growth outlook. The combined trade activity of the European Union and the US accounts for 30% of the global trade, and 43% of global GDP, according to data from the European Council.

British Pound PRICE Today

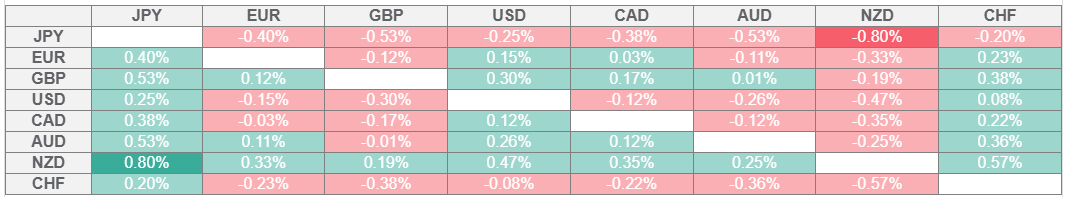

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Safe assets suffer in risk-on markets

In the absence of relevant macroeconomic data in the UK and Japan, the positive sentiment is buoying the risk-sensitive Sterling, with the safe-haven Yen looking weak.

Later this week, Ueda’s press release on Tuesday and the advanced Tokyo CPI might provide further clues about the Bank of Japan’s monetary policy and provide further guidance for the Japanese Yen. In the UK, BoE Governour Bailey’s speech, due on Thursday, will be the highlight of the week.

The Pound is gaining about 0.6% so far today, reversing Friday’s losses and approaching the mid-May high, at 194.20. Beyond that, the focus will shift to the four.-month high, at 196.25.

On the downside, support is at last week’s lows, in the 192.00 area ahead of 190.35.

GBP/USD 4-Hour Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.