President Trump said that he needs two weeks to decide whether to strike Iran, and the markets sigh with relief.

An ebbing risk aversion is providing some support to the Euro as safe-haven demand eases.

EUR/USD remains on a bearish correction from 1.1630 highs.

The EUR/USD pair is trading higher for the third consecutive day on Friday and has returned above the 1.1500 level, trading at 1.1520 at the moment of writing. US President Donald Trump's comments saying that he needs two weeks to decide on entering the Middle East conflict have eased investors' fears of an imminent attack and provided some support to the Euro.

The pair, however, remains on track to a moderate weekly loss, as investors' concerns that the war between Iran and Israel might turn into a wider regional conflict have kept risk appetite subdued, boosting demand for the US Dollar and other traditional safe havens.

Beyond that, the sharp increase in Oil prices poses another challenge for a soft Eurozone Economy while the trade relationship with the US remains highly uncertain. The negotiations between the US and European authorities remain stalled just two weeks before Trump's July 9 deadline to cut a deal or face high tariffs.

Earlier this week, the Federal Reserve (Fed) left interest rates unchanged and maintained its projection of two cuts in 2025, but Chairman Jerome Powell struck a hawkish note, downplaying the dot plot and warning about higher inflationary pressures stemming from Trump's tariffs. Powell's press release turned the decision into a "hawkish hold," which gave additional support to the US Dollar.

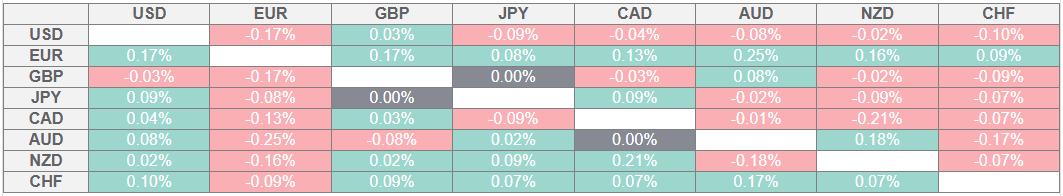

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Euro extends its recovery as risk aversion eases

Market sentiment improved somewhat on Friday after Trump eased fears of an imminent attack on Iran, and news reports suggest that US and Iranian officials are keeping diverse lines of direct and indirect negotiations. There is also news that Iranian diplomats will meet Eurozone officials to hold nuclear talks on Friday, which opens a possibility of a peace agreement.

Meanwhile, the Middle East conflict enters its eighth day with Tehran and Tel Aviv exchanging missiles and threats. Israel attacked several military and nuclear targets overnight in an attempt to cripple the Islamic Republic's aim to obtain a nuclear weapon and topple its Government.

Risk aversion eases somewhat as Trump calmed fears of US involvement in the war, but market sentiment remains frail. Oil prices have escalated to $73, about 12% above May's range, which adds a new layer of uncertainty to a global economy already threatened by higher tariffs from the US that will severely restrict international trade.

The Federal Reserve kept interest rates on hold at the 4.25%-4.50% range as expected, as well as the projections of two interest rate cuts by year end, but the economic growth expectations for 2025 were downgraded to 1.4% from the previous 1.7%, and inflation expectations hiked to 3% from the previous 2.7%. A context of softer growth and higher inflation poses a dilemma for the central bank.

On Thursday, European Central Bank (ECB) President Christine Lagarde pitched for greater regional trade between the European Union and neighboring economies to offset losses from global fragmentation during an event in Kyiv.

The macroeconomic calendar is thin on Friday. In the US, the highlight will be the Philadelphia Fed Manufacturing Survey, which is expected to show some minor improvement, yet with the index remaining in negative territory for the third consecutive month.

Somewhat later, the preliminary Consumer Confidence Index released by the European Commission is expected to have improved to -14.5 in June from -15.2 in the previous month, still at levels consistent with a soft economic growth.

EUR/USD remains on a bearish correction from 1.1630

EUR/USD is trading within a descending channel since peaking at 1.1630 on June 12. The pair has pared some losses over the last three days, but it remains on track for a moderate weekly loss. From a technical perspective, the bearish correction from last week's highs remains in play.

Upside attempts are being capped around the June 18 high at 1.530 on Friday. The pair should confirm above that level and breach the top of the descending channel, now at 1.1570, to break the immediate bearish structure and shift the focus back to the mentioned 1.1630 high.

On the downside, immediate support is at 1.1445 (June 19 low) and the descending channel trendline support, at 1.1440. A bearish reaction below that level would increase pressure towards 1.1370, the June 6 and 10 lows, and the 61.8% Fibonacci retracement level drawn from the May 29 low of 1.1210 to the June 12 high of 1.1630.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.