USD/JPY Price Forecast: The pair remains bullish with 146.15 on sight

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

The USD/JPY maintains its bullish trend intact despite the strong Japanese inflation numbers.

Some dovish tweak in the BoJ's monetary policy minutes is adding pressure on the Yen.

Above 145.35, the next targets are 146.15 and 147.25.

The US Dollar keeps trading in a bullish trend with higher highs and higher lows against a weaker Yen and is on track to close the week 0.8% higher, despite the strong Japanese inflation figures seen earlier today.

Japanese inflation eased to a 3.5% yearly rate in May, from 3.6% in Aporil, but the core inflation, more relevant for BoJ’s monetary policy as it stripes off the seasonal impact of food and energy prices accelerated to 3.7%, its highest level in more than three years, from the 3.5% level registered in April.

The positive impact of the inflationary pressures on the Yen, however, has been offset by the dovish minutes from this week’s BoJ monetary policy meeting. BoJ board members have highlighted increasing concerns about the downside risk to the economy, which may force the bank to reconsider future rate hikes.

Technical analysis: USD is in a bullish trend towards 146.15 and the 147.00 area

The USD/JPY keeps trading higher, with downside limited so far. Recent price action suggests that the pair found a significant bottom at 142.15, and last week’s higher low confirmed that a deeper recovery is on the cards.

A confirmation above 145.35 would endorse the view that the pair is in the C-D leg of a Butterfly formation with the next target at the May 29 high, at 146.15, ahead of the 78.6% Fibonacci retracement of the late May sell-off, at 147.25.

On the downside, support is at the Jun 18 low, at 144.35, ahead of the June 16 low, at 143.65. A break of 142.80 cancels this view.

US Dollar PRICE This week

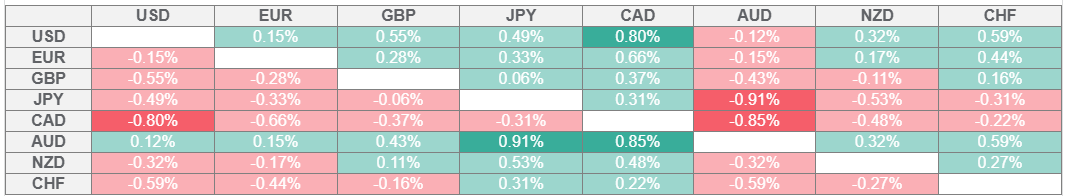

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.