BoE expected to leave interest rate flat at 4.25% despite inflation remaining above objective

The Bank of England is expected to keep its policy rate at 4.25%.

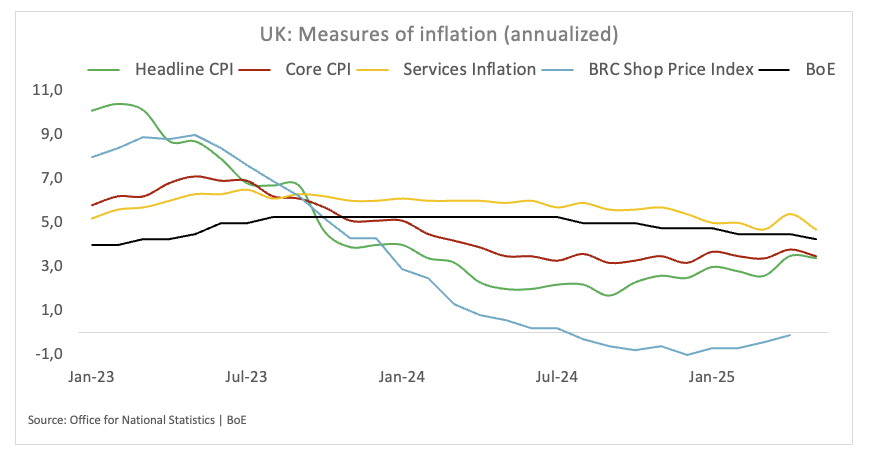

UK inflation figures remain well above the BoE’s target.

GBP/USD maintains its trade in the upper end of the range near 1.3600.

The Bank of England (BoE) is set to reveal its latest monetary policy decision on Thursday, coinciding with its fourth rate-setting meeting of 2025.

Market analysts anticipate that the central bank will keep its benchmark interest rate steady at 4.25% after the reduction announced during the May 8 meeting.

The Monetary Policy Committee’s (MPC) decision will be followed by the release of Meeting Minutes, which will detail the internal discussions that shaped the outcome.

As the rate decision appears to be largely anticipated, investors are likely to shift their focus to the anticipated performance of the UK economy, which presents mixed signals. Key considerations will include the potential trajectory of interest rates, the ongoing debate over tariffs, and the recent developments surrounding the US-UK trade agreement.

Rates, elevated inflation and tariffs

The Bank of England has reduced its policy rate by a quarter point to 4.25% as of May 8, following a notably divided vote among the Monetary Policy Committee (MPC): Swati Dhingra and Alan Taylor supported a more significant half-point cut, while Chief Economist Huw Pill and Catherine Mann argued for keeping interest rates unchanged.

The “Old Lady” has updated its inflation forecast for the year and is now projecting a peak of around 3.50%. This adjustment signifies a reduction from a prior estimate of 3.75%, while simultaneously reflecting an increase from the latest official figure of 2.60% noted in March. Experts predict that inflation will reach the 2% target by the first quarter of 2027.

The central bank has forecasted a 1% growth rate for the economy this year, an increase from the previous estimate of 0.75%. The revision reflects a robust conclusion to 2024, bolstered by promising official data from early 2025, which reveals a quarterly growth rate of 0.60% for the first quarter.

The report indicates that the growth surge observed in the January-March period seems to be an isolated incident. As a result, the growth forecast for 2026 has been revised downward to 1.25%, a decrease from the previous estimate of 1.5%.

The most recent data released by the Office for National Statistics (ONS) indicates that the annual headline Consumer Price Index (CPI) increased to 3.4% in May. Core inflation, excluding the fluctuating costs of food and energy, increased by 3.50%, indicating a continued trend of easing underlying price pressure. Services inflation, in the meantime, rose by 4.70% over the last 12 months.

In the meantime, some rate setters, Governor Bailey included, showed some caution regarding the easing cycle going forward, as well as the still elevated consumer prices:

Addressing the Treasury Committee, Governor Andrew Bailey said that his approach to reducing interest rates would be “gradual and careful”. He emphasised that these words served as his guiding principles. He stated that, while he continued to anticipate a decline in rates, the trajectory had become “shrouded in a lot more uncertainty” and had turned “unpredictable” due to the turmoil in global trade policy.

Deputy Governor Sarah Breeden informed the committee that she believed a case for a rate cut existed in May, independent of international developments. She assessed that the domestic disinflationary process was advancing as anticipated and was expected to persist.

MPC member Swati Dhingra also noted that she perceives downside risks to the forecast for UK inflation. She said that the recent upticks in inflation are primarily attributed to escalating energy costs rather than fundamental price pressure.

Policymaker Megan Greene argued that although the bank anticipates a decline in the recent inflation surge, it remains "not sanguine" regarding the outlook. She cautioned about the considerable risk posed by potential second-round effects.

How will the BoE interest rate decision impact GBP/USD?

Investors expect the BoE to retain its reference rate at 4.25% on Thursday at 11:00 GMT.

While the result is fully priced in, attention will focus on the vote split among MPC members, which might be a market mover for the British Pound if it indicates an atypical vote.

In the run-up to the meeting, GBP/USD appears to have met decent contention around the 1.3400 zone, driven by US Dollar (USD) dynamics and shifting sentiment toward US trade policy, as well as reignited geopolitical jitters.

"Cable came under some unconvincing downside pressure after hitting more than three-year highs north of 1.3600 the figure on June 13," said Pablo Piovano, senior analyst at FXStreet. He noted that a decisive break above the yearly tops could potentially trigger a move toward the 2022 high of 1.3748 (January 13).

On the downside, Piovano identified the 55-day Simple Moving Average (SMA) at 1.3329 as an initial provisional support, followed by the May trough at 1.3139 (May 12). Once Cable clears the latter, the more relevant 200-day SMA could return to investors’ radar at 1.2922, just before the April floor of 1.2707 (April 7).

Are you looking to stay ahead of market trends? Join Mitrade’s WhatsApp channel now to unlock endless trading opportunities!

By following Mitrade on WhatsApp, you’ll gain:

Leading Edge: Real-time market updates to track price movements in forex, commodities, and indices.

Professional Insights: Expert analysis and trading strategies to boost your performance.

Global Perspective: Stay informed on central bank policies, geopolitical events, and macroeconomic trends.

Scan the QR code to join instantly and receive timely notifications, ensuring you never miss critical market insights.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.