Bitcoin Investments in Japan Surge as Firms Hedge Against Yen Weakness

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The crypto market is witnessing a surge in participation from Japanese public companies such as Metaplanet, ANAP, Remixpoint, and Gumi.

This move appears to be a calculated response to Japan’s unique economic challenges, including a weakening yen, persistently low interest rates, and limited domestic investment opportunities.

Japan Bitcoin Wave: Public Firms Go Crypto

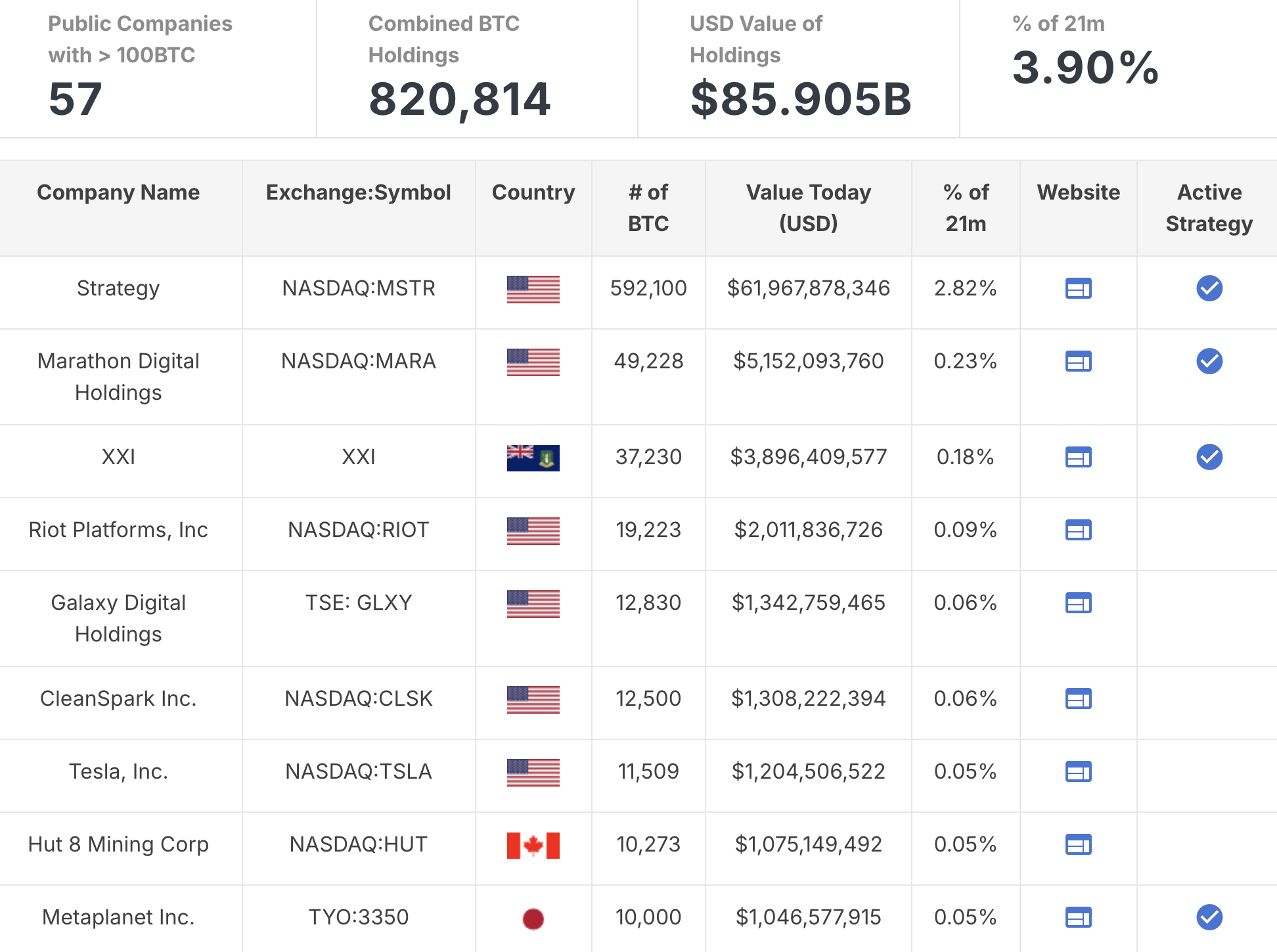

According to data from Bitcoin Magazine, the BTC treasury holdings of public companies have surpassed 820,000 Bitcoin (BTC) worth over $85 billion. Strategy remains a leading name, holding over 592,000 BTC.

Bitcoin holdings by public companies. Source: Bitcoin Magazine

Bitcoin holdings by public companies. Source: Bitcoin Magazine

Metaplanet has emerged as the most significant rival to Strategy in Asia’s crypto market. The company’s stock price has shown positive signals after its entry into this market. Following Metaplanet’s lead, the region has recently seen the emergence of new players.

Several factors explain Japanese public companies’ participation in the crypto market. The first major driver is the significant depreciation of the Japanese Yen. According to data from Trading Economics, the Yen has lost considerable value in recent years. This decline is partly due to the prolonged negative interest rate policy of the Bank of Japan (BOJ).

USD/JPY exchange rate. Source: Trading Economics

USD/JPY exchange rate. Source: Trading Economics

A 2025 BOJ research report indicates that this policy, while intended to stimulate the economy, has weakened the domestic currency, prompting companies to seek alternative assets to preserve value. With its inflation-resistant properties, Bitcoin has become an attractive option for Japan’s companies.

Secondly, the lack of profitable opportunities for domestic assets plays a crucial role. Prolonged negative interest rates have resulted in low or even negative yields from government bonds and traditional assets, putting Japanese companies in a challenging position.

This has led many firms to turn to Bitcoin as a long-term investment strategy, similar to MicroStrategy’s model in the US. The strong rise in stock prices of Japanese public companies like Metaplanet demonstrates investor confidence in this Bitcoin strategy.

Additionally, Japan’s progressive legal framework for cryptocurrencies is a key enabler. The Financial Services Agency (FSA) has established clear regulations, including KYC and AML requirements, while recognizing the purchasing power of cryptocurrencies, though not as legal tender. This creates a safe environment for companies to participate, unlike many countries with stricter limitations.

However, risks cannot be overlooked. Bitcoin’s price volatility and dependence on global monetary policies could pressure these companies. This poses challenges for long-term strategies. Additionally, the BOJ’s recent decision to end its negative interest rate policy may alter economic dynamics, potentially affecting future accumulation decisions.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.