AUD/JPY hovers above 95.00 with markets anticipating further RBA easing

- Trump’s Greenland Tariff Suspension: Crypto Prices Rebound as Investors Weigh Rally Longevity

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Fed Rate Decision Looms as Apple, Microsoft, Meta and Tesla Q4 Earnings Draw Attention: Week Ahead

- US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

- Australian Dollar rises as employment data boosts RBA outlook

The Aussie Dollar remains pinned near the 95.00 against a firmer Japanese Yen.

Hopes of further RBA monetary easing next week are weighing on the Australian Dollar

In Japan the minutes of the BoJ meeting reveal that the bank maintains its commitment to hike raes further

The Australian Dollar remains trapped within a tight range above 95.00 against the Japanese Yen. Market expectations that the Reserve Bank of Australia will cut interest rates further after next week's meeting are keeping Aussie’s upside attempts limited.

The RBA meets next week and is expected to ease its monetary policy further amid the uncertain global trade outlook, with Trump’s tariffs coming into effect this week. Recent data show that Australian inflation has moderated further, which gives more leeway to the bank to adopt a more accommodative monetary policy.

In Japan, the minutes of the latest BoJ meeting revealed that the bank remains committed to tightening its monetary policy further if the bank’s economic forecasts are confirmed. The Yen appreciated across the board following the release of the minutes.

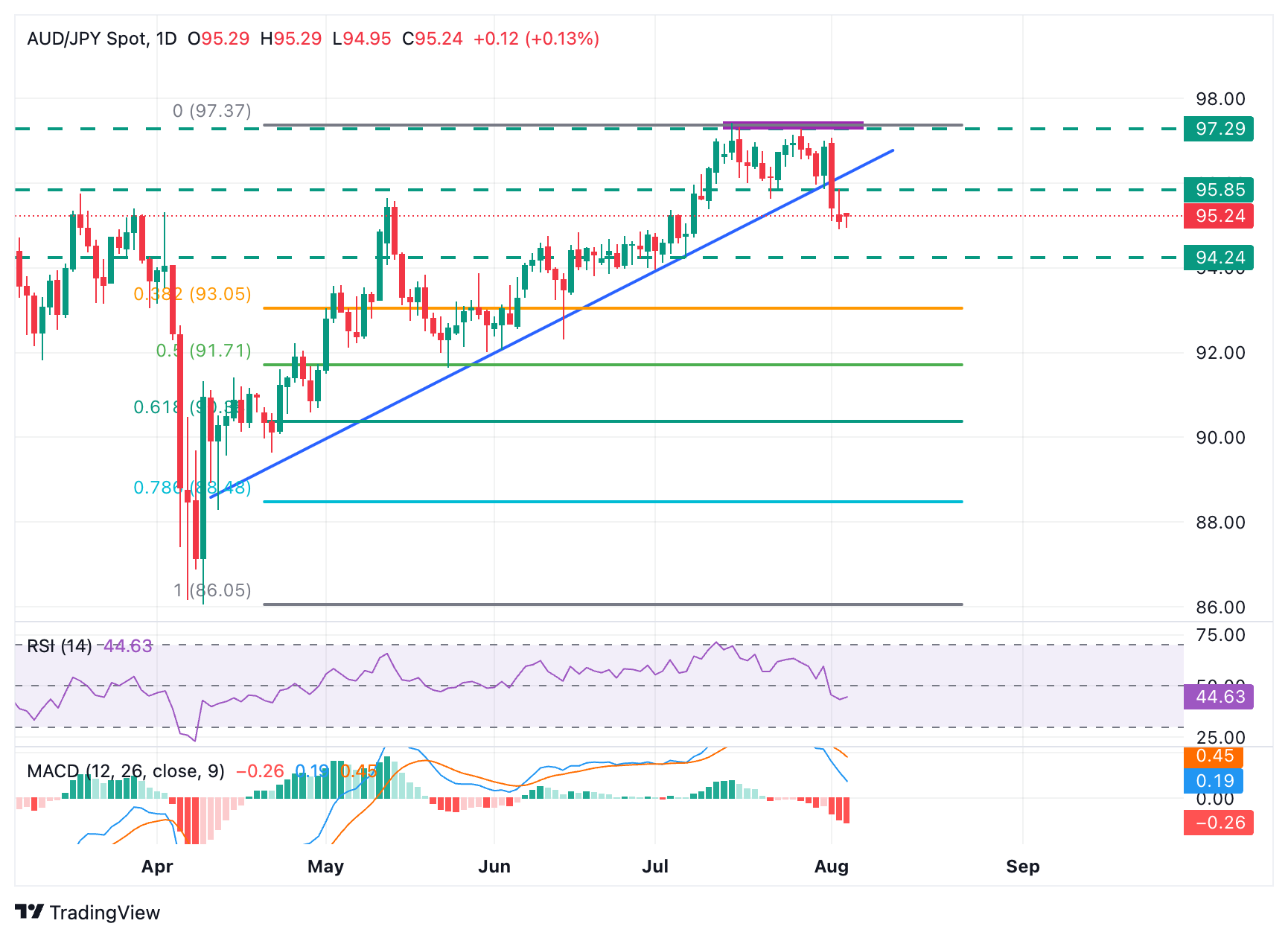

Technical analysis: Double top above 97.00

From a technical perspective, a double top at the 97.30-97.45 area in late July suggests that the pair’s bullish trend from early April’s low has come to an end, and bears are taking control.

The confirmation below the confluence of the DT’s neckline and the ascending trendline, at the 96.00 area is giving hopes for sellers while the pair remains pinned near the 95.00 support area. Further down, the next targets are the July 7 low, at 94.25 and the 38.2 Fibonacci retracement, at 93.00.

On the upside, the mentioned support, at 95.90 (Jul 30, 31 lows) will probably act as a resistance ahead of the reverse trendline, now at 96.30. Above here, the bearish view would be cancelled and the focus would be shifted back to 97.30-97.45 July 15, 16 and 28 highs.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.