EUR/USD climbs to near 1.1600 as safe-haven assets lose steam after the announcement of Israel-Iran truce.

Fed’s Bowman argues in favor of reducing interest rates in July.

ECB’s Lagarde warns of downside risks to Eurozone economic growth.

The EUR/USD pair posts a fresh weekly high to near 1.1610 during late Asian trading hours on Tuesday. The major currency pair strengthens as the US Dollar (USD) has faced a sharp sell-off, following the announcement of the Israel-Iran ceasefire by United States (US) President Donald Trump.

A truce between Israel and Iran has improved investors’ risk appetite and diminished demand for safe-haven assets, such as the US Dollar. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls sharply to near 98.10 from its two-week high of 99.42 posted on Monday.

US Dollar PRICE Today

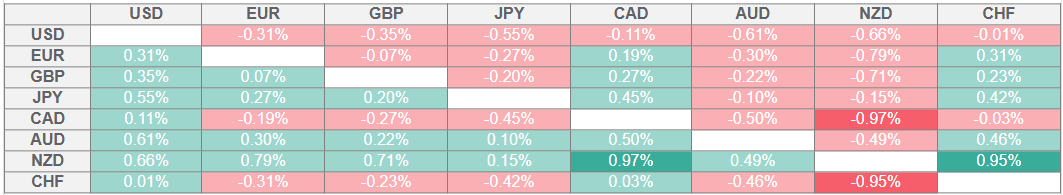

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Another reason behind weakness in the US Dollar is changing stance from Federal Reserve (Fed) officials on the monetary policy outlook towards the dovish side. On Monday, Fed Governor Michelle Bowman signaled that she is open to cut interest rates as soon as in the July policy meeting amid growing concerns over job market. “It is time to consider adjusting the policy rate, and we [Fed] should put more weight on downside risks to the job market going forward,” Bowman said.

A dovish monetary policy guidance from Fed’s Bowman has led to a slight increase in market expectations for interest rate cuts in the July meeting. According to the CME FedWatch tool, the probability for the Fed to reduce interest rates next month has increased to 22.7% from 14.5% recorded on Friday.

In the Eurozone region, European Central Bank (ECB) officials have become concerned over the economic outlook due to the tariff policy announced by US President Trump. A few ECB officials, including President Christine Lagarde have warned of downside risks to economic growth and cited concerns over the sustainability of inflation near the 2% target.

On Monday, Christine Lagarde said in her prepared remarks before the European parliament economic committee that survey data point to “some weaker prospects for economic activity in the near term”. "Risks to the growth outlook remain tilted to the downside," Lagarde added.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.