EUR/USD jumps near YTD highs after Trump announces a complete Iran-Israel ceasefire

A relief rally is boosting the Euro and crushing the safe-haven US Dollar.

A sharp decline in Oil prices is giving additional support to the common currency.

EUR/USD has broken the top of a bullish flag formation and aims for 1.1630 and 1.1700.

The EUR/USD pair is rallying on Tuesday, following a significant rebound on Monday after US President Donald Trump announced a "complete and total ceasefire" between Israel and Iran. The common currency has jumped about 1.30% from Monday's lows to reach levels right above 1.1600 at the time of writing, at a short distance from the year-to-date high of 1.1630.

Israel and Iran seem to have reached a ceasefire agreement after twelve days of hostilities that included a strike from the US on Iran's strategic nuclear sites. The terms of the agreement have not been disclosed, and Iran launched a barrage of missiles at Israel earlier today. The market, however, is celebrating the agreement, buying risky assets while the US Dollar (USD) and Oil are dropping sharply.

Crude prices are dropping nearly 3% so far on Tuesday, following a nearly 13% sell-off on Monday, with the barrel of WTI returning to $63.00 from above $77.00. The decline in Oil prices gives some respite to the Eurozone, as Europe is a net Crude importer, and expensive Oil would add inflationary pressures on a weakening economy.

ini the Fed Chairman Jerome Powell's testimony to Congress, due at 14:00 GMT, in which he is expected to lay out the country's economic prospects and the bank's policy plans.

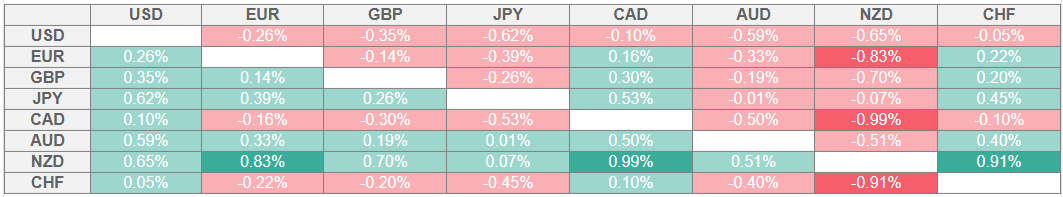

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Risk appetite sends the US Dollar tumbling

Markets are going through a relief rally. The announcement of the ceasefire between Israel and Iran has dissipated fears of a full-blown war in the region, triggered by the involvement of the US during the weekend. The US Dollar Index, which measures the value of the USD against the six most traded currencies, has dropped more than 1% since the ceasefire was announced, giving away most of the ground gained over the last two weeks.

Iran launched missiles at Israel, killing four, after an attack on a US military base in Qatar, which did not cause injuries. The Iranian Foreign Minister affirmed that Tehran will only stop its attacks when Israel ceases its airstrikes. Investors, however, are celebrating the agreement as a done deal.

On the macroeconomic front, the German IFO business climate, which is expected to show a moderate improvement in June, and some European Central Bank (ECB) speakers will attract attention on Tuesday. With geopolitical fears easing, macroeconomics might have a higher impact on FX markets.

In the US, the highlight is Fed Chairman Powell's Semiannual Monetary Policy Report to Congress, due on Tuesday and Wednesday. The central bank's chief will be questioned about the bank's plans to deal with a context of weakening growth and higher inflationary pressures. His comments will be observed with interest after the recent dovish calls by both Bowman and Waller.

Investors have ramped up bets on a Fed rate cut in the coming months following recent Fedspeak. Futures markets are now pricing a 22% chance of a July cut, up from around 14% last week, while expectations of a September cut have increased to above 80% from below 70% last week, according to the CME Group's Fed Watch Tool.

Eurozone data released on Monday showed that business activity remained broadly steady in June. The preliminary Manufacturing and Services PMIs came in roughly at the same levels as in the previous month at 49.4 and 50.0, respectively. The Euro retreated after the data release as investors had expected slightly better results.

In the US, the preliminary S&P Global PMIs beat expectations. The Manufacturing PMI remained steady at 52 in June, against expectations of a slowdown to 51, while the Services PMI eased to 53.1 from the previous 53.7, still better than the 52.9 reading forecasted by the analysts.

EUR/USD breaks higher and sets its focus at the 1.1630 high

EUR/USD has broken above the top of the last few weeks' corrective channel, boosted by a favourable market sentiment with bulls focusing on the June 12 high at 1.1630.

The breach of the trendline resistance at 1.1540 highlights a bullish flag formation, whose measured target is located at the 1.1700 area, where the 127.2% Fibonacci extension of the June 10-12 rally lies.

bring

On the downside, a bearish reaction from these levels might seek support at the reverse trendline, now around 1.1535, before rallying further. A confirmation below that level would cancel the bullish view and bring the June 19 and June 22 low at 1.1445 back to the focus.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.