How To Trade Stock CFD? Beginner's Step by Step Guide

With US stocks like NVDA surging amid AI hype, an increasing number of retail traders—especially in Australia—are opting for stock CFDs over direct ownership. The appeal lies in leverage (up to 30:1 under ASIC rules), allowing amplified exposure with minimal capital; easy short-selling to profit from downturns; 24/5 trading hours.

While risks are high (70-80% of retail accounts lose money), disciplined mid-level traders view CFDs as the ultimate tool for capturing volatile US market alpha—flexibility that traditional shares simply can't match.

In this article, we’ll take you through key information you need to know about Stock CFD trading.

What are stock CFDs?

Simply put, Stock CFDs (contracts for difference) are financial instruments that allow you to trade on a stock's price movements without actually owning the underlying asset.

It means you can take a position on whether you think the stock's price will rise or fall without actually buying or selling it.

To understand how stock CFDs work, let's take an example.

Let's say you want to invest in Tesla but don't want to buy the actual stock. Instead, you can use a stock CFD to speculate on whether the price of Tesla(TSLA.US) will rise or fall.

If the price rises, you can enter a long position (buy) on the CFD. You can enter a short position (sell) on the CFD if the price falls. If you're right, you'll make a profit. If you're wrong, you'll make a loss.

Key Differences from Directly Buying Stocks:

No Ownership: With CFDs, you don't own the shares—no dividends, no voting rights, and no shareholder perks. Direct stock purchases give you actual equity in the company.

Short-Selling Ease: CFDs let you go short effortlessly to profit from falling prices. Shorting actual stocks often requires borrowing shares, with restrictions and extra costs.

Leverage: CFDs are traded on margin (e.g., 5:1 to 30:1 under regulations), amplifying gains and losses with less upfront capital.

How Stock CFD Trading Works (Simple Example)

Imagine you want to trade NVIDIA, currently priced at US$180 per share. Here's how a Stock CFD works in practice—step by step, using just $500 of your money. Assume 5:1 leverage and a position on 100 shares.

| Scenario | Stock Price | Position Details | Profit/Loss Calculation | Your Account Balance |

|---|---|---|---|---|

| Opening the Trade | $180 | Long 100 shares CFD Margin required: ~$3,600 (full value) / 5 = $720 (You use $500) | N/A | $500 (margin posted) |

| Price Rises (Win) | $185 | Price up $5/share | 100 shares × $5 = +$500 | $1,000 (+100% return) |

| Price Falls (Loss) | $175 | Price down $5/share | 100 shares × $5 = -$500 | $0 (or less without stop-loss) |

In short, Stock CFDs let you trade the move with a fraction of the capital. Start on a demo account first—try this exact NVDA example risk-free. Once it clicks, you'll see why so many Aussie traders now prefer CFDs for US stocks.

How to trade stock CFDs?

If you are all pumped up about stock CFD trading and want to open an account asap, well, you can do that easily with Mitrade. It's a simple five-step process, and you can start after reading this guide.

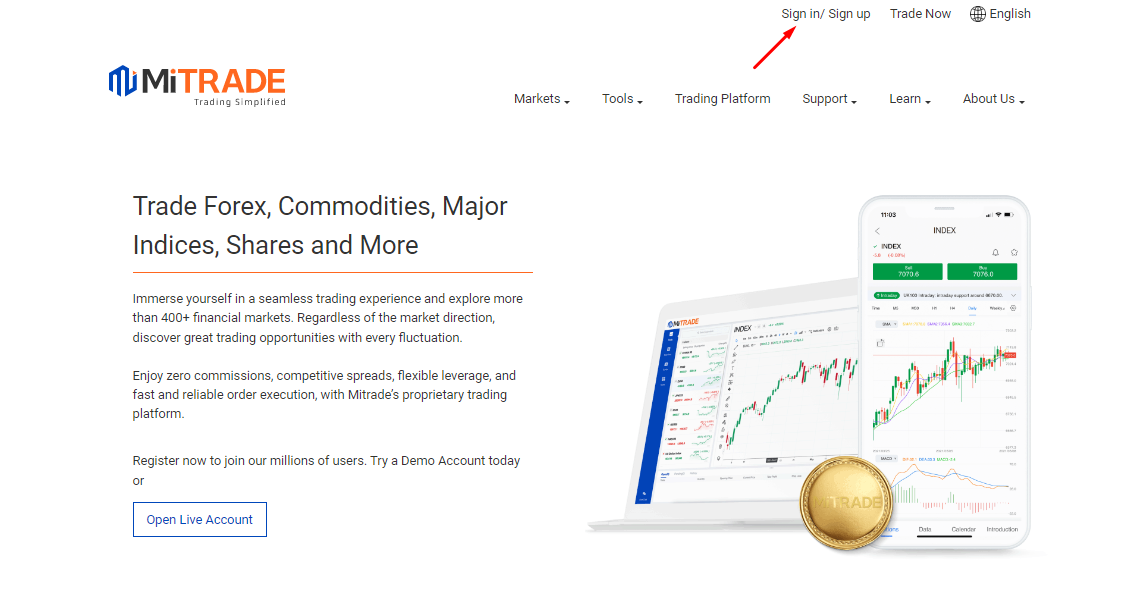

Step 1: Open a trading account

The first step is to open a trading account with Mitrade. Click on the Sign In/Sign Up option to take you to the registration page.

On the registration page, two methods exist to open an account; a demo and live accounts.

You just need an email or a phone number for the demo account. With the account, you can get $50,000 of virtual money and practice your trading skills. You must provide personal info and complete the verification process to open a live account. If you opt for a live account, you need to fund it, which brings us to the second step.

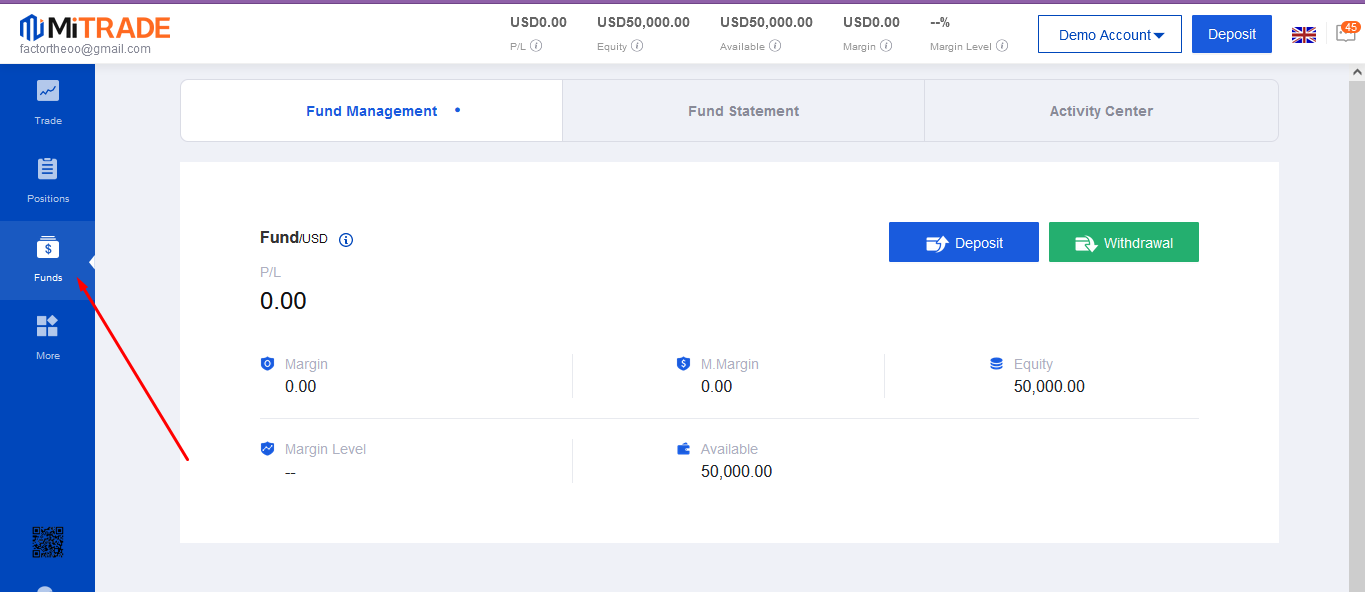

Step 2: Fund your account

Once your account opens, you'll get Mitrade's web trader platform. From there, you'll need to deposit funds into it. Click on the fund option to take you to the deposit and withdrawal page.

Mitrade offers convenient deposit methods, including credit cards, bank transfers, and electronic wallets like Skrill and Neteller.

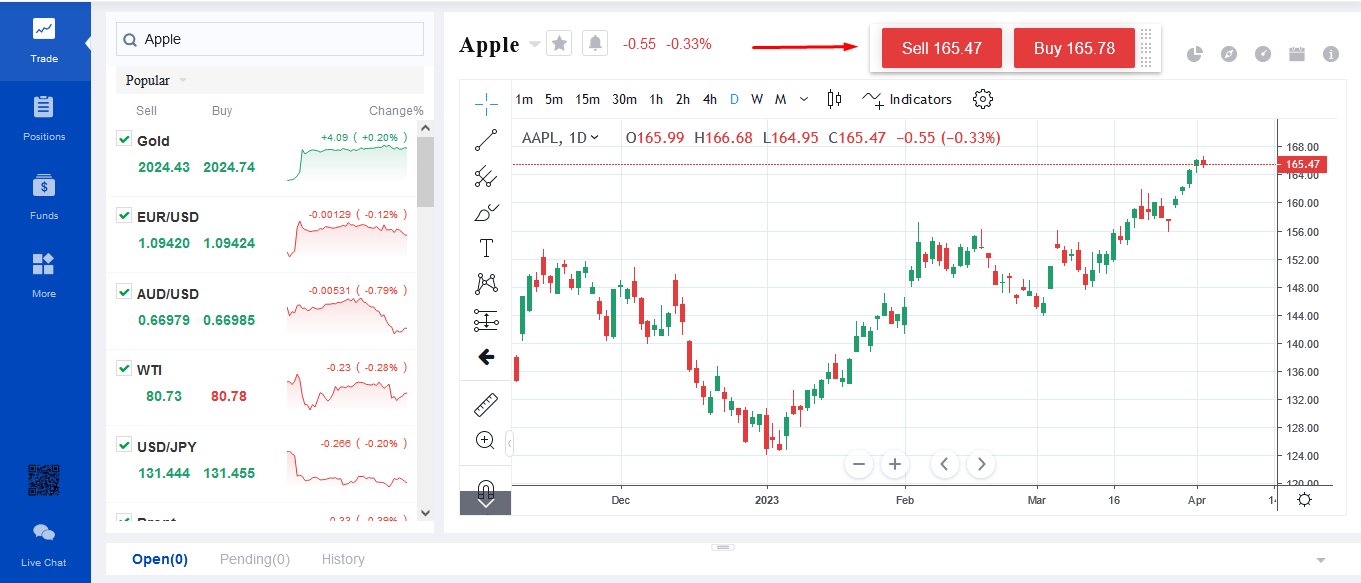

Step 3: Select the Stock You Want to Trade

Now, let's come to the main part. Mitrade offers a wide range of stock CFDs from the US and Australian markets, including popular companies like Apple, Amazon, and Tesla. Choose the stock CFD you want to trade by searching for it in the platform's symbol bar. Not all stocks are equal for CFD trading. Focus on high liquidity, volume, tight spreads, and easy entry/exit. Avoid illiquid small-caps—wide spreads will eat your edge.

Step 4: Decide: Buy or Sell (Long vs Short)

Before placing your trade, it's important to analyze the market and decide go long (buy) or go short (sell).

Mitrade's platform provides powerful trading tools, including technical analysis tools and indicators, to help you make informed trading decisions.

You can see them all on the left side.

Step 5: Place your trade

You can select the Sell or Buy option on the platform to make a trade. After that, enter the size of your position, set your stop loss and take profit levels, and click the 'Buy' or 'Sell' button to enter the market.

Step 6: Open, Monitor, and Close the Trade

With these simple steps, you can start trading stock CFDs with Mitrade today.

Key Costs When Trading Stock CFDs

Stock CFDs let you trade shares like NVIDIA (NVDA) with leverage, but certain costs can quietly reduce your profits—especially if you hold positions for more than a day. Here are the main costs to watch out for.

1. The Spread

This is the gap between the buy price and the sell price. It’s a cost you pay as soon as you enter a trade. For popular US stocks, spreads are usually small (e.g., 0.1–0.5 points for NVDA on platforms like Mitrade), but they can widen when the market is volatile. You pay the spread on every full trade (buy and sell), so you’ll need to overcome this cost before you can make a profit.

2. Overnight Fees

If you keep a CFD position open overnight (usually after 10pm UK time, depending on your broker), you’ll be charged a daily interest fee on leveraged positions. This fee is typically based on a benchmark interest rate plus an admin fee (often around 2.5–3%).

Stock CFD Trading Strategies for Beginners

Stock CFDs let you jump into US shares with small capital and big flexibility. The key for beginners is keeping things simple and controlled. Here are three straightforward strategies that actually work without overcomplicating your life.

Trend Trading: Go with the Flow

This is the simplest way to start. Markets trend more often than they reverse, so trade in the direction they’re already moving.

Spot an uptrend on a liquid stock like Apple or Tesla using a basic 50-day moving average. If price stays above it, go long. If it breaks below convincingly, consider shorting. Keep leverage low—5:1 at most—and place your stop just below the recent swing low. In 2025, this approach caught most of the big AI-driven moves without guessing tops or bottoms.

Earnings Plays: Quick In and Out

Earnings season creates sharp, predictable volatility—ideal for short-term CFD trades.

Check the calendar, pick a major name you know, and wait for the report. If results beat expectations and price gaps higher, go long on the breakout. If it gaps down on a miss, short the weakness. Hold for hours or a day at most to avoid overnight fees, and always use a tight stop. Fading extreme opening gaps when fundamentals don’t match the reaction often paid off nicely this year.

Play It Safe: Steer Clear of Chaos

As a beginner, the smartest strategy is often knowing when not to trade. Skip the US market open (11:30 pm AEDT)—it’s wild and full of fake moves. Avoid trading around major news like Fed decisions or jobs reports unless you’re watching closely. Stick to quieter mid-session hours when trends are cleaner and spreads narrower.

Risks of Trading Stock CFDs (And How to Manage Them)

Stock CFDs give you powerful access to US shares like NVDA with leverage and shorting, but the reality is harsh: 70-80% of retail CFD traders lose money, according to consistent broker disclosures and regulators like ASIC. Leverage turns small moves into big wins—or wipes out accounts fast. Here's the straight talk on the main risks, plus real ways to handle them without sugarcoating.

Leverage Risk

The biggest danger is leverage itself. With leverage of 5:1 or more, a move of just a few percent against a position can erase the entire margin. Without protection, losses can run right up to the account balance. This is why experienced traders keep leverage low, especially early on.

For beginners, staying around 5:1 or below, risking no more than 1–2% of capital per trade, and always using stop-losses isn’t conservative — it’s survival.

Market Volatility and Gapping

Stock prices don’t always move smoothly. Earnings releases, Fed decisions, or unexpected headlines can cause prices to jump, skipping over stop levels entirely. This is especially common in US tech names.

Traders who want to manage this risk usually avoid holding positions over weekends or major events, and sometimes use guaranteed stops. They cost more, but on volatile stocks, they can prevent catastrophic losses.

Overnight Funding Costs

Holding CFDs past the market close means paying daily interest on long positions. Over time, this quietly eats into returns, especially for swing trades. Shorts may earn funding in some environments, but that’s never guaranteed.

This is why many CFD traders focus on shorter-term trades, or factor funding costs carefully into their break-even calculations.

Emotional and Overtrading Risk

Emotions such as greed or the urge to recover losses quickly can lead to impulsive decisions and compounding drawdowns.

Traders should develop and follow a clear written trading plan with predefined entry and exit criteria. Keep a detailed trade journal to review performance objectively and take breaks after a series of losses.

CFDs aren't for passive money. They are a high-risk trading tool. Used with discipline, small position sizes, and strong risk management, they can offer opportunities in US stocks.

Final thoughts

Trading stock CFDs can be a great way to access a wide range of markets and potentially profit from rising and falling prices.

They can be a powerful tool for traders looking to expand their trading strategies and access a wider range of markets.

By opening an account with a reputable broker like Mitrade, using powerful trading tools and resources, and practicing responsible trading habits, you can take advantage of stock CFDs while managing the risks effectively.

Is stock CFD trading legal?

In short, yes, but it’s highly regulated and geographically restricted.

CFD trading is legal and widely offered in many major financial jurisdictions, including the United Kingdom, Australia, the European Union, and Singapore. However, it operates under strict regulatory frameworks designed to protect retail investors. Authorities like the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) enforce rules such as leverage limits, negative balance protection, and mandatory risk warnings.

Important caveat: CFDs are illegal for retail traders in some countries, most notably the United States and Belgium. Always verify the legal status and regulatory environment in your country of residence before proceeding.

How much money do I need to start?

You can start with relatively little, but risk management dictates you should have more.

Many brokers allow you to open a trading account with a modest deposit, sometimes as low as a few hundred dollars. The defining feature of CFDs—leverage—means you only need to commit a fraction of a trade's total value (the margin) to open a position.

Can beginners trade stock CFDs?

Technically, yes, but it is generally not advisable as a first step into investing.

CFDs are complex derivative instruments. They introduce layers of complexity—like leverage costs, overnight financing fees, and spread dynamics—that are absent in traditional share ownership. For a novice, this can be overwhelming.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.