Top 10 crypto predictions for 2026: Institutional demand and big banks could lift Bitcoin

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- Bitcoin Price Surges To $90,000. U.S. Arrests Venezuela's President, Triggers Bull Frenzy

- After Upheaval in the World’s Largest Oil Reserve Holder, Who Will Emerge as the Biggest Winner in Venezuela’s Oil Market?

- U.S. to freeze and take control of Venezuela's Bitcoin holdings after Maduro capture

- Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

- Silver Price Forecast: XAG/USD bulls look to build on momentum beyond $79.00

Bitcoin may have lost its footing after the October–November shakeout, but several big allocators still think 2026 can deliver fresh highs. The real swing factor is whether institutional flows come back in size—especially through ETFs and corporate-style “digital-asset treasury” buyers. If they don’t, the path of least resistance could still be down, with April lows near $74,500 back on the radar.

Bitcoin’s (BTC) adoption narrative is getting rewritten in real time. Asset managers such as Grayscale are leaning into a “next-high” thesis for 2026, and the idea of Bitcoin as a reserve asset is creeping into more portfolio discussions. Add another year of regulatory progress—think the GENIUS Act and the broader convergence of traditional finance with DeFi rails—and you have a setup where the infrastructure improves even if price action stays messy.

This outlook also extends beyond BTC. Stablecoins, AI-linked tokens and applications, and altcoins (especially those tied to the “attention economy”) remain key talking points going into 2026. But the same question keeps cutting through the noise: do whales and institutions actually return—or do they just talk about returning? Without real demand, BTC could keep sliding and revisit April lows around $74,500.

Bitcoin ownership shifted as big money cooled off

BTC ran into a wall when institutional appetite faded in October and November. After printing an all-time high above $126,000, Bitcoin sold off hard, with retail traders and multiple whale cohorts taking profits. Wallets holding over 10,000 BTC were part of that broad profit-taking wave, and large institutional participants also stepped back.

On-chain signals backed up the “institutional demand dried up” narrative. Santiment’s network realized profit/loss metric and supply distribution data were consistent with a market that had gone from “risk-on” to “de-risk first, ask questions later.”

%20[22-1766387549170-1766387549171.03.52,%2016%20Dec,%202025].png)

The redistribution was also oddly specific to this cycle. Wallets with 100–1,000 BTC and 10,000–100,000 BTC increased holdings, while the 1,000–10,000 BTC cohort reduced exposure. That kind of reshuffling challenges the whole “diamond hands” storyline: a meaningful chunk of long-dormant whales did take profits this time.

%20[22-1766387572054-1766387572055.11.21,%2016%20Dec,%202025].png)

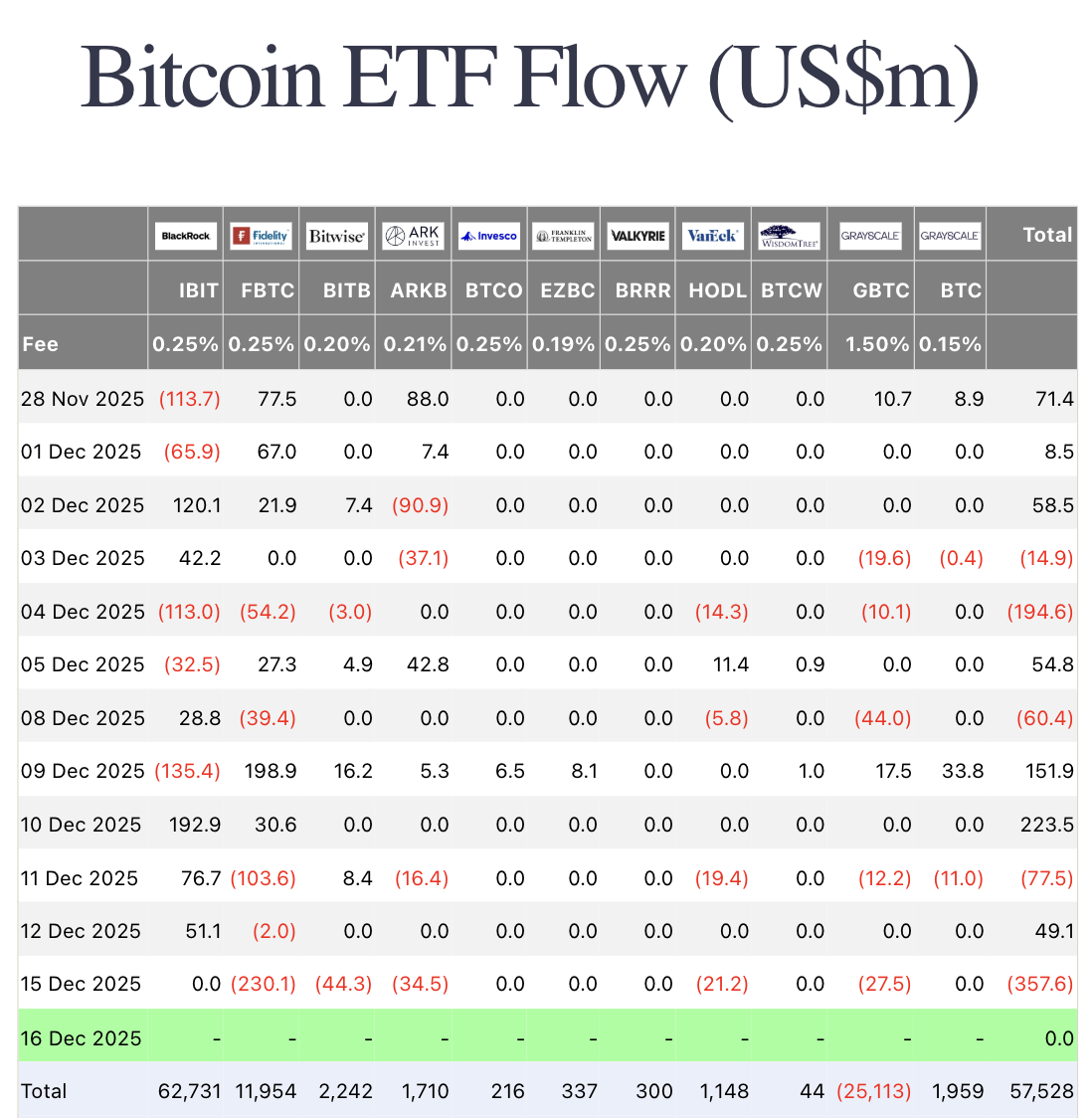

Meanwhile, one of the biggest whale categories—institutions such as Digital Asset Treasury (DAT) companies and miners—either sold holdings or pulled capital from ETFs. Farside fund-flow data showed capital leaving ETFs over the last two weeks, and December alone saw over $700 million in institutional money exit ETFs. That’s usually a decent temperature check for Wall Street’s BTC appetite.

Outflows don’t automatically mean “bear market forever,” though. Historically, ETF inflows often return once the correction slows—institutions tend to scale in, not FOMO in. The timing is the entire game.

Three themes that could define crypto in 2026

1) Bitcoin as a reserve asset (more openly, more often).

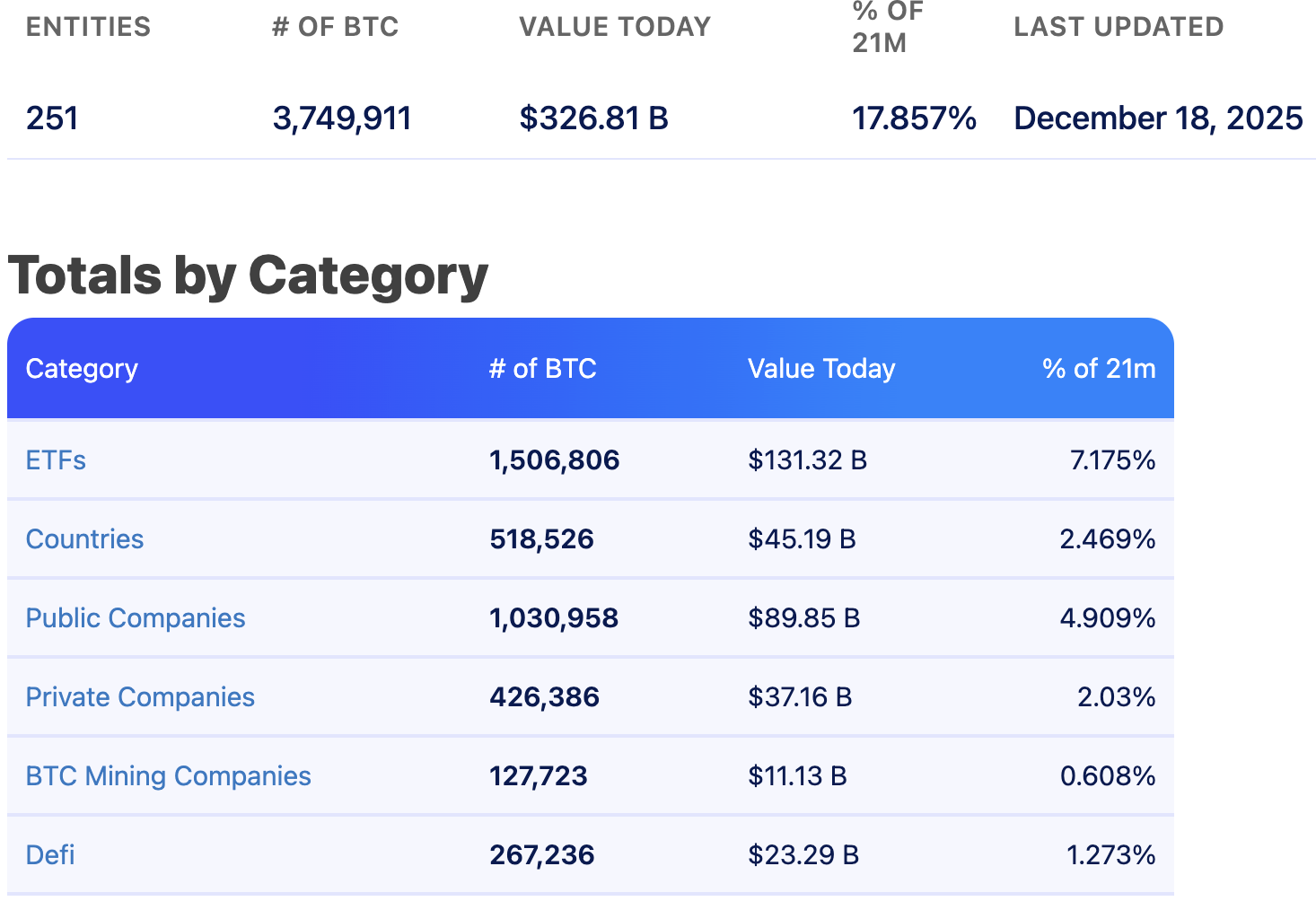

Data from Bitbo.io shows 251 entities hold over 3.74 million BTC worth over $326 billion—nearly 18% of total Bitcoin supply. More than half of that 3.74 million BTC is held by ETFs, countries, public and private companies, while mining firms hold 7–8% of BTC supply. If “reserve asset” framing keeps spreading, that’s a durable narrative tailwind—provided it’s matched by real allocations.

2) The institutionalization of Bitcoin via stablecoins, ETFs and banks.

After the Trump administration’s advances in stablecoin regulation and the growing institutional embrace of stablecoins and BTC exposure, the US “crypto superpower” narrative could keep building. US-based spot Bitcoin ETFs now sit at over $111 billion in total net assets, roughly 7% of Bitcoin’s market capitalization. If issuers keep accumulating net assets, that’s a potential catalyst.

A revival in institutional demand—particularly with traditional financial institutions participating—could provide fuel. A return of retail traders, lower exchange reserves, and a slowdown in miner selling would all help.

3) Miner capitulation as a short-term pressure point (and potential turning signal).

The Bitcoin hashribbons indicator shows the 30-day hash rate moving average dropping below the 60-day, suggesting miners are capitulating or selling at a loss. That typically adds short-term selling pressure. Traders will be watching for stabilization here, because it often marks a transition phase rather than a permanent regime.

Top 10 predictions for 2026

1) Bitcoin could print a new all-time high above $140,000

BTC is still consolidating, and the two-year uptrend is being stress-tested. Momentum signals on the daily timeframe are mixed, but in a clean bullish break, the “blue-sky” target cited for 2026 is $140,259—the 127.2% Fibonacci retracement of the rally from the April 2025 low of $74,508 to the $126,199 all-time high.

Key level: the consolidation floor at $80,600 remains critical support.

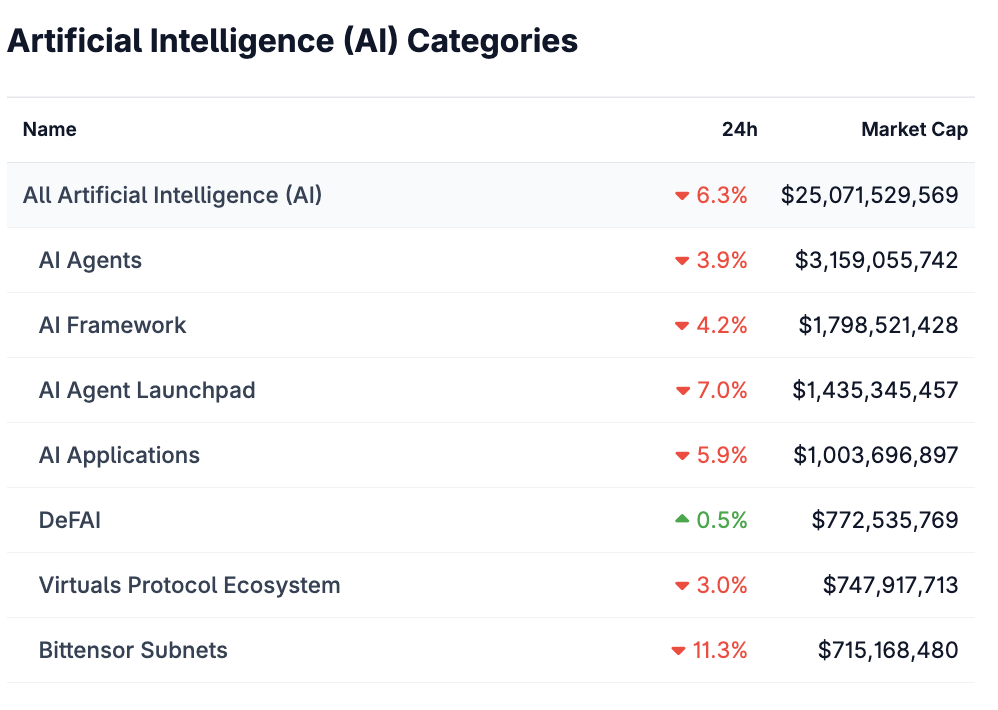

2) AI sector market cap could reach $30 billion

The AI sector added $5 billion in market cap this year. If it expands at a similar pace, it could tack on another $5 billion in 2026—though the category keeps catching “hype/bubble” criticism. Bitcoin heard similar noise in earlier cycles (notably 2017). If AI tokens follow that arc, 2026 could see broader adoption and relevance, especially in AI Agents and AI Applications—helped by major launches from players like NVIDIA and OpenAI, plus deeper integration into web3 tooling.

3) Stablecoin adoption could lift “beta” tokens

With Visa’s stablecoin pilot and Ripple’s multichain stablecoin grabbing headlines, 2025 leaned heavily into stablecoin regulation and adoption. If stablecoins keep growing as the default on/off-ramp, the second-order trades could show up in leveraged “beta” plays—particularly lending and staking tokens that benefit from new users and exchange flows. Tokens cited as relevant here include Pendle (PENDLE), Lido DAO (LDO), and Ethena (ENA).

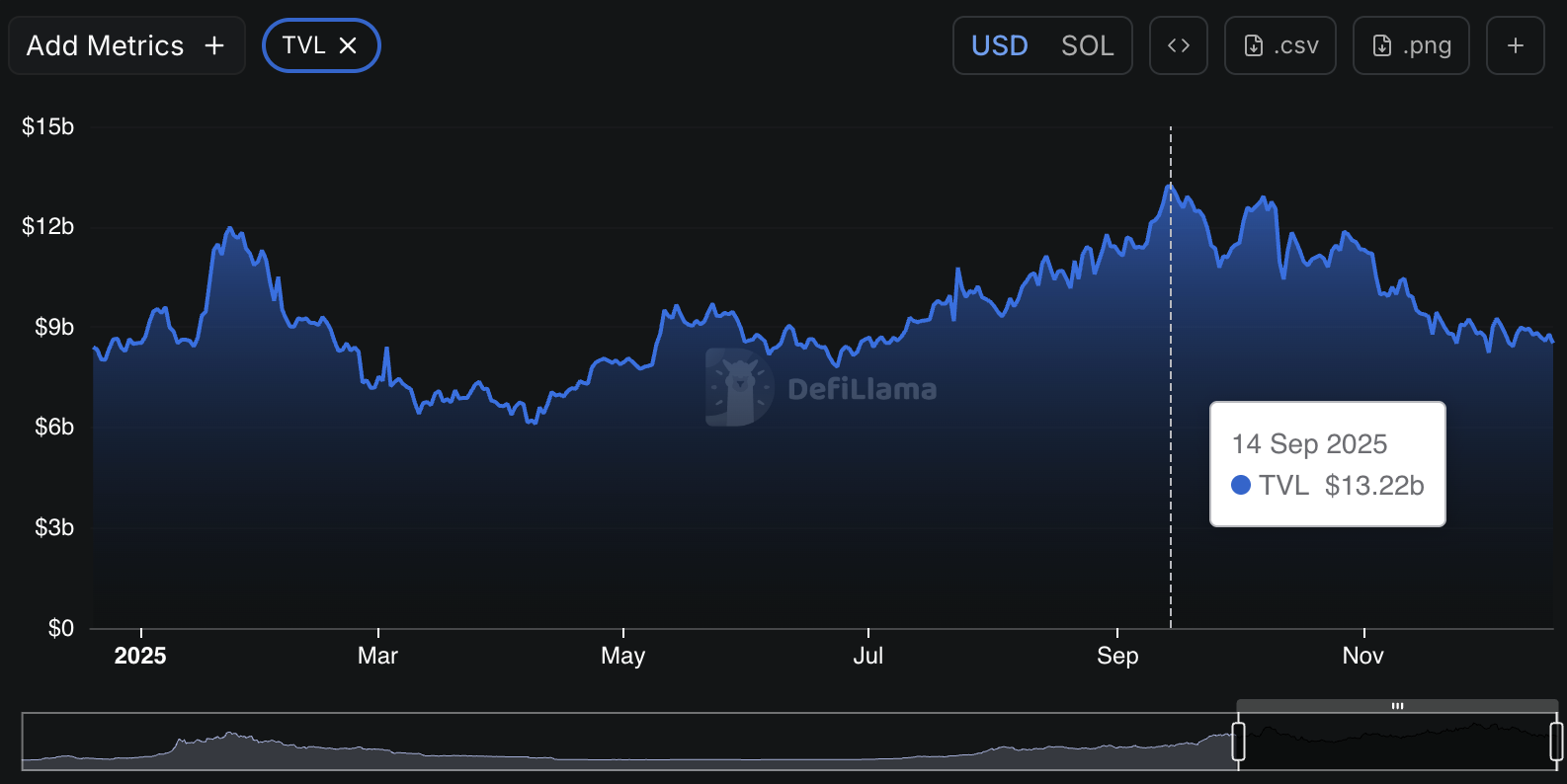

4) Solana TVL could finally break higher

Solana heads into 2026 with multiple narrative catalysts. XRP has announced plans to launch on the SOL chain, and Breakpoint announcements—such as FXTech, MediaTek and Trustonic planning to integrate the Solana Mobile stack at the Android chipset level—could become a bigger deal next year. MediaTek accounts for 50% of the global Android market.

Solana’s TVL is $8.51 billion, roughly back near where it started 2025. If adoption follows the announced integrations, TVL could re-test the 2025 peak of $13 billion and potentially push beyond.

5) Regulatory clarity could widen retail participation

Regulation is becoming a market theme, not a footnote. The US saw the GENIUS Act (stablecoin clarity), while several Asian markets—India in particular—moved toward clearer crypto taxation. If this trend continues globally, crypto’s footprint could widen. Retail tends to enter through stablecoins and fiat rails, while institutions often funnel capital through ETFs. More regulatory structure could make access easier across both tracks.

6) Privacy coins could regain relevance

It sounds contradictory after 2025’s setbacks for Tornado Cash and other privacy platforms—but price action is doing its own thing. The recent move in ZCash suggests the category isn’t dead. ZEC volume is up nearly 50% in the last 24 hours, and the token has been trending for nearly a week. With figures like Arthur Hayes and Ansem repeatedly arguing for privacy’s importance, the narrative has been resurfacing—especially on X.

7) TradFi and DeFi could start blending “for real”

Traditional financial institutions are warming to stablecoins and Bitcoin exposure, and ETFs have changed how crypto sits alongside other assets. With the SEC’s latest altcoin ETF approvals, 2026 could deepen the “TradFi offers + DeFi rails” theme. Analysts expect the altcoin-ETF approval race to continue, with another wave of potential green lights in Q1 2026.

8) Fiat uncertainty could strengthen the “digital gold” bid

Rising debt, sticky inflation over long periods, and default risk in multiple countries are fueling uncertainty. Gold’s run and Bitcoin’s “digital gold” framing are feeding off that. The more investors worry about fiat erosion, the more attractive BTC and stablecoins can look—at least as diversifiers.

9) Tokenization could pull in real capital

Real-world asset (RWA) tokenization stayed on the agenda throughout 2025 because it enables fractional ownership and faster transfer. In 2026, tokenization could become a front-page theme if capital flows accelerate into BlackRock’s tokenization initiative and more private players enter the space.

10) The four-year cycle narrative could break down

The classic “four-year cycle” assumes supply dynamics after halving + stable demand patterns lead to a new BTC all-time high every four years. But this cycle already behaved differently: the bull run kicked off in 2024 after US spot Bitcoin ETF approvals—months before the halving. If the trigger mechanism is shifting from halving-driven scarcity to ETF-driven flow cycles, the old playbook may matter less in 2026.

Read more

The above content was completed with the assistance of AI and has been reviewed by an editor.