Pi Network Price Annual Forecast: PI Heads Into a Volatile 2026 as Utility Questions Collide With Big Unlocks

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

PI is coming off a brutal 2025: after the mainnet launch in February 2025, the token slid more than 90% from its $3.00 peak, as exchange deposits rose and confidence thinned out.

The network does have scale — 17.5 million users have cleared KYC, with 15.7 million migrated to mainnet — but 437 million PI tokens sitting on CEXs has kept supply pressure front-and-center.

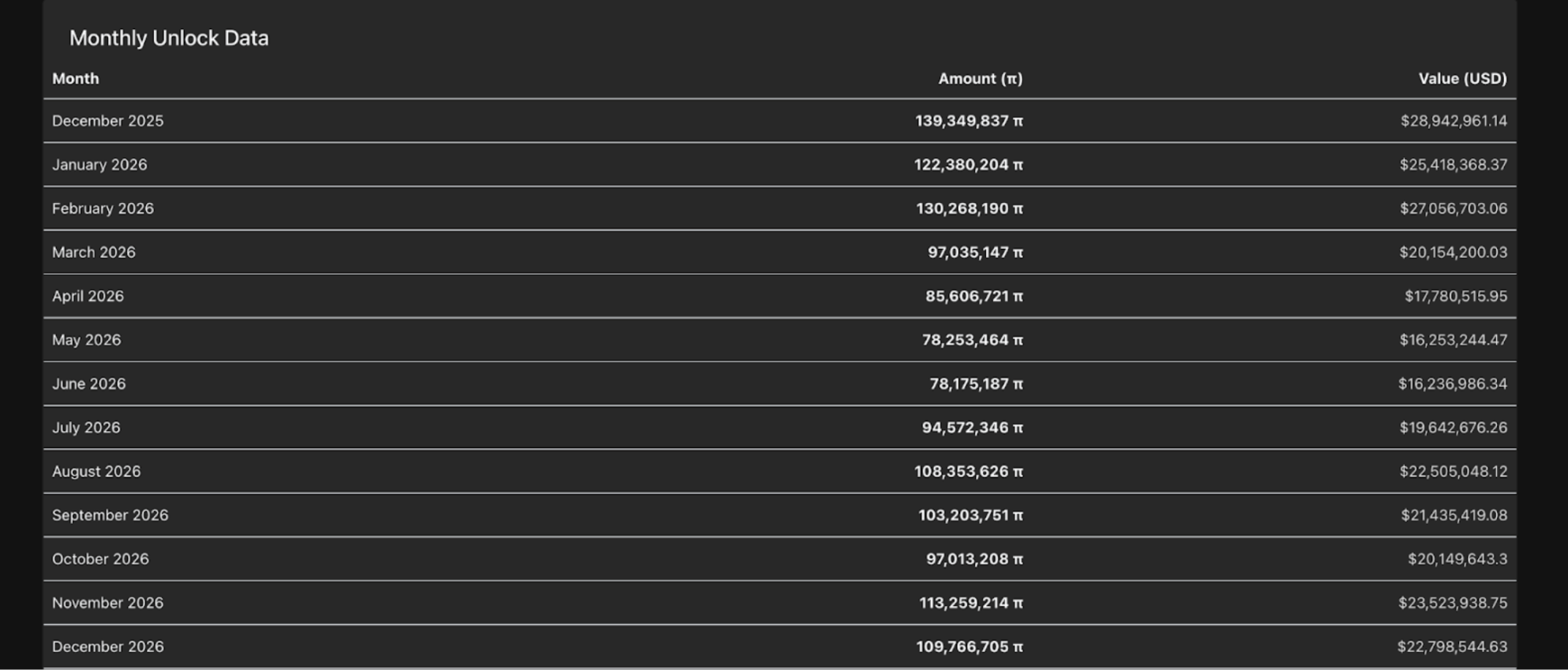

2026 looks like a tug-of-war: a Stellar protocol version 23 upgrade (with smart contracts) could finally widen real-world use, yet 1.21 billion PI tokens slated to unlock risks keeping price choppy, with any rebound needing follow-through and credibility.

Pi Network (PI) had the kind of post-launch year that tests even loyal communities. After the project shipped its mainnet on February 20, 2025 and landed listings on OKX, Bitget, MEXC, Gate.io, and Pionex, PI initially ripped — printing an all-time high of $3.00 on February 26, 2025 — then spent most of the year grinding lower, ultimately falling over 90% from the peak despite periodic bounces.

The common thread through 2025 wasn’t a lack of headlines — it was that headlines didn’t translate into sustained demand. Network upgrades, partnerships with gaming companies, and AI features aimed at improving KYC verification all arrived, but they didn’t change the market’s core question: what is PI’s durable, on-chain utility — and how quickly does supply hit exchanges?

Pi’s 2025 launch rally faded fast — and key moments became sell triggers

After PI’s early listings, the token’s path turned south quickly. The community’s traditional “show of strength” on Pi Day (March 14) didn’t save it in 2025: Pi Day was met with heavier selling, and PI dropped 7%. March also delivered PI’s sharpest monthly hit, a decline of over 66%.

Even high-profile visibility didn’t help the chart. Nicolas Kokkalis’ first public appearance at Consensus 2025 by CoinDesk (May 14–16) coincided with a 42% drop during the event. Later, a community meetup visit in Seoul on September 22 involving Kokkalis and Chengdiao Fan lined up with another sharp move lower — a 19% decline.

Kokkalis also used Consensus 2025 to announce Pi Network Ventures, a $100 million investment arm. On October 29, Pi Network officially announced an investment in the OpenMind startup (amount undisclosed), with OpenMind running a test on Pi Network’s 350,000 nodes to assess computational power. The problem for investors: these developments didn’t resolve concerns around roadmap clarity, token economics, or how quickly “potential users” become “active users.”

Utility ambitions are real — but so is the supply overhang

On the product side, Pi has been laying groundwork that could matter in 2026.

Pi Network announced the testnet 1 upgrade to Stellar protocol version 23 on September 16, with rollout planned to testnet 2 before deployment to mainnet. The 2026 move to Stellar protocol version 23 is framed as opening the door to smart contracts, which would be a meaningful expansion if executed cleanly.

Chengdiao Fan also outlined a broader Web 3.0 expansion at Token2049, including a DEX, an AMM liquidity pool, and token creation tools on the Pi testnet.

Pi’s ecosystem push included its first hackathon in the Open Network era. Between August 15 and October 15, developers submitted 215 applications to mainnet. Winners included Blind_Lounge (dating platform), Starmax (loyalty program app), and RUN FOR PI (runner game).

On gaming, Pi’s partnership with CiDi Games aims to use PI as in-game currency, with early platform testing set for Q1 2026.

The bullish argument is straightforward: Pi has distribution. In its own blog update, Pi Network said 17.5 million users completed KYC, and 15.7 million migrated to mainnet. That’s a massive funnel that most crypto projects simply don’t have.

The bearish argument is also straightforward: access creates supply. Those KYC-verified users are allowed to deposit PI to exchanges — and that’s already visible. Roughly 437 million PI tokens have been deposited on CEXs.

PiScan data shows PI supply on centralized exchanges has crossed 436 million PI, which is only 3.40% of the total PI supply (12.84 billion). Ironically, that “limited exchange float” cuts both ways: it can create sharp squeezes, but it also raises the risk of price manipulation and opaque OTC dynamics.

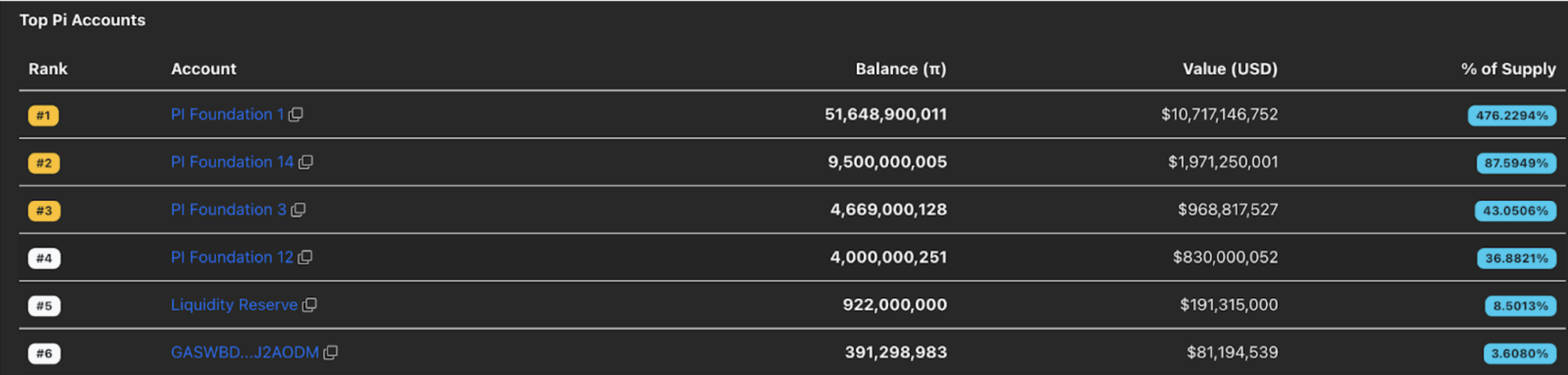

Then there’s the reputational drag. Critics have pointed to delayed responses and unclear messaging on roadmap and tokenomics. Bybit founder Ben Zhou publicly called Pi Network a “Scam” and shared an official warning from Chinese police in a tweet tied to Pi’s mainnet launch. Add in supply concentration — with major balances in Pi Foundation wallets (including the Liquidity Reserve) and an unknown wallet holding over 391 million PI (worth over $81 million) as the sixth-largest holder — and it’s not hard to see why some investors stay on the sidelines.

2026 could be a “make-or-break” year — and 1.21 billion tokens are waiting

The 2026 setup looks messy because multiple forces push in opposite directions:

What could weigh on PI:

1.21 billion PI tokens are scheduled to unlock in 2026, which can amplify selling pressure in a market already sensitive to supply.

If AI-enabled KYC speeds up migrations, that could increase the flow of tokens onto exchanges.

Pi’s mandatory KYB requirement for exchanges is a hurdle for listings on tier-1 venues like Binance, limiting the “liquidity unlock” narrative many communities rely on.

What could support PI:

Clearer communication and a credible tokenomics roadmap could reduce the project’s “trust discount.”

A successful Stellar protocol v23 path to smart contracts could move PI from “big community” to “big utility.”

The 17.5 million KYC-verified user base is a unique asset — potentially valuable for payments, local commerce, ecosystem apps, and even regulated-asset distribution if the network delivers full functionality.

As Dr. Altcoin (a Pi community KOL) told FXStreet: Pi’s user base and payments focus could support broader use cases — but adoption depends on “execution, liquidity, regulatory clarity, and the ability to convert users into active participants.”

2026 technical map: supports look thin if confidence doesn’t return

On the daily logarithmic chart, PI’s downtrend has been persistent since the February 26 peak.

As of December 18, PI traded slightly above the $0.2000 psychological support. If the tape stays heavy, the next levels to watch are:

$0.1924 (October 17 low)

$0.1533 (October 10 low)

$0.1000 (listing price), described as the final line of defense in an extreme bearish scenario. A break below $0.1000 would push PI into downside price discovery.

On the upside, the “bull case” is more conditional: a double-bottom reversal from around $0.2000 would target the $0.2945 level (October 27 high) as the neckline. Supporting that view, the weekly RSI sits at 30 and is rising out of oversold territory, creating bullish divergence with the double-bottom structure. The MACD has also been rising within negative territory, signaling reduced selling pressure.

If PI prints a decisive close above that neckline, the next levels mentioned are $0.4000 (support-turned-resistance) and then the $0.5000 psychological mark. And yes — the broader forecast still allows for a mid-2026 rebound with targets exceeding $1 — but only if the project can deliver real utility while absorbing unlock-driven supply.

Expert view: the “>$1” path requires execution, not vibes

FXStreet also interviewed Dr. Altcoin, who recently published “Pi Network – The Sleeping Giant,” to frame scenarios for 2026. On December 16, PI was trading around $0.2, and his projections were explicitly conditional:

Conservative ($0.35–$0.75): likely if adoption remains limited, real-world use cases are minimal, and liquidity/exchange support stays restricted.

Moderate ($0.75–$2.00): possible if adoption broadens, the ecosystem expands (dApps, payments, merchants), and PI secures more reputable exchange listings.

Bullish ($2.00+): could occur if Pi sees strong global adoption, utility at scale, a crypto bull market tailwind, and favorable regulatory conditions.

He also addressed the obvious risk: if a large portion of supply awaiting KYC verification becomes unlocked via migration, it can trigger a dump — especially if many users sell at once. His counterpoint is that the Pi Core Team has historically used mechanisms like staking rewards and gradual migration to reduce sell pressure, though he still expects some selling and noted price impact may be temporary.

On the question of a Binance listing or another tier-1 exchange: he said it remains possible, but not guaranteed.

Read more

The above content was completed with the assistance of AI and has been reviewed by an editor.