U.S. November Nonfarm Payrolls: What Does the Rare "Weak Jobs, Strong Economy" Mix Mean for U.S. Equities?

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- Trump says Venezuela's Maduro deposed, captured after US strikes

- Bitcoin Price Surges To $90,000. U.S. Arrests Venezuela's President, Triggers Bull Frenzy

- Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

- Gold Price Forecast: XAU/USD climbs to near $4,350 on Fed rate cut bets, geopolitical risks

- Gold Price Forecast: XAU/USD jumps above $4,350 on US-Venezuela tensions

1. Introduction

After retreating from the late-October highs, U.S. equities embarked on a bottoming rebound in mid-to-late November, a trend driven by the interplay of multiple factors. That said, it is worth noting that the U.S. economy’s rare "weak jobs, strong growth" configuration has emerged as the core driver underpinning this equity rally. On 16 December, the U.S. Bureau of Labour Statistics will release the November nonfarm payrolls data. Will this reading extend the labour market’s recent softening trend? Looking ahead, will the U.S. economy sustain its "weak jobs, strong growth" trajectory? And what lies in store for U.S. equities in 2026? This report addresses these questions one by one.

Our core logic is crystal clear: The U.S. economy will likely maintain a divergent pattern of weak employment but robust growth in 2026. As one of the Fed’s core policy mandates, employment carries greater weight than economic performance, which is not a direct target of its policy calibration. From this, we can deduce that softness in the labour market will heighten the urgency for the Federal Reserve to cut interest rates. This imperative will outweigh the rationale of “no need for rate cuts” stemming from economic resilience. Therefore, the Fed is highly likely to scale up the magnitude of rate reductions in 2026. In terms of the implications for U.S. equities: On one hand, the intensified rate cuts will serve as a direct tailwind for the stock market; on the other hand, the strong economic performance will underpin the revenue and earnings of listed companies, thereby providing additional support for the upward trajectory of U.S. equities.

2. Why Is a "Weak Employment" Scenario Unfolding?

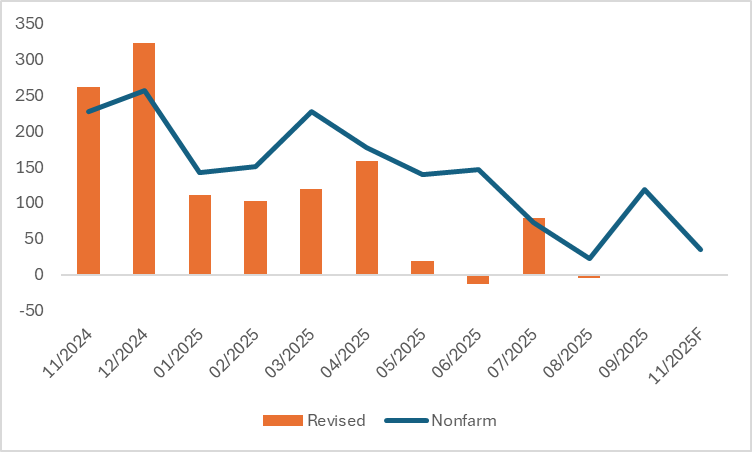

The market widely anticipated that nonfarm payrolls would register a gain of 35,000 in November. From a historical data perspective, the U.S. job market has been on a downward trajectory since March this year. Moreover, the indicator has undergone downward revisions in 7 out of the past 8 months (Figure 2). Regarding the core drivers behind the current softening of the U.S. labour market, the much-discussed displacement effect of AI technology has actually exerted a relatively limited impact. Meanwhile, two other factors that sparked extensive debate during the Trump administration—the contraction in immigration volumes and government-sector layoffs—are also not the dominant culprits. The key variable weighing on the labour market’s sustained weakness lies in the persistently elevated interest rate environment. This phenomenon serves as indirect evidence that, against the backdrop of manageable inflation, the Federal Reserve is highly likely to step up the pace of interest rate cuts. A detailed analysis is provided below:

Figure 2: U.S. Nonfarm Payrolls (000)

Source: Refinitiv, TradingKey

2.1 The AI Displacement Effect

The most intensely debated topic in the market right now revolves around the employment slowdown triggered by AI-driven human labour displacement. According to estimates from Challenger, Gray & Christmas (CGC), a leading U.S. employment consulting firm, U.S. layoffs surged to 153,000 in October, marking a 175% year-on-year spike, with the technology sector accounting for 21.7% of the total job cuts. Overall, the structural impact of AI is likely to concentrate in three key dimensions: AI-exposed industries, young professionals, and high-wage positions. That said, a holistic analysis suggests AI is unlikely to be the core driver behind the recent softening of the U.S. job market. The rationale is threefold: First, from a statistical perspective, there has been an extremely weak negative correlation between the rising adoption rate of AI applications and fluctuations in employment growth since 2023. Second, there has been no acceleration in the transformation of the labour force’s occupational structure. Third, among enterprises that have implemented AI applications, companies are more inclined to retrain existing employees rather than resort to direct layoffs. If AI-driven displacement is not the real root cause of the job market’s downturn, then what exactly is the dominant factor?

2.2 A High-Interest Rate Environment

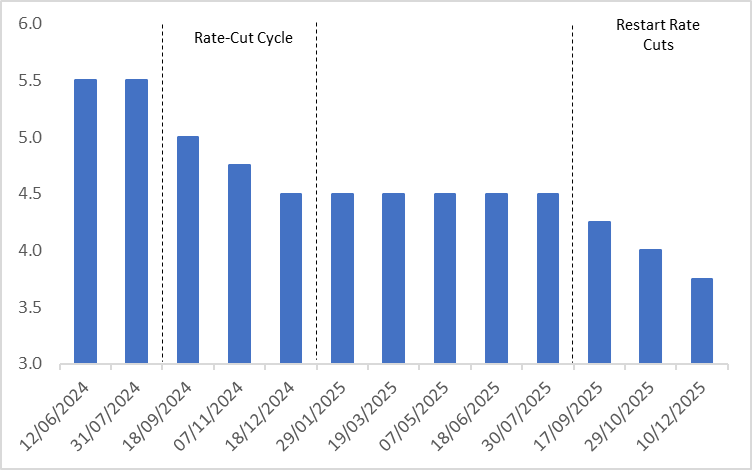

The core driver of the "weak employment" phenomenon lies in the high-interest-rate environment. Although the Federal Reserve has initiated an interest rate cut cycle since September this year, the belated start and insufficient magnitude of rate cuts have kept current market interest rates at elevated levels (Figure 2.2), making it difficult to effectively reverse the slowdown in employment growth. A compelling piece of evidence is that the varying interest rate sensitivity across industries can well explain the recruitment contraction observed since the start of the year — interest-sensitive sectors such as construction, mining and logging, retail trade, as well as accommodation and food services, have witnessed the most pronounced declines in employment demand.

Figure 2.2: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

2.3 Reducing Immigration

There are two additional relevant yet non-core influencing factors, namely the contraction in immigration scale and government sector downsizing. Tighter immigration policies have constrained the labour market from the supply side. First, following Donald Trump’s inauguration, the annual number of immigrants to the U.S. plummeted sharply from 1.5 million to approximately 400,000. Second, the new policy introduced by the Trump administration in September—which requires H-1B work visa applicants to pay related fees of $100,000—has already led to a rapid decline in the volume of immigration work permit applications. This shift may disrupt subsequent employment data. Nevertheless, from a holistic perspective, the drag effect of immigration on employment is short-term and one-off in nature, and will not evolve into a long-term negative factor.

2.4 Government Workforce Reduction

Although the federal government has cut over 100,000 jobs year to date, the net employment gain across the entire government sector has remained stable at around 40,000. This is primarily because most of the laid-off federal employees have transitioned to roles at the state or local government levels. Data on unemployment insurance claims filed by former federal workers indicates that the majority of these displaced public servants have achieved swift re-employment. While the U.S. government has not released official statistics on the exact scale of workforce reduction, progress can be tracked via job posting data from Indeed: job openings in Washington, D.C. have seen a marked decline relative to the national average since the start of the year, but have essentially stabilised since October. This trend further confirms that the impact of government workforce reduction on the U.S. labour market is also one-off in nature.

3. Why Has a "Strong Economy" Emerged?

The "strong economy" is the result of the combined effect of two key factors. First, the negative sentiment shocks triggered by "tight fiscal policy" and "high tariffs" in the first half of the year have gradually subsided. Second, the AI boom and the bull market in U.S. tech stocks have driven an expansion in corporate capital expenditure and generated a wealth effect among households. Given that the Trump administration will be fully occupied with preparations for the midterm elections over the coming year, U.S. macroeconomic policies are highly likely to maintain a "dual easing" stance, and the "strong economy" is expected to persist.

4. US Equity Strategy

We must reaffirm our core thesis: the US economy will likely sustain its current dichotomy of weak employment alongside robust growth in 2026. On one hand, the softness in the labour market will compel the Federal Reserve to maintain an accommodative policy stance, with additional rate cuts serving as a tailwind for US equities. On the other hand, the economy’s strong performance will directly underpin corporate profitability, thereby providing further impetus for upward momentum in the stock market. Against this backdrop, we anticipate that US equities will continue their ascent and keep setting record highs throughout the year. For passive investors, priority may be given to broad-market ETFs such as SPY and QQQ.

For active investors, against the backdrop of a weak labour market paired with a resilient economy and the Federal Reserve's interest rate cuts, U.S. equities are poised to see structural gains, with interest-sensitive and cyclical sectors taking the lead. Among interest-sensitive industries, the technology sector stands out prominently. AI computing leaders NVIDIA (NVDA) and AMD (AMD) are set to benefit substantially: rate cuts lower their financing costs for R&D and capacity expansion, and coupled with the explosive demand in the AI industry, these firms are experiencing a dual uplift in earnings and valuations. In consumer electronics, Apple (AAPL) will also see valuation expansion driven by ample liquidity. The financial sector is a direct beneficiary of rate cuts. Banking stocks such as JPMorgan Chase (JPM) and Bank of America (BAC) are not only relieved of net interest margin pressures but also buoyed by liquidity injections from the Federal Reserve. Meanwhile, the "resilient economy" provides a tailwind for cyclical sectors. Energy stocks like Exxon Mobil (XOM) are likely to rally as demand expectations improve amid economic resilience. Industrial leaders, including Caterpillar (CAT) and Boeing (BA), are poised to achieve a fundamental and liquidity resonance—fuelled by the recovery in global infrastructure and aviation demand, as well as reduced financing costs.

5. Conclusion

In summary, the unique dynamic of a weak labour market alongside a robust economy is rarely seen in the United States. Against the backdrop of manageable inflation, this distinctive trend is more beneficial than detrimental to U.S. equities. Therefore, investors should prioritise exposure to broad-market ETFs, interest rate-sensitive and cyclical sectors, as well as leading enterprises within these segments.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.