Litecoin Stuck at 3-Month Resistance, Breakout Unlikely – Here’s Why

- Tesla Stock Hits Record High as Robotaxi Tests Ignite Market. Why Is Goldman Sachs Pouring Cold Water on Tesla?

- Gold Price Hits New High: Has Bitcoin Fully Declined?

- Gold jumps above $4,440 as geopolitical flare, Fed cut bets mount

- U.S. November CPI: How Will Inflation Fluctuations Transmit to US Stocks? Tariffs Are the Key!

- US Q3 GDP Released, Will US Stocks See a "Santa Claus Rally"?【The week ahead】

- December Santa Claus Rally: New highs in sight for US and European stocks?

Litecoin (LTC) has encountered a persistent challenge over the past three months, failing to break above the key resistance at $136. Despite recent attempts to breach this barrier, the altcoin has struggled to maintain upward momentum.

While some believe a breakthrough is imminent, a lack of investor support suggests the price may face further declines.

Litecoin Investors Are Not Supportive

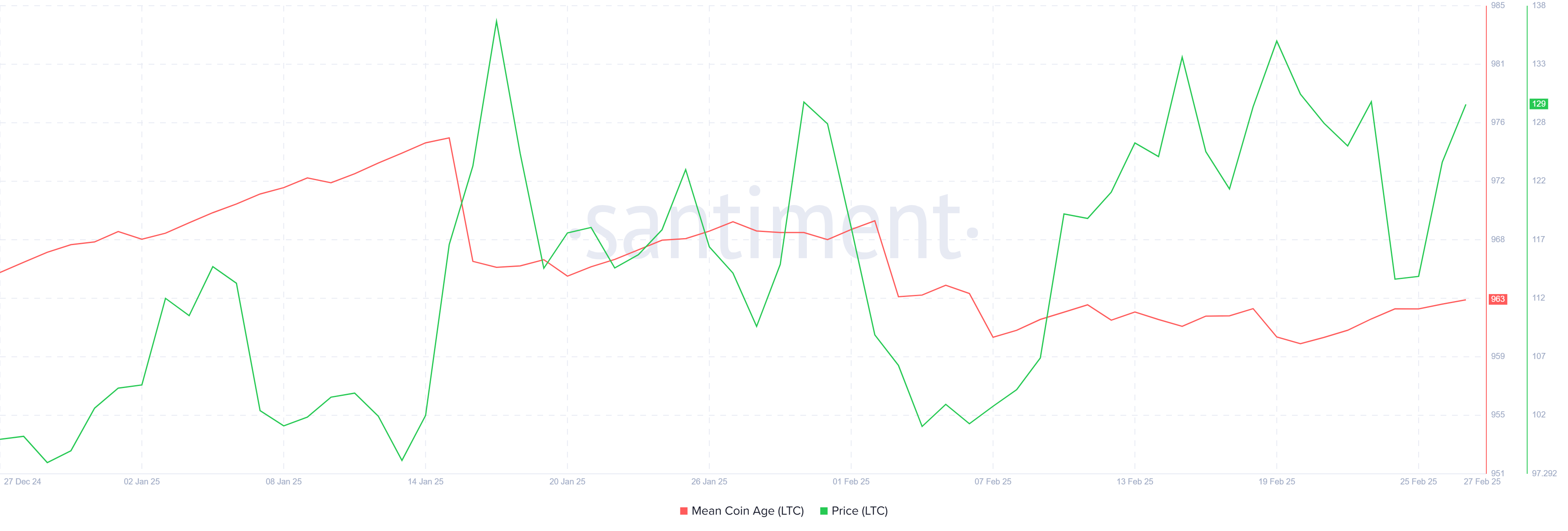

Litecoin’s Long-Term Holders (LTHs) have not shown substantial bullish behavior recently, according to the Mean Coin Age (MCA) indicator. The lack of a noticeable uptick suggests minimal accumulation, leaving the market stagnant. If the MCA indicator were to show a significant downtick, it could signal that LTHs are selling off their holdings, which would be a bearish sign. However, since this is not happening, Litecoin may avoid a sharp crash but still struggles to attract long-term investment.

Without stronger conviction from LTHs, Litecoin may continue its sideways movement without a significant rally. This minimal accumulation by investors who typically dictate long-term trends leaves the altcoin vulnerable to remaining stuck in the same range without meaningful progress. Until LTHs show more interest, substantial gains for Litecoin seem unlikely.

Litecoin MCA. Source: Santiment

Litecoin MCA. Source: Santiment

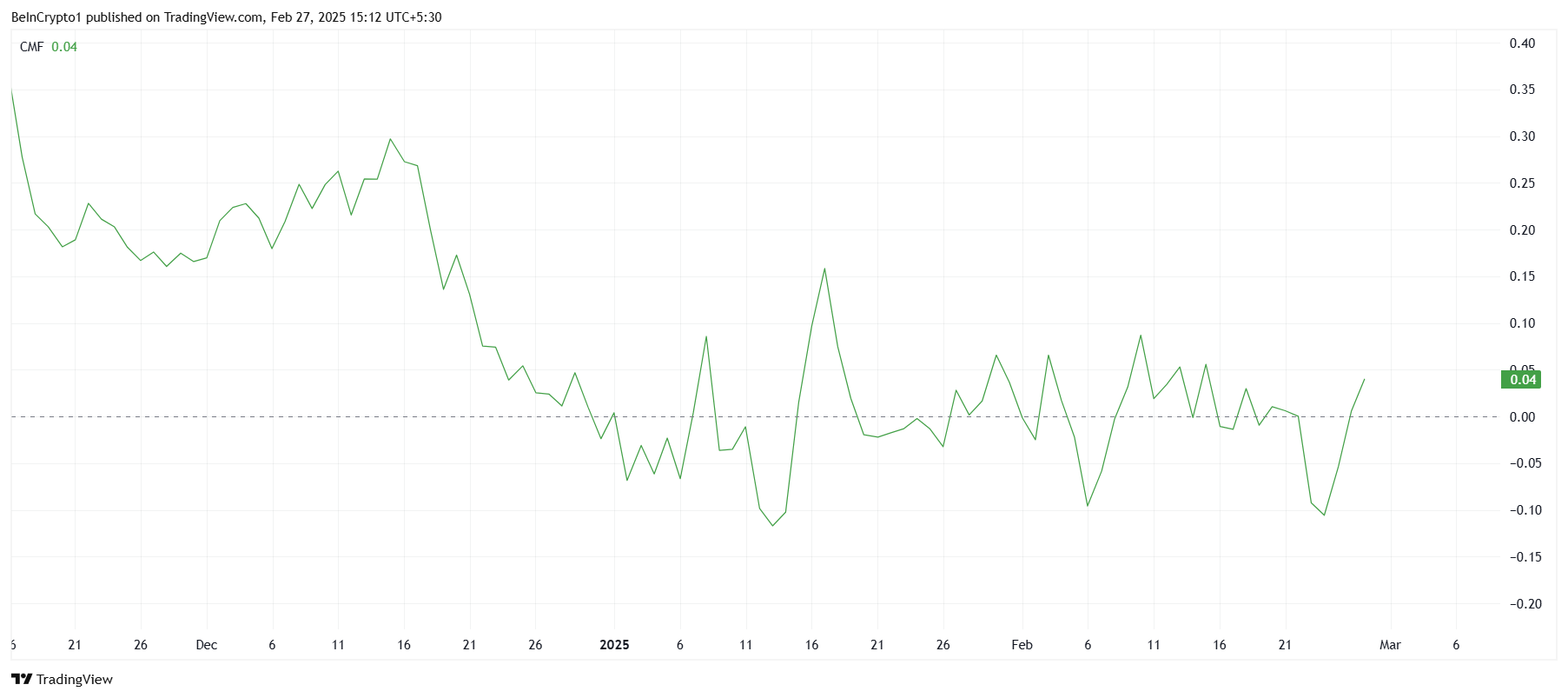

The overall macro momentum for Litecoin is being heavily influenced by the Chaikin Money Flow (CMF) indicator, which has struggled to stay above the zero line for the past two months. The lack of inflows has hindered Litecoin’s ability to rally sharply. Although the CMF has shown some signs of upward movement recently, it has yet to signal a sustained rise, leaving the altcoin in a state of indecision.

Since the start of the year, Litecoin’s price has remained relatively flat, with the absence of strong market inflows contributing to its stagnation. The CMF’s continued struggle to break above zero reflects broader market hesitancy toward Litecoin. While the recent uptick provides some hope, whether this momentum can be sustained remains uncertain.

Litecoin CMF. Source: TradingView

Litecoin CMF. Source: TradingView

LTC Price Faces Key Barrier

Currently, Litecoin is trading at $129, reflecting a 13% rise over the last 24 hours. This uptick has brought the altcoin closer to the critical resistance of $136, which it has struggled to breach for the past three months. The current price movement suggests that Litecoin may attempt another rally, but the same factors that caused previous failures remain.

Should Litecoin fail to breach the $136 resistance, the price could fall back to $117, with further support at $105. A decline below these levels would signal a continuation of the downtrend, keeping Litecoin stuck below key resistance for an extended period.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

If Litecoin successfully breaks above the $136 resistance and flips it into support, a significant rally could follow. The next target would be $147, just under the psychological $150 price point. Reaching this target would invalidate the bearish outlook and could set Litecoin on a path toward even higher prices.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.