Ethereum (ETH) Struggles To Hit $2,000 With Weak Whale Accumulation

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- Bitcoin Rebounds After Falling to $62,500 Low, Crypto Market Still Extremely Fearful

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP post cautious recovery amid downside risks

Ethereum (ETH) has been struggling, down nearly 30% over the past 30 days as bearish sentiment continues to weigh on the asset. Over the last week, ETH has remained stuck below the $2,000 mark, unable to regain key resistance levels.

While some indicators, like BBTrend, are showing early signs of stabilization, whale activity points to cautious behavior among large investors. As Ethereum trades near critical support zones, the market is watching closely to see if the downtrend will deepen or if bulls can stage a meaningful recovery.

BBTrend Is Now Positive After 6 Days, But Still At Modest Levels

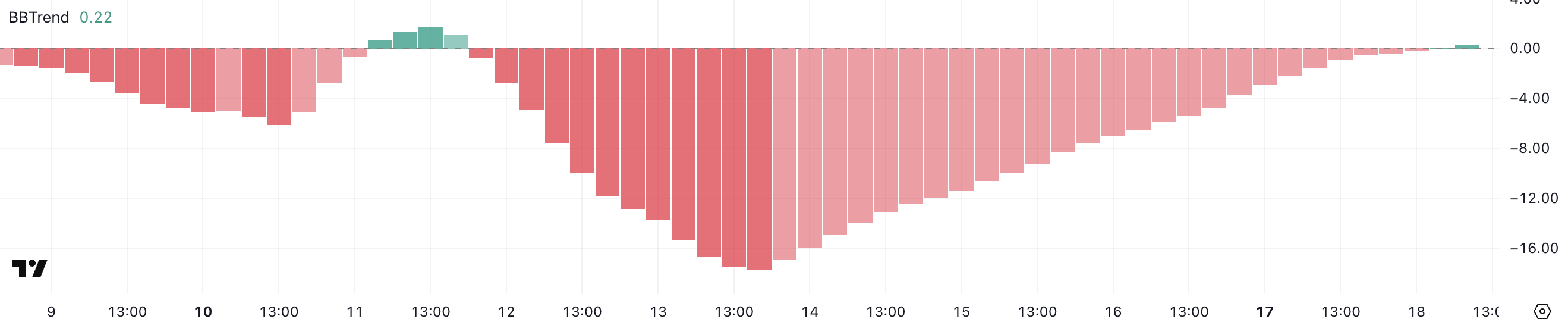

Ethereum’s BBTrend indicator is currently sitting at 0.22, having just turned positive after spending six consecutive days in negative territory.

During that stretch, it reached a negative peak of -17.68 on March 13, reflecting strong bearish momentum.

This shift marks a potential early sign of stabilization for Ethereum. The indicator has crossed back above zero, signaling that sellers may be losing control in the short term, as Ethereum network activity recently hit yearly lows.

ETH BBTrend. Source: TradingView.

ETH BBTrend. Source: TradingView.

BBTrend, or Bollinger Band Trend, is a momentum-based indicator that measures the strength and direction of a price trend relative to its Bollinger Bands. Readings below 0 typically suggest bearish conditions, while readings above 0 indicate bullish momentum.

Thresholds around -10 or +10 often highlight periods of stronger trend conviction. Ethereum’s BBTrend is now back in positive territory after a prolonged bearish phase, suggesting that downward pressure is easing.

However, at just 0.22, the indicator is still at low levels, signaling that while the sell-off might be cooling, the market has yet to transition into a strong bullish trend fully.

Whales Are Not Accumulating Ethereum

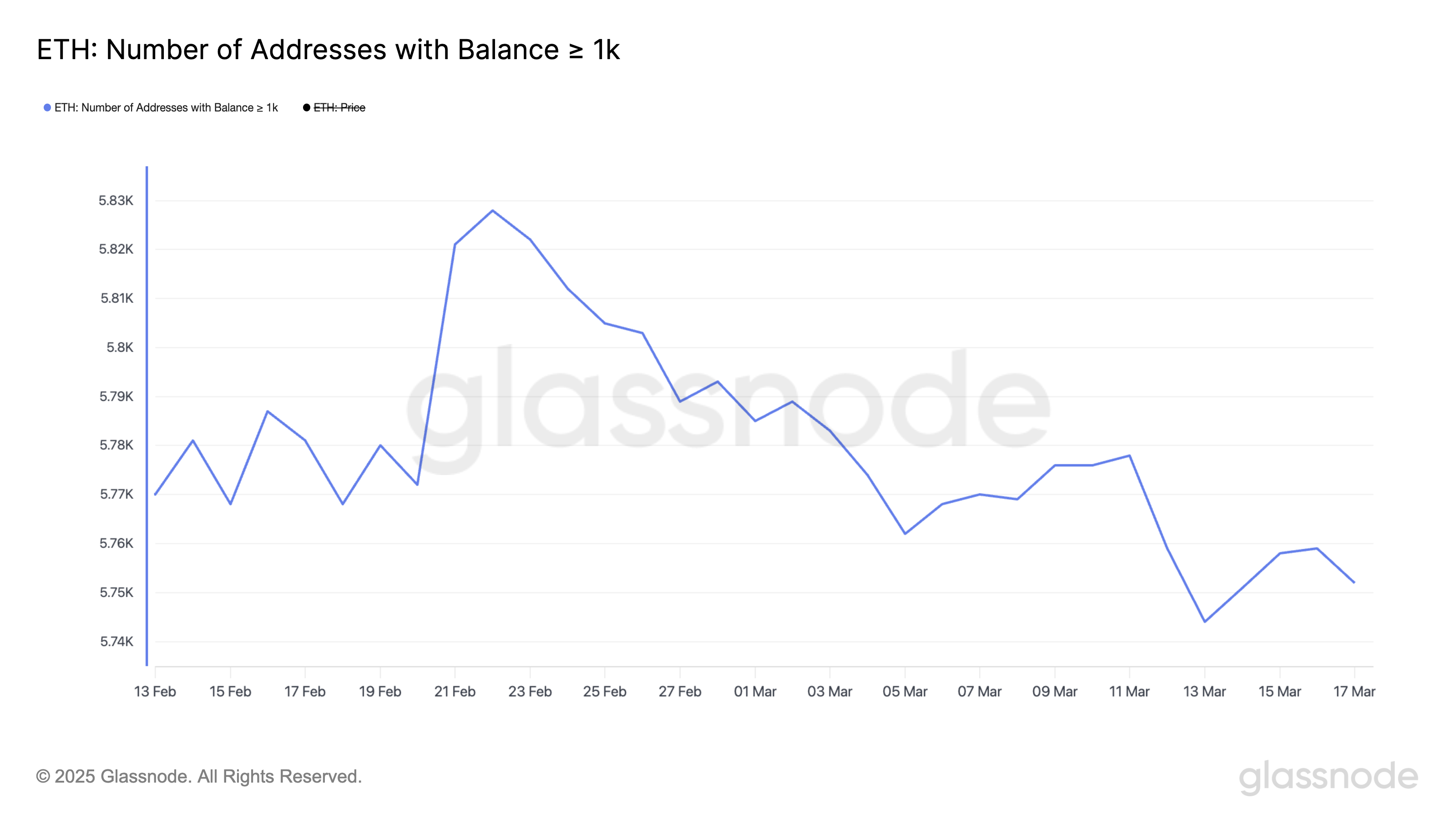

The number of Ethereum whales—wallets holding at least 1,000 ETH—has been steadily declining since February 22, after peaking at 5,828 addresses.

The current number of Ethereum whales stands at 5,752, despite a modest attempt at a rebound in recent days, with Ethereum market dominance hitting its lowest levels since 2020.

This gradual reduction in large holders points to a cautious approach among key players. Some whales are reducing their exposure or taking profits as Ethereum’s price action remains mixed.

ETH Whales. Source: Glassnode.

ETH Whales. Source: Glassnode.

Tracking whale behavior is crucial because these large addresses often act as market movers, capable of influencing price trends through their buying or selling activity.

A steady decline in Ethereum whale numbers may suggest waning confidence or a shift toward risk-off sentiment among institutional or high-net-worth investors.

This downward trend in whale accumulation could limit the strength of any potential rallies, as fewer large players are positioned to provide strong buying support in the short term.

Will Ethereum Fall Below $1,700 In March?

Ethereum has been under pressure, trading below the $2,000 mark for the past seven days. Sellers have kept the asset pinned beneath key resistance levels.

The current support stands at $1,823, and if this level is tested and broken, Ethereum could decline further toward $1,759 and potentially fall below $1,700 for the first time since October 2023, despite some experts defending its future echoes early Amazon and Microsoft.

ETH Price Analysis. Source: TradingView.

ETH Price Analysis. Source: TradingView.

However, if Ethereum’s price manages to stabilize and build an uptrend, it could challenge the immediate resistance at $1,956.

A breakout above this level may open the path for a rally toward $2,106, with further bullish momentum potentially pushing ETH to retest $2,320 and even $2,546.

A break above $2,500 would mark the first time Ethereum reclaims that level since March 2, signaling a notable shift in market confidence and buyer strength.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.