TradingKey – Ancient whale wallets dumped Bitcoin throughout August, sending its price on a roller-coaster ride. With September’s Federal Reserve meeting on the horizon, traders are asking: can Fed action spark a BTC rebound?

On Monday, September 1, Bitcoin (BTC) extended August’s sell-off, sliding over 1% and failing to hold the $110,000 level. As of press time, it was trading around $108,180.

Minute-by-minute price chart via TradingView

In August, BTC first climbed to a record $124,000 on August 14, then relinquished nearly $20,000 in the latter half of the month — ending down almost 5% overall as it drifted back toward the $100,000 mark.

Daily price chart via TradingView

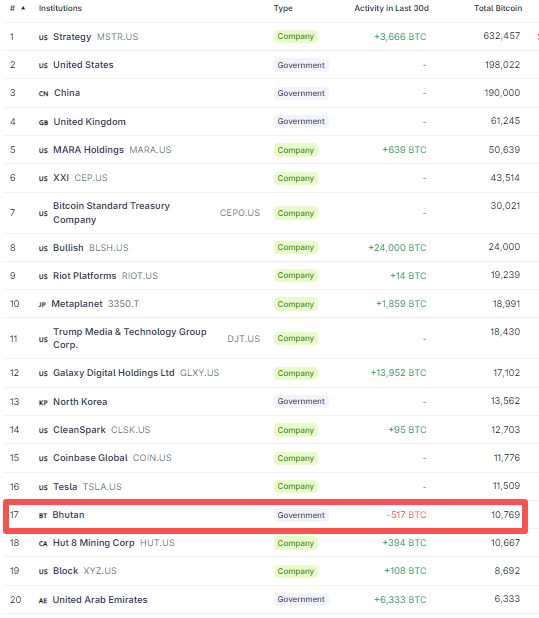

Institutional players largely refrained from selling into the highs; most even added to their positions. According to CoinGecko, Bullish topped the list of net buyers — accumulating over 24,000 BTC — followed by Galaxy Digital (GLXY) with 13,900 BTC. The lone exception was the government of Bhutan, which trimmed its holdings by 517 BTC.

Top 20 BTC holders chart via CoinGecko

Yet a powerful under-the-radar force has been at work: historic “whale” wallets rotating out of BTC and into Ethereum (ETH). On-chain data shows a wallet beginning with 169qY sold 34,000 BTC, and another prefixed 19D5J offloaded 22,700 BTC. These whales mined coins at near-zero cost, allowing them to unload massive volumes without worry of losses — putting strain on market absorption.

At the same time, high BTC prices have stretched the finances of public holders like MicroStrategy (MSTR) and Metaplanet, slowing their buying pace as they face funding challenges.

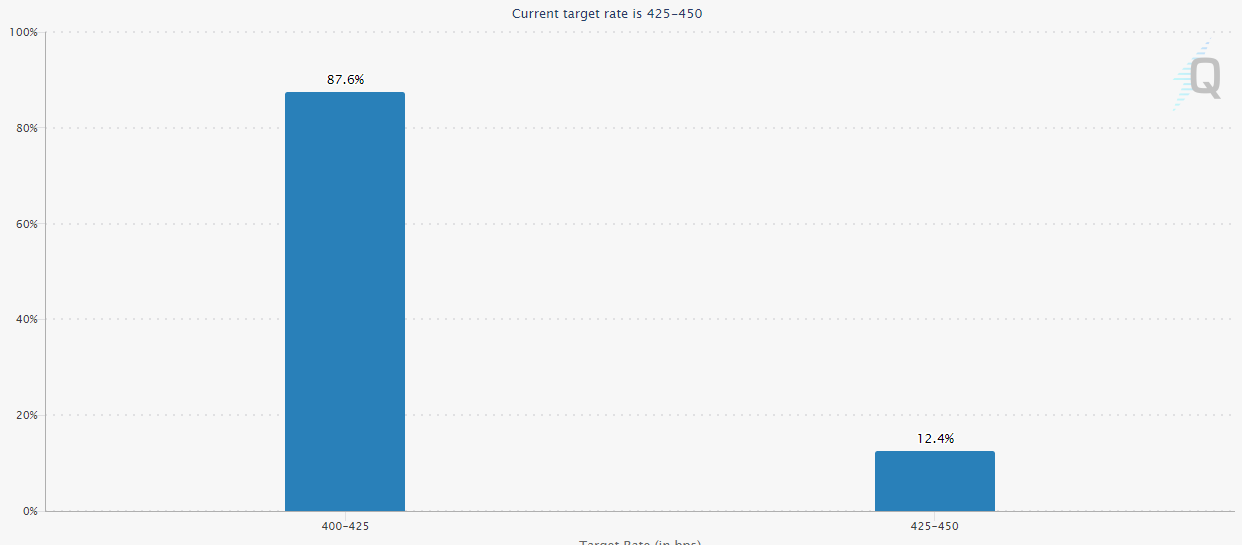

All eyes now turn to the Federal Reserve’s meeting on September 17, its sixth of the year. The Fed has held rates at 4.25–4.50% through five meetings — September could deliver its first cut in 2025. A rate reduction may curb whale selling and ignite bullish sentiment, laying the groundwork for a Bitcoin recovery.

Market odds for a September cut are overwhelming: CME’s FedWatch Tool pegs a 87.4% probability of a 25-basis-point cut. Fed officials such as Mary Daly and Christopher Waller have hinted at easing, with Governor Waller openly backing a 25bp reduction at the September meeting.

Fed rate-cut probability chart via CME

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.