Crypto market liquidates over $400 million as correction lingers

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

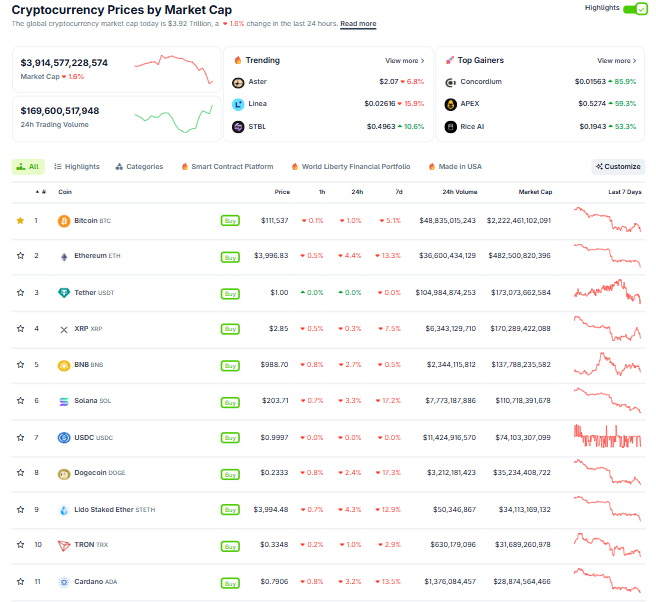

Broader crypto market trades in the red on Thursday, extending the sell-off sparked by heavy liquidations earlier this week.

Bitcoin dips below $112,000, Ethereum slips below $4,000, and altcoins follow with further losses.

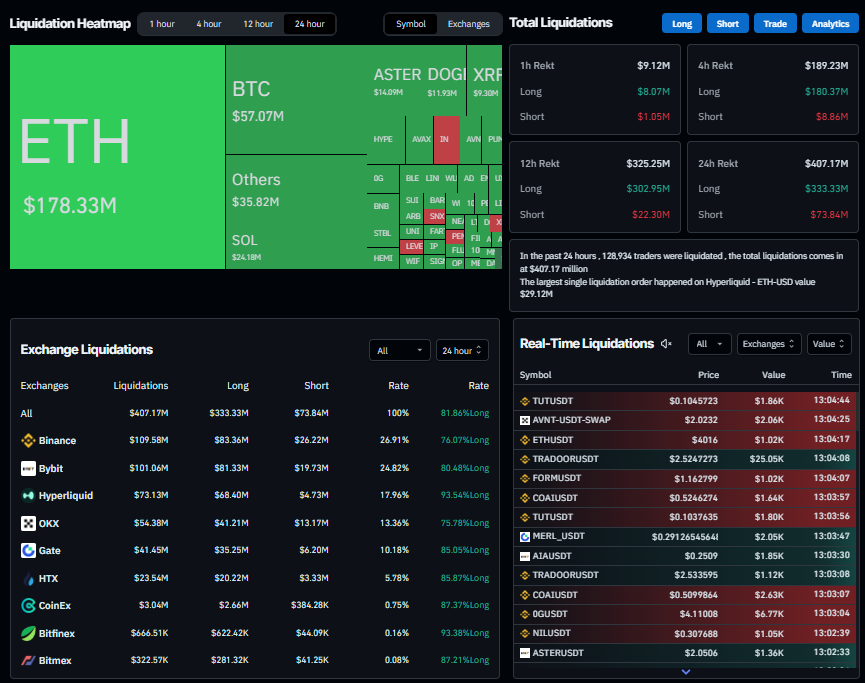

The recent sell-off leads to over $400 million in liquidations amid sour market sentiment.

The cryptocurrency market extends its downturn on Thursday, with Bitcoin (BTC), Ethereum (ETH), and major altcoins slipping further after a wave of liquidations earlier in the week. More than $400 million in positions were wiped out in the past 24 hours, highlighting bearish sentiment among traders.

Why is the crypto market falling?

The overall cryptocurrency market trades in the red on Thursday, with major coins such as Bitcoin falling below $112,000, and Ethereum slipping below $4,000. Meanwhile, top altcoins like Ripple (XRP), BNB (BNB), and Solana (SOL) continue to extend their losses.

The reason for the market decline is the Federal Reserve’s (Fed) cautious stance, followed by rising geopolitical conflicts, which have triggered a risk-off sentiment in the markets.

After a 25 basis point (bps) interest rate cut last week, Fed Chair Jerome Powell tried to push back expectations of more rate cuts in the coming months and said, on Tuesday, that the central bank needed to continue balancing the competing risks of high inflation and a weakening job market in coming rate decisions.

Powell added that easing too aggressively could leave the inflation task unfinished and would necessitate a reversal of course. This helps revive demand for the US dollar (USD), while risk assets such as cryptos continue to slide.

Adding to this cautious Fed stance, the ongoing geopolitical conflicts, such as the Russia-Ukraine war and Israel's continuing military operations across Gaza, contribute to bearish sentiment in the cryptomarket.

Liquidations continue as crypto markets remain under pressure

Following a wave of massive liquidations on Monday, sour market conditions have remained throughout the week, triggering another round of sell-offs.

According to Coinglass data, near 129,000 traders were liquidated in the past 24 hours, resulting in the liquidation of more than $400 million in positions. 81% of these were long bets, highlighting traders’ overly bullish positioning, while the largest single liquidation came on Hyperliquid, where an ETH/USD position worth $29.12 million was wiped out.

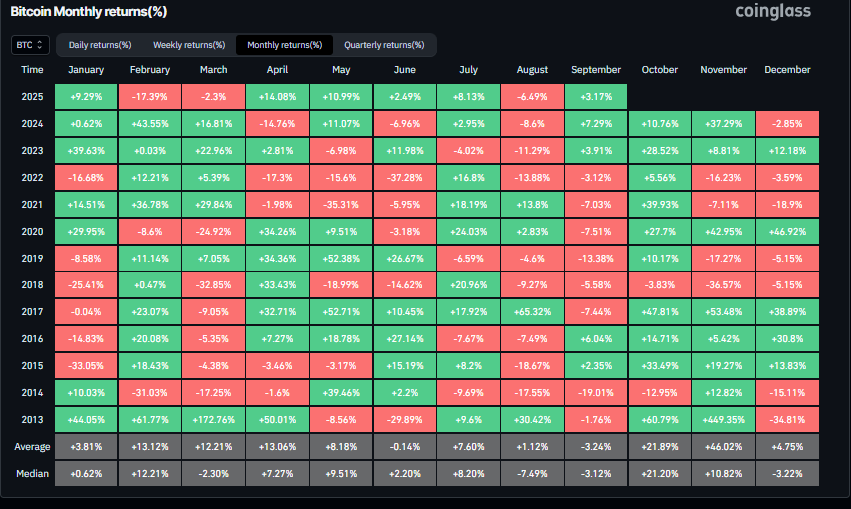

September remains sour for Bitcoin

CoinGlass’s historical monthly return (%) data shows that September has generally delivered negative returns for Bitcoin, averaging -3.24%. While BTC is up 3.17% so far this month, traders should remain cautious as history suggests the month could still close in the red.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.