Crypto Bulls Cheer as Fed Pivot Hopes Rise and Quantitative Tightening Nears Its End

- Gold Price Forecast: XAU/USD recovers above $4,100, hawkish Fed might cap gains

- Bitcoin's 2025 Gains Erased: Who Ended the BTC Bull Market?

- Gold Price Forecast: XAU/USD holds positive ground above $4,100 as Fed rate cut expectations rise

- Gold hits three-week top as dovish Fed bets offset US government reopening optimism

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH, and XRP flash deeper downside risks as market selloff intensifies

- Australian Dollar declines as US Dollar gains amid nearing government shutdown end

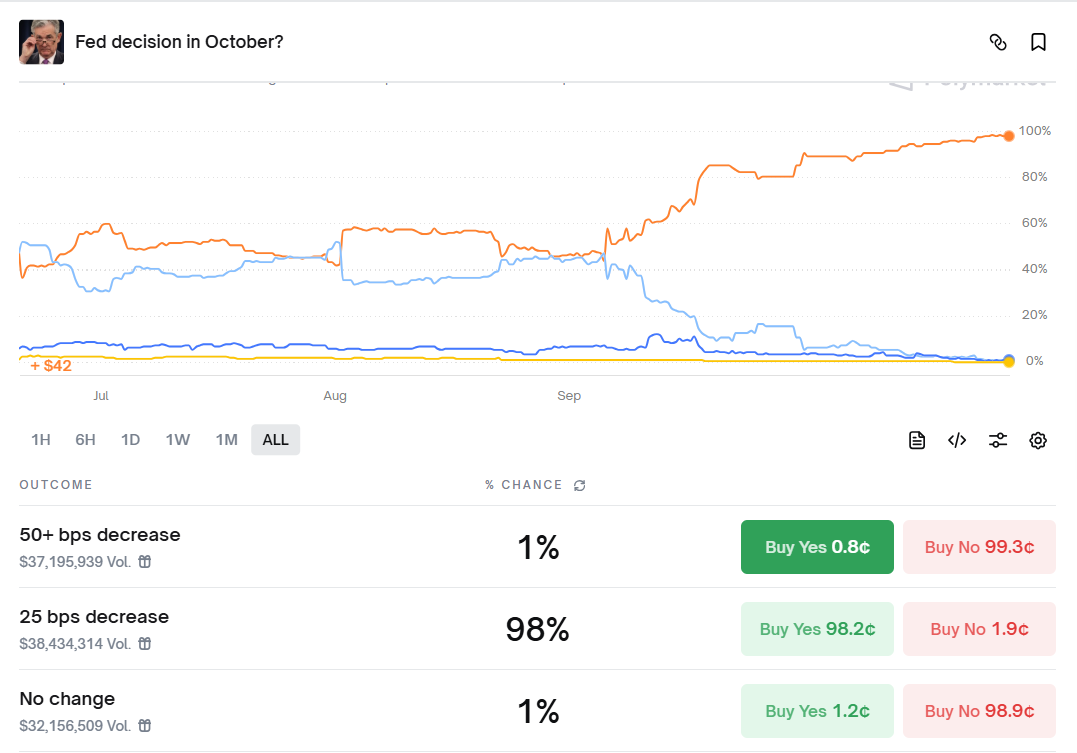

Prediction markets are pricing in a 98% chance that the Federal Reserve (Fed) will deliver a 25 basis point rate cut at its late October meeting. Meanwhile, there is also speculation that the central bank may also soon signal an end to quantitative tightening (QT).

Crypto traders are watching closely, drawing comparisons to the 2019 liquidity surge that boosted Bitcoin and sparked hopes for another strong rally in November.

Prediction Markets and Macro Signals Point Dovish

The upcoming Federal Open Market Committee (FOMC) meeting is highly anticipated in traditional and digital asset markets. Investors are looking for indications of a policy shift.

Reducing interest rates and ending QT could boost financial system liquidity, which has historically supported risk assets. Data from Polymarket shows a 98% probability that the Fed will cut rates by 25bps at its October 28-29 meeting.

Fed Rate Cut Bets. Source: Polymarket

Data on the CME FedWatch Tool corroborates this outlook, showing that the Fed’s decision to cut rates today is near certain, at 99.9%.

Meanwhile, discussions are intensifying about the possible end of QT, a process by which the Fed reduces its balance sheet by not reinvesting in maturing securities.

Research by the Federal Reserve Bank of Cleveland stresses the need for maintaining ample reserves. The market instability of September 2019, when reserves dipped too low, prompted central bank intervention and liquidity injections. At that time, Bitcoin prices roughly tripled over several months.

Crypto Markets Eye a 2019-Style Rally

Against these backdrops, many crypto analysts are connecting current events to potential market impacts.

“The FOMC meeting is tomorrow. Papa Powell is expected to cut interest rates by 25bps. Rumors are floating that we could see the end of QT tomorrow. On top of that, the US-China trade deal could be finalized soon. If all goes well, we could see a mega bullish November for crypto,” said Lark Davis.

Adding to the sense of anticipation, VirtualBacon referenced the 2019 comparison, indicating that the Fed may be about to end QT.

Ending QT could inject up to $95 billion per month in liquidity. Many hope this surge will boost digital asset prices in the coming weeks.

Risks, Parallels, and the Broader Picture

The connection between Fed policy changes and crypto markets is complex. Although rising liquidity often supports risk assets, results depend on inflation, economic growth, regulation, and adoption trends.

While Bitcoin’s 2019 surge was dramatic, today’s digital asset market is more mature and regulated, and macroeconomic uncertainty lingers.

The Fed’s balance sheet policy affects global dollar liquidity. Ending QT would mean halting the reduction of its balance sheet, potentially enhancing funding conditions worldwide, including the crypto sector.

The coming weeks will reveal whether November delivers a liquidity-driven rally or if broader factors dampen the optimism.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.