Gold price rallies nearly 1% on Friday on renewed US debt concerns.

Markets fear that US President Trump’s spending bill will balloon the US debt even further.

Gold sees a weekly gain of around 4%, fully recovering from the previous week’s fall.

Gold (XAU/USD) price extends its weekly gains, trading near $3,330 at the time of writing on Friday, up nearly 1% on the day, on a new tailwind for the safe haven precious metal. The spending bill from United States (US) President Donald Trump passed through the House of Representatives on Thursday and is now on its way to the Senate. Traders are worried that the spending bill will only add more US debt, while income from tariffs remains to be seen as enough to provide funding for all the spending.

The best place to track these concerns is the US 30-year benchmark rate. Yields in that maturity rallied to 5.15% on Thursday from 4.64% at the start of May, a more than one-year high since the 5.18% seen at the end of December 2023. Adding all things up, the recent downgrade on US credit rating from agency Moody’s, and now this spending bill, which adds $3.8 billion to the US debt, traders and market participants demand a higher premium or return before considering buying US debt bonds, which pushes US yields higher, the Economic Times reports.

Daily digest market movers: Yield vs. Gold correlation broken

Yields on 10-year US Treasuries have pushed higher this week, topping 4.5%. In earlier years, such a move would have been a major headwind for Gold as it doesn’t pay interest, with bullion prices and yields typically moving inversely. That correlation has now weakened, Bloomberg reports.

“Gold is likely to remain range-bound in the near term,” said Justin Lin, an analyst at Global X ETFs. “However, ongoing geopolitical tensions and increasing concerns about the US fiscal outlook continue to provide underlying support”, Bloomberg reports.

China’s onshore, gold-backed Exchange Traded Funds (ETFs) saw inflows resume as prices rebounded, according to a report by China Securities Journal. Some 20 Gold ETFs listed on Chinese bourses received inflows of about 370m Yuan on May 21, the report said, Bloomberg reports.

If output doubles as planned, Ghana expects to rake in $12 billion a year from small-scale Gold production. Gold exports from Ghana have surged as international prices have soared, and much of that expansion is down to small mines and artisanal production. This year, the government set up a regulator to handle all Gold buying and selling, hoping to boost foreign-currency reserves and curb black-market trading, Reuters reports.

Gold Price Technical Analysis: Out of control

The US debt market is entering wild waters from here on out. The ballooning debt, along with uncertainty on the income of tariffs and other measures lagging to fund the spending bill, makes the US debt a heavy weight for markets to bear. This translates into a higher yield demanded for investors to be convinced to buy the issued debt, creating uncertainty that sends Gold higher and might see more room to go.

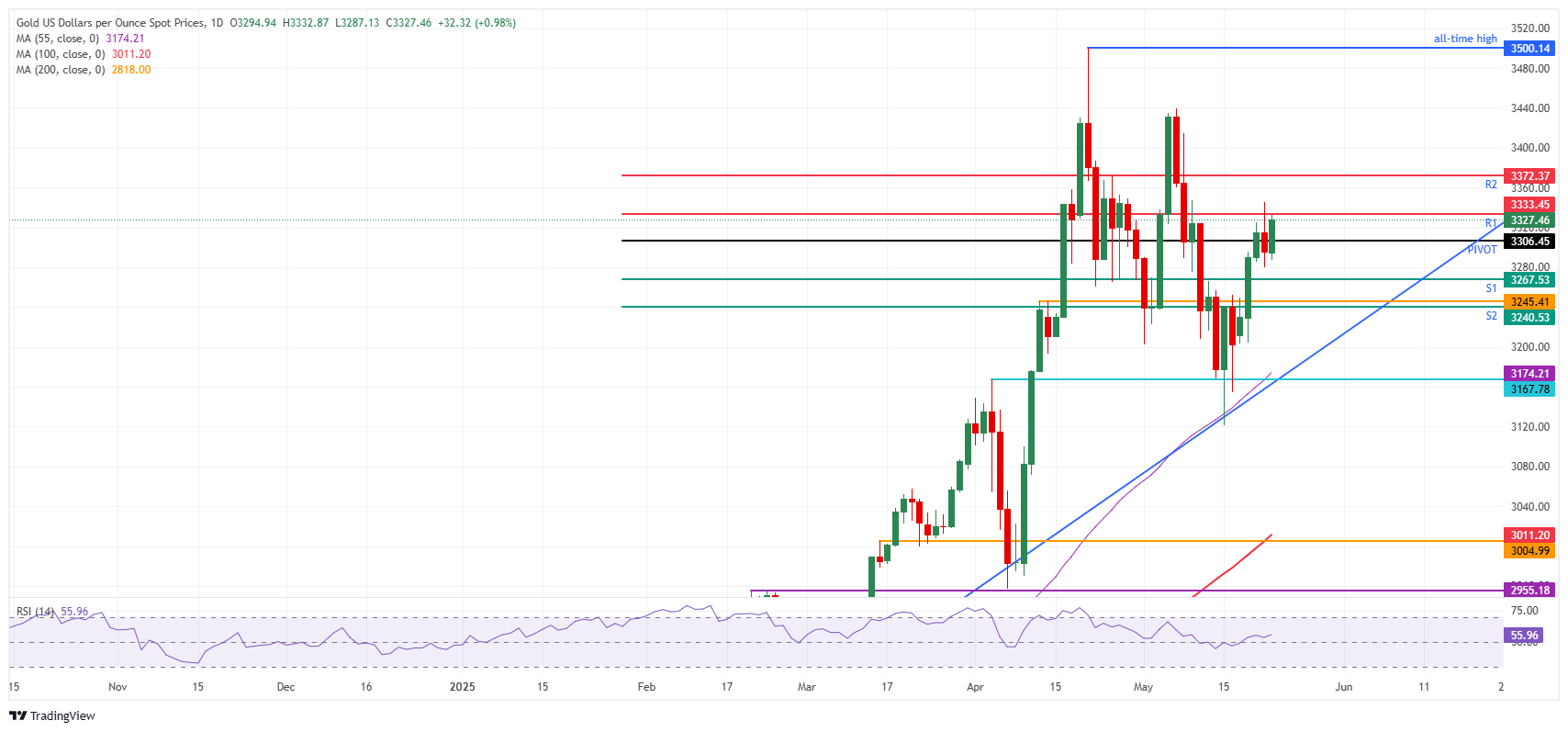

On the upside, the R1 resistance at $3,333 is the first level to look out for as it already looks toppish in the European trading session for now. The R2 resistance at $3,372 follows not far behind and could open the door for a return to the $3,400 round level and potentially further course to new all-time highs.

On the other side, some thick-layered support emerges in case the Gold price declines. On the downside, the daily Pivot Point comes in at $3,306, safeguarding the $3,300 big figure. Some intermediary support could come from the S1 support at $3,267. Further below, there is a technical pivotal level at $3,245, roughly converging with the S2 support at $3,240.

XAU/USD: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.