Gold price slips below $3,300 amid weak US data, set for over 5% monthly gains

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- Trump says Venezuela's Maduro deposed, captured after US strikes

- Bitcoin Price Surges To $90,000. U.S. Arrests Venezuela's President, Triggers Bull Frenzy

- Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

- Gold Price Forecast: XAU/USD climbs to near $4,350 on Fed rate cut bets, geopolitical risks

- Gold rebounds as safe-haven flows support demand

Gold retreats but heads for the third-strongest monthly gain during 2025.

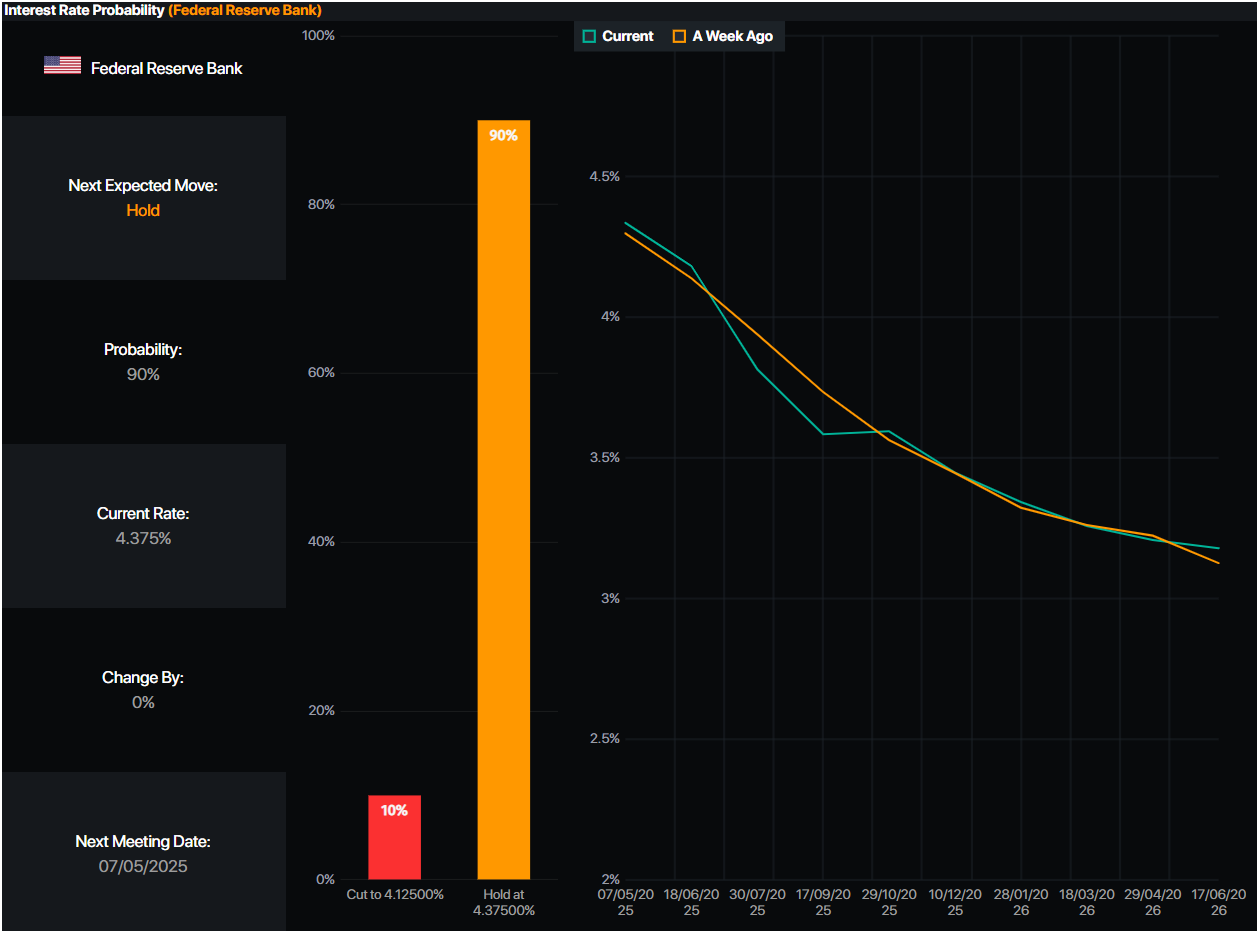

Traders price in 100 bps of Fed cuts despite inflation remaining sticky.

US GDP contraction fuels recession fears and boosts Fed rate cut bets.

Core PCE dips in line with forecasts, but remains above 2% inflation target.

Gold fell some 0.69% during the North American session on Wednesday after hitting a daily high of $3,328. Data from the United States (US) revealed an economic contraction and fueled speculation for further interest rate cuts by the Federal Reserve (Fed). At the time of writing, XAU/USD trades at $3,293, near the current week's lows.

The largest economy in the world is facing an ongoing economic slowdown, as revealed by the US Department of Commerce. Gross Domestic Product (GDP) figures for the first quarter of 2025 disappointed investors, exerting pressure on the Federal Reserve, which is fighting to bring inflation back towards its 2% goal.

After the data release, investors rushed to price in 100 basis points of rate cuts by the Fed, meaning that the fed funds rate will end near 3.45%, as revealed by data from Prime Market Terminal.

Source: Prime Market Terminal

Bullion traders were also attentive to the March release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index. The figures dipped as expected by analysts, though they remain above the US central bank's 2% goal.

Labor market data was soft, as revealed by ADP in its National Employment Change report in April.

Despite posting daily losses, Bullion prices are set to end April with gains of over 5.49%.

Ahead in the week, traders are eyeing the release of the ISM Manufacturing PMI for April and Nonfarm Payroll figures for the same period.

Daily digest market movers: Gold price prints losses and fails to capitalize on US yields fall

The yield on the US 10-year Treasury note drops one a half basis points, reaching 4.154%.

US real yields edges down two bps to 1.90%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

US GDP for Q1 2025 shrank 0.3%, missing the mark for a 0.4% expansion and a drop from Q4 2024's 2.4% increase, revealed the US Commerce Department.

Labor market data revealed by the ADP National Employment Change in April suggests that Friday’s Nonfarm Payroll figures could be lower than projected. Private companies hired 62K people, below estimates of 108K.

At the same time, the US Federal Reserve preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, rose by 2.6% as projected, down from the 3% rise in February.

XAU/USD technical outlook: Remains bullish but poised to test $3,200

Gold price uptrend remains in place, though sellers seem to be gathering momentum as XAU/USD has fallen below $3,300; it remains shy to clear the latest swing low of $3,261 on April 23. A breach of the latter will expose the $3,200 mark, followed by the $3,150 mark.

On the other hand, if Gold claims $3,300, the next resistance would be $3,350, followed by the $3,400 figure.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.