Gold price surges to $3,500 neighborhood; strong uptrend remains uninterrupted

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

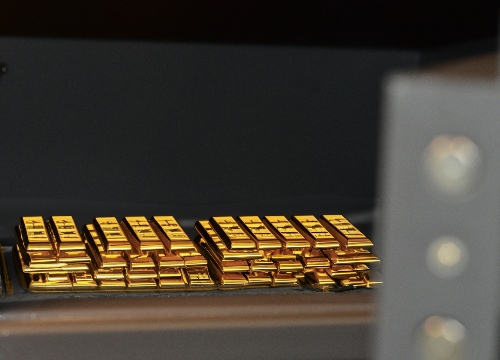

Gold price buying remains unabated as trade uncertainties continue to boost safe-haven demand.

Geopolitical risks and Trump's threat to Fed’s independence further benefit the XAU/USD pair.

Bulls seem unaffected by extremely overbought conditions on the short-term chart amid a weaker USD.

Gold price (XAU/USD) builds on the previous day's breakout momentum beyond the $3,400 mark and continues scaling new record highs during the Asian session on Tuesday. Fears that US President Donald Trump's tariffs and the escalating US-China trade war could dent global economic growth continue to boost demand for the traditional safe-haven bullion. Apart from this, the recent US Dollar (USD) slump to a three-year low turns out to be another factor fueling the precious metal's ongoing strong move higher.

Trump’s back-and-forth tariff announcements have weakened investors' confidence in the US economy. Adding to this Trump's fresh attack on Federal Reserve (Fed) Chair Jerome Powell raised doubts about the central bank’s independence. This, along with the prospects for more aggressive policy easing by the Fed, keeps the USD bulls on the defensive and provides an additional lift to the Gold price. However, extremely overbought conditions on short-term charts warrant caution before placing fresh bullish bets around the XAU/USD pair.

Daily Digest Market Movers: Gold price continues to attract safe-haven flows amid worries about tariffs-driven economic slowdown

The uncertainty over US President Donald Trump’s steep tariffs and their impact on the global economy continues to push the safe-haven Gold price to fresh record highs on Tuesday.

Moreover, Trump's rapidly shifting stance on trade policies, along with a call to fire Federal Reserve Chair Jerome Powell, keeps investors on the edge and further benefits the commodity.

Trump accused Powell of not moving fast enough to bring down interest rates. Furthermore, Trump and his team are studying whether they can oust Powell before the end of his term.

This raises doubts over the Fed's monetary policy independence, which, along with bets that the US central bank will resume its rate-cutting cycle, continues to weigh on the US Dollar.

According to the CME Group's FedWatch Tool, traders are pricing in the possibility of the Fed cutting interest rates by 25 basis points in June and deliver at least three rate reductions in 2025.

On the geopolitical front, Russian forces had launched 96 drones and three missiles into eastern and southern Ukraine after the 30-hour short-lived and partially observed Easter ceasefire.

Traders now look forward to the release of the Richmond Manufacturing Index from the US, which, along with speeches from influential FOMC members, will drive the USD demand.

The focus, however, will remain on the flash PMIs on Wednesday, which would offer fresh insight into the global economic health and provide some meaningful impetus to the XAU/USD pair.

Gold price overbought conditions make it prudent to wait for a near-term consolidation or a modest pullback before the next leg up

From a technical perspective, the daily Relative Strength Index (RSI) remains well above the 70 mark and warrants caution for bulls. Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before placing fresh bullish bets around the Gold price and positioning for an extension of the recent well-established uptrend witnessed over the past four months or so.

In the meantime, any meaningful corrective slide is likely to find decent support near the $3,425-3,423 horizontal zone ahead of the $3,400 mark. A convincing break below the latter might prompt some technical selling and drag the Gold price further toward the $3,358-3,357 region. This is followed by the $3,344 support, which if broken decisively should pave the way for deeper losses.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.