Bitcoin likely to return to all-time high of $73,949, QCP Capital says

- Crypto trading firm QCP Capital predicts Bitcoin will return to the $74,000 all-time high seen in March.

- The firm cites macroeconomic catalysts, rising institutional demand and sizable buys of $100,000 to $120,000 Bitcoin calls as the main bullish drivers.

- Bitcoin price rises above $66,000 on Thursday.

Bitcoin (BTC) price is likely to rally back to $74,000 in the coming weeks, it's all-time high reached in March, riding on three bullish catalysts, according to crypto trading firm QCP Capital. The expected BTC price rally would be in response to favorable macroeconomic conditions, increased institutional investor activity and statistics from the firm’s trading desk.

Trading firm predicts Bitcoin rally to $74,000

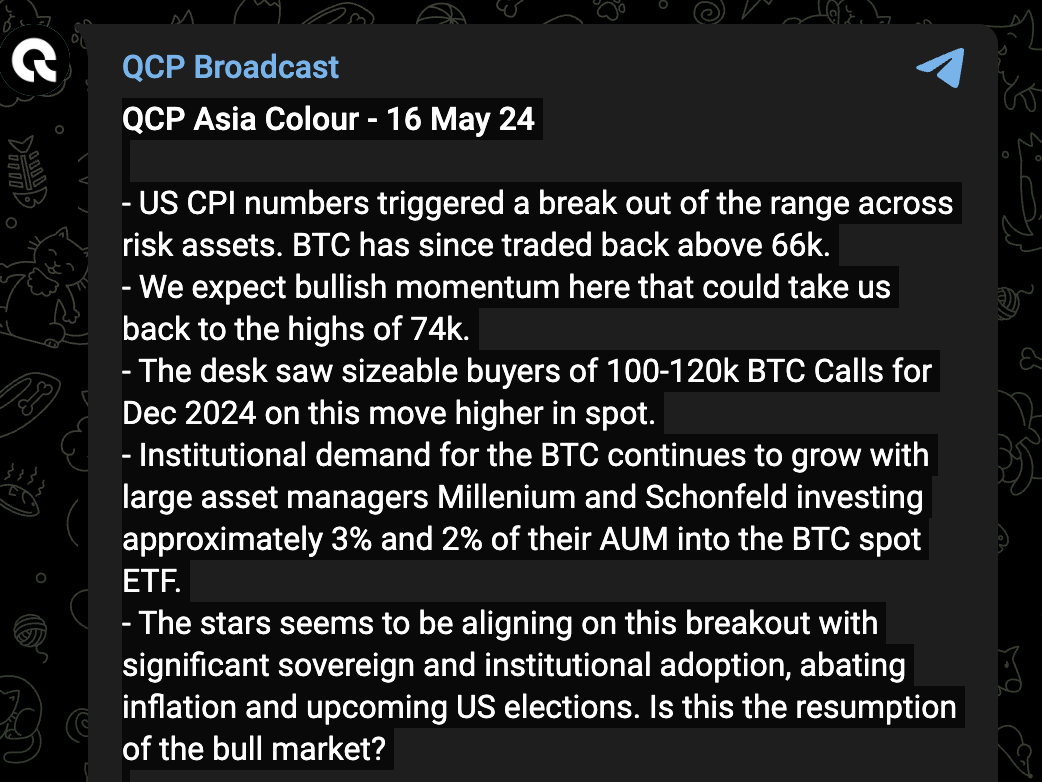

Through its official Telegram account, QCP Capital analyzed on Thursday the current market conditions and predicted a Bitcoin price rally to the highs of $74,000. QCP Capital expects bullish momentum in Bitcoin price in response to macroeconomic developments in the US, as the gradual decline in inflation and the subsequent cut in interest rates should support risk assets.

The US Consumer Price Index (CPI) numbers released on Wednesday, which pointed to a decline in inflation after three months of persisting price pressures, triggered a breakout across risk assets, including crypto markets.

QCP Capital Broadcast

Since the news, Bitcoin has traded close to the $66,000 level. Analysts at QCP Capital identified sizeable buyers of $100,000 to $120,000 Bitcoin calls for December 2024 in response to the recent price gains in the spot market.

At the same time, institutional demand for Bitcoin is growing. Large asset managers like Millenium and Schonfeld have invested 3% and 2% of their Assets Under Management (AUM) into the Bitcoin Spot ETF.

Analysts note that the breakout in Bitcoin price comes alongside sovereign and institutional adoption ahead of the upcoming US elections. Citing the timing, the firm wonders if this could be “the resumption of the bull market”, according to a comment on its official Telegram account.

In its note, the firm suggests that Bitcoin price dips could continue to be bought as the market continues to see rising liquidity from global rate cuts and higher fiscal spending and there is an increasing institutional adoption of BTC in the US.

Bitcoin trades at $66,100 on Binance at the time of writing.