1INCH Price Forecast: 1INCH steadies near $0.18 as on-chain and derivatives data point to recovery

- 1INCH price hovers around $0.187 on Wednesday after facing rejection from the $0.207 level earlier this week.

- Rising large whale orders, buying dominance and positive funding rates suggest a recovery on the horizon.

- The technical indicators suggest a recovery with bulls aiming for the $0.234 mark.

1INCH (1INCH) price is stabilizing near $0.187 at the time of writing on Wednesday, after being rejected by the key resistance earlier this week. On-chain and derivatives data show improving market conditions, with rising whale activity, growing buy-side dominance and positive funding rates hinting at a possible recovery. Technical indicators further support a bullish shift, with buyers setting their sights on the $0.234 target.

1inch’s on-chain and derivatives show early signs of recovery

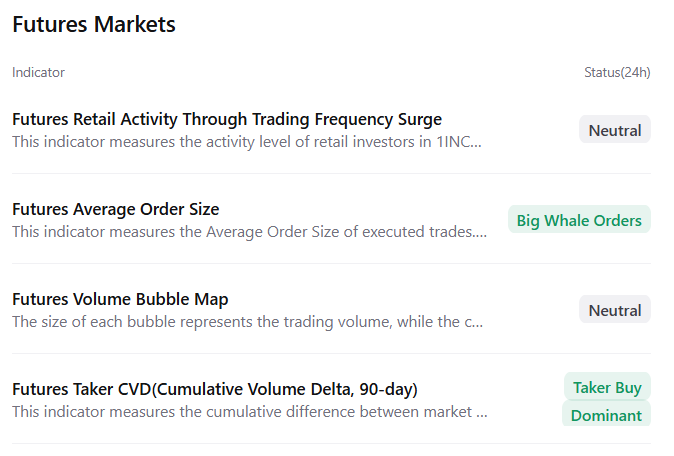

CryptoQuant summary data supports a positive outlook for 1INCH as futures markets show large whale orders and buying dominance, signaling a potential rally ahead.

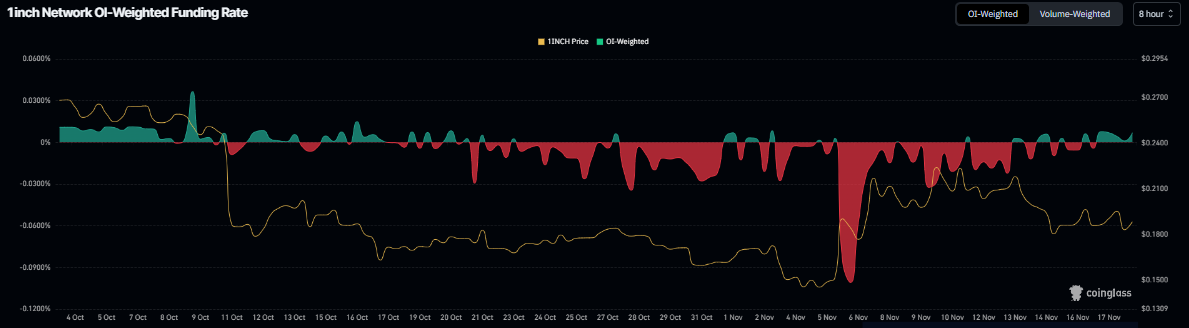

The derivatives data also support a recovery rally for 1INCH, as Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of 1INCH will slide further is lower than those anticipating a price increase.

The metric flipped to a positive rate on Monday and stood at 0.0070% on Wednesday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, 1INCH has rallied sharply.

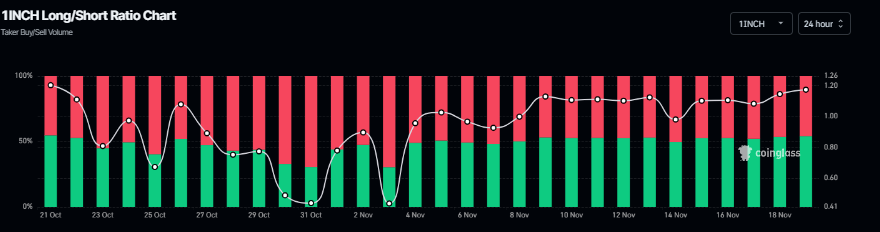

Additionally, Coinglass’s long-to-short ratio for 1INCH reads 1.17 on Wednesday, the highest level over a month. The ratio above one suggests that more traders are betting on 1INCH’s price to rally.

1INCH Price Forecast: 1INCH bulls aiming for the $0.234

1INCH price dipped slightly from the 61.8% Fibonacci retracement level at $0.207 on Monday but regained strength the following day. At the time of writing on Wednesday, it hovers at around $0.187.

If 1INCH continues its recovery and closes above $0.207 on a daily basis, it could extend its recovery toward the next daily resistance at $0.234.

The Relative Strength Index (RSI) on the daily chart is hovering around the neutral 50 level, suggesting indecision among traders. For the recovery rally to be successful, the RSI must move above the neutral level. Moreover, the Moving Average Convergence Divergence (MACD) lines are converging, signaling indecision in momentum. For the rally to sustain, the MACD would need to confirm a bullish crossover.

On the other hand, if 1INCH faces a correction, it could extend the decline toward the next weekly support at $0.163.