Why Ethereum ETFs are underperforming amid rising ETH exchange reserve

- Ethereum ETFs may be underperforming due to historical market decline in Q3.

- Rising Ethereum exchange reserve could cause selling pressure.

- Ethereum's open interest needs to grow to fuel a potential rally.

Ethereum (ETH) is up 1% on Tuesday as ETH exchange-traded funds (ETF) continue underperforming with another day of outflows. The weak flows in ETH ETFs may be due to their historically weak Q3 performance. Meanwhile, the ETH exchange reserve has also been rising following its slow price growth.

Daily digest market movers: Why Ethereum ETFs are underperforming, rising exchange reserve

Ethereum ETFs extended their streak of negative flows to five consecutive days after posting $5.2 million in outflows on Monday.

The flows were dominated by $22.6 million outflows from Grayscale's ETHE, taking its total asset loss since ETH ETFs went live to $2.69 billion. While other issuers saw zero flows, Fidelity's FETH and Grayscale Mini Ethereum Trust managed inflows of $7.6 million and $8 million, respectively.

The weak performance of spot ETH ETFs has led to concern among investors who had anticipated an Ethereum outperformance similar to that of Bitcoin weeks after spot BTC ETFs launched in January. Notably, ETH ETFs have only recorded one day of inflows in the past three weeks of trading and a cumulative outflow of $573 million since launch.

A possible reason for the underperformance could be the historical decline across risk assets in Q3. Hence, most analysts have suggested that Q3 needs to pass before giving an accurate analysis of ETH ETF performance.

Meanwhile, Ethereum's exchange reserve saw a notable uptick, rising by over 94K ETH worth about $220 million in the past 24 hours. An increase in a crypto asset's exchange reserve indicates higher selling pressure and could lead to price declines. As a result, ETH could face selling pressure in the next few hours.

-638615950096871868.png)

ETH Exchange Reserve

ETH technical analysis: Ethereum's open interest needs to rise to fuel quest for rally

Ethereum is trading around $2,360 on Tuesday, up 1% on the day. In the past 24 hours, ETH has seen $22.55 million in liquidations, with long and short liquidations accounting for $4.69 million and $17.86 million, respectively.

Ethereum succumbed to the selling pressure around the $3,400 resistance as it declined immediately after approaching the level. ETH's price is also restricted by a descending trendline extending from May to September. ETH needs to overcome the $3,400 rectangle's resistance and the descending trendline to stage a rally toward the $2,817 resistance level. A successful move above this level could see ETH rally toward the $3,230 price level.

ETH/USDT 4-hour chart

A daily candlestick close below $2,100 could send ETH crashing toward the $1,544 support level.

The Relative Strength Index (RSI) is above its midline at 53, indicating bullish momentum. The Stochastic Oscillator has crossed into the oversold region, indicating a potential brief price correction.

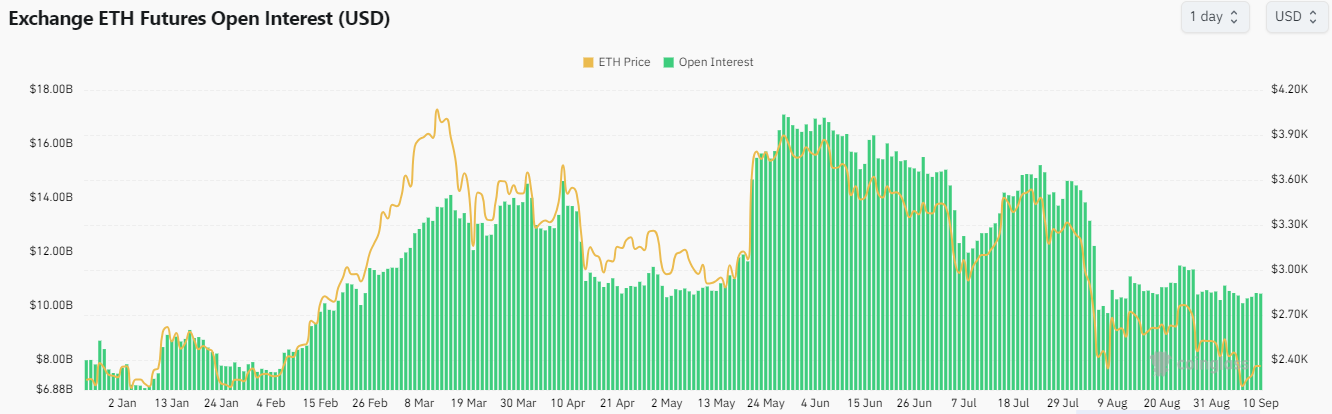

Meanwhile, Ethereum's futures open interest (OI) also needs to rise to provide support for potential price growth.

Open interest is the total number of unsettled long and short positions in a derivatives market.

ETH's OI has declined by over 38% from an all-time high of $17.09 billion on May 28 to $10.51 billion on Tuesday. In the same period, ETH declined by over 39%. Notably, its OI peaked following news of the Securities & Exchange Commission's (SEC) U-turn to approve ETH ETFs. Similar bullish news may be needed to incentivize long traders to come into the market again.

ETH Open Interest

In the short term, ETH could decline to $2,318 to liquidate positions worth $28.33 million.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.