XRP's 14% monthly gain renews $3.00 bid, but on-chain data calls for caution

- XRP breaks out, holding intraday gains amid cooling spot volume and a steady increase in futures Open Interest.

- Investors may be preparing to take profits as exchange balances surge to 3.5 billion XRP.

- Supply in profit explodes, nearing May's peak of around 62 billion XRP, which signals a potential trend reversal in the short term.

Ripple (XRP) extends its recovery in tandem with major cryptocurrencies, trading above $2.80 on Friday. The prevailing technical structure reinforces XRP's bullish case and upholds the potential to rally above the critical psychological resistance at $3.00.

Meanwhile, on-chain data shows signs of a potential weakening of the uptrend as investors take profits or send XRP to exchanges in preparation for selling. Understanding the forces behind metrics like Exchange Balance and Total Supply in Profit could help provide a holistic view of the direction XRP is taking, particularly now when risk-on sentiment is increasing.

What's next for XRP as exchange balance, supply in profit expand

XRP has sustained the uptrend since the drop to the June low of $1.90, accruing nearly 50% in gains.

The steady price increase can be attributed to growing risk-on sentiment and a stronger derivatives market, as evidenced by the futures Open Interest's (OI) recovery to $5.9 billion, up from $3.5 billion on June 23.

XRP futures Open Interest | Source: CoinGlass

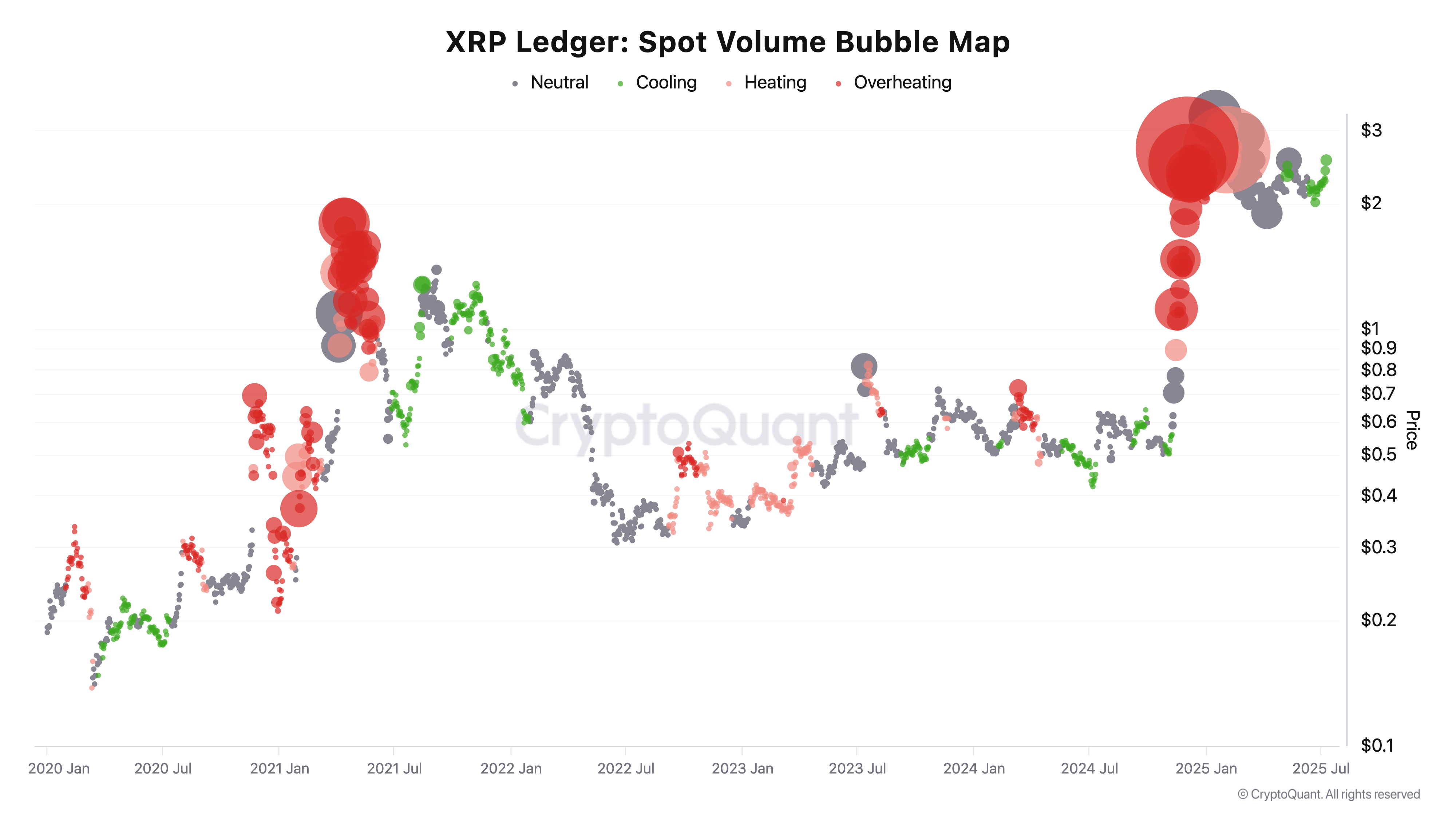

CryptoQuant's Spot Volume Bubble Map shows that trading volume in the spot market is declining or cooling. Subdued activity in the spot market often indicates falling interest in XRP, which could hinder further price increases.

XRP Spot Volume Bubble Map | Source: CryptoQuant'

At the same time, investors are increasing transactions toward exchanges, with Glassnode's Total Exchange Balance metric rising by 2.9% to 3.5 billion XRP, as seen on June 23.

A surge in the exchange balance signals incoming selling pressure as holders prepare to sell or trade their XRP. If supply overshadows demand, this could result in a decline or price consolidation.

XRP Total Exchange Balance metric | Source: Glassnode

Additionally, a subsequent increase in the total supply, which creates a profit, predisposes XRP to overhead pressure, as holders are likely to sell to realize profit. The green line on the chart below represents the supply currently in profit at approximately 57.6 billion XRP.

A similar uptrend in May saw the supply in profit approach 62 billion XRP, but a sell-off followed, capping price action at $2.65 and extending the decline to $1.90 in June.

XRP Total Supply in Profit metric | Glassnode

Technical outlook: XRP completes technical pattern breakout

XRP price rally has surpassed $2.76, a target from an inverse Head-and-Shoulders (H&S) pattern, which was validated on Wednesday when bulls broke above the neckline resistance at $2.33.

The cross-border money remittance token is trading at $2.80 at the time of writing, buoyed by rising trading volume of $165 million. Similarly, the Money Flow Index (MFI), which tracks the amount of money entering or leaving XRP, backs this bullish outlook, holding at 89.

XRP/USDT daily chart

Still, the Relative Strength Index (RSI) overbought 88, suggesting that the rally could cool off before continuing toward $3.00. Hence, there is a need to tread carefully and prepare for a potential trend reversal. Profit-taking and risks highlighted by on-chain will likely be the main drives of the pullback.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.